What Role Do Exchange Metrics Play in Evaluating Crypto Volatility?

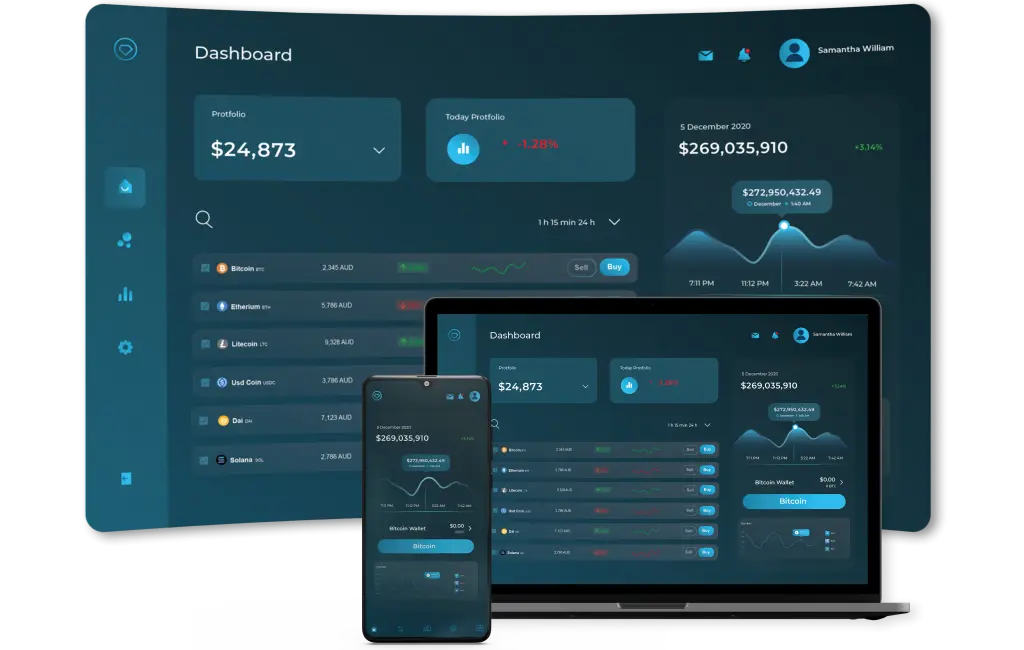

Exchange metrics serve as critical indicators for assessing crypto market volatility by offering real-time insights into trading behavior, liquidity, and investor sentiment. Key metrics such as trading volume, order book depth, bid-ask spreads, and price slippage help traders and analysts understand the intensity and direction of market movements. For instance, sudden spikes in trading volume often signal increased volatility, while wider bid-ask spreads may indicate uncertainty or low liquidity. Monitoring these data points allows stakeholders to make informed decisions, manage risk, and strategize more effectively. A Cryptocurrency Exchange Development Company leverages these metrics to design platforms that not only track and visualize market volatility but also provide users with advanced analytics tools for improved trading precision. By embedding such real-time data insights, these companies help shape smarter and more resilient exchange ecosystems in today’s fast-evolving crypto landscape.

Visit- https://wisewaytec.com/cryptocurrency-exchange-development-company/

Exchange metrics serve as critical indicators for assessing crypto market volatility by offering real-time insights into trading behavior, liquidity, and investor sentiment. Key metrics such as trading volume, order book depth, bid-ask spreads, and price slippage help traders and analysts understand the intensity and direction of market movements. For instance, sudden spikes in trading volume often signal increased volatility, while wider bid-ask spreads may indicate uncertainty or low liquidity. Monitoring these data points allows stakeholders to make informed decisions, manage risk, and strategize more effectively. A Cryptocurrency Exchange Development Company leverages these metrics to design platforms that not only track and visualize market volatility but also provide users with advanced analytics tools for improved trading precision. By embedding such real-time data insights, these companies help shape smarter and more resilient exchange ecosystems in today’s fast-evolving crypto landscape.

Visit- https://wisewaytec.com/cryptocurrency-exchange-development-company/

What Role Do Exchange Metrics Play in Evaluating Crypto Volatility?

Exchange metrics serve as critical indicators for assessing crypto market volatility by offering real-time insights into trading behavior, liquidity, and investor sentiment. Key metrics such as trading volume, order book depth, bid-ask spreads, and price slippage help traders and analysts understand the intensity and direction of market movements. For instance, sudden spikes in trading volume often signal increased volatility, while wider bid-ask spreads may indicate uncertainty or low liquidity. Monitoring these data points allows stakeholders to make informed decisions, manage risk, and strategize more effectively. A Cryptocurrency Exchange Development Company leverages these metrics to design platforms that not only track and visualize market volatility but also provide users with advanced analytics tools for improved trading precision. By embedding such real-time data insights, these companies help shape smarter and more resilient exchange ecosystems in today’s fast-evolving crypto landscape.

Visit- https://wisewaytec.com/cryptocurrency-exchange-development-company/

0 Comments

0 Shares

273 Views

0 Reviews