AI in Auto Insurance Market: Driving Efficiency and Risk Intelligence with Automation

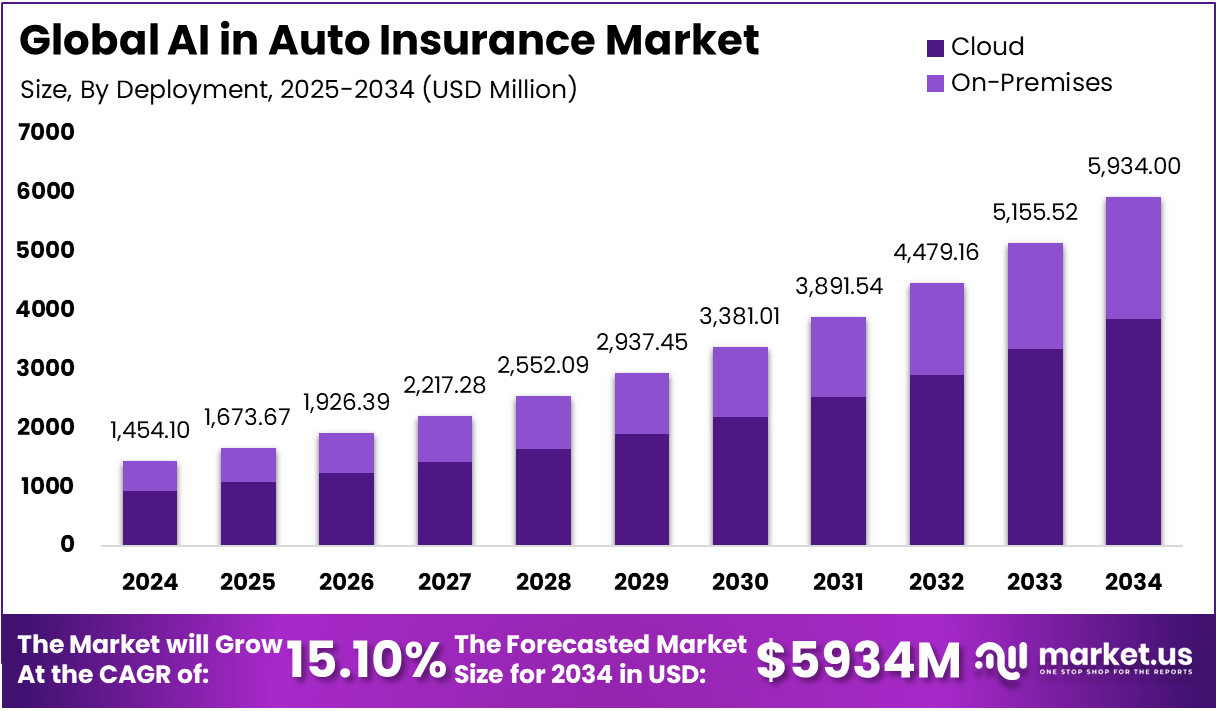

The global AI in Auto Insurance market was valued at USD 1.2 billion in 2023 and is expected to reach USD 9.4 billion by 2032, growing at a CAGR of 25.6%. The rising need for operational efficiency, personalized pricing, fraud detection, and seamless claims processing is accelerating the adoption of AI technologies in the auto insurance sector. Insurers are leveraging machine learning, predictive analytics, and telematics to enhance underwriting, detect anomalies, and deliver customized policies. Increasing vehicle connectivity and the expansion of digital insurance platforms are also contributing significantly to market growth and customer satisfaction.

Read More : https://market.us/report/ai-in-auto-insurance-market/

The global AI in Auto Insurance market was valued at USD 1.2 billion in 2023 and is expected to reach USD 9.4 billion by 2032, growing at a CAGR of 25.6%. The rising need for operational efficiency, personalized pricing, fraud detection, and seamless claims processing is accelerating the adoption of AI technologies in the auto insurance sector. Insurers are leveraging machine learning, predictive analytics, and telematics to enhance underwriting, detect anomalies, and deliver customized policies. Increasing vehicle connectivity and the expansion of digital insurance platforms are also contributing significantly to market growth and customer satisfaction.

Read More : https://market.us/report/ai-in-auto-insurance-market/

AI in Auto Insurance Market: Driving Efficiency and Risk Intelligence with Automation

The global AI in Auto Insurance market was valued at USD 1.2 billion in 2023 and is expected to reach USD 9.4 billion by 2032, growing at a CAGR of 25.6%. The rising need for operational efficiency, personalized pricing, fraud detection, and seamless claims processing is accelerating the adoption of AI technologies in the auto insurance sector. Insurers are leveraging machine learning, predictive analytics, and telematics to enhance underwriting, detect anomalies, and deliver customized policies. Increasing vehicle connectivity and the expansion of digital insurance platforms are also contributing significantly to market growth and customer satisfaction.

Read More : https://market.us/report/ai-in-auto-insurance-market/

0 Comments

0 Shares

258 Views

0 Reviews