IMARC Group, a leading market research company, has recently released a report titled “Livestock Insurance Market Report by Coverage (Mortality, Revenue, and Others), Animal Type (Bovine, Swine, Sheep and Goats, and Others), Distribution Channel (Direct, Agency/Broker, Bancassurance), and Region 2025-2033”. The study provides a detailed analysis of the industry, including the livestock insurance market share, growth, size, trends and forecast. The report also includes competitor and regional analysis and highlights the latest advancements in the market.

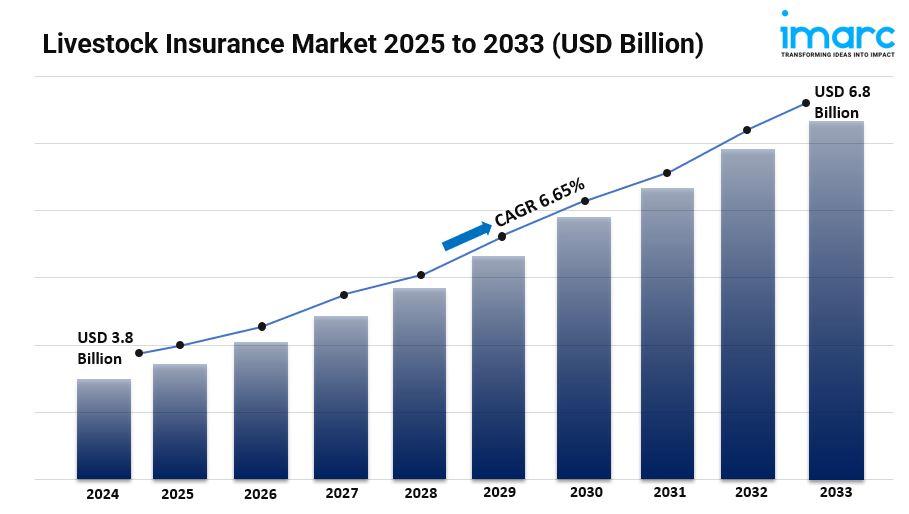

The global livestock insurance market size reached USD 3.8 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 6.8 Billion by 2033, exhibiting a growth rate (CAGR) of 6.65% during 2025-2033.

Request to Get the Sample Report: https://www.imarcgroup.com/livestock-insurance-market/requestsample

Factors Affecting the Growth of the Livestock Insurance Industry:

Increasing Awareness and Adoption of Livestock Insurance:

The livestock insurance market is changing. Farmers and ranchers are becoming more aware of its benefits. Traditionally, many livestock owners avoided insurance. They didn't understand its advantages or thought it was too costly. But now, with climate change causing unpredictable weather and disease risks, the need for protection is clear. Government and insurance companies are educating producers about avoiding losses with insurance.

As a result, demand for livestock insurance is set to rise. More people will see that insurance protects assets and supports sustainable farming. Additionally, technological advances are making insurance easier to access and claims simpler. This makes insurance more appealing to livestock owners.

Technological Innovations in Insurance Solutions:

Technology is changing livestock insurance. Insurtech companies use data, AI, and blockchain for better, personalized products. For example, predictive analytics helps assess risk accurately. This allows tailored policies for livestock owners. Moreover, mobile apps and online platforms make buying insurance easier.

Farmers can compare policies, manage coverage, and file claims easily. These innovations improve customer experience and increase market competition. This leads to cheaper, more accessible insurance. As technology advances, it will further shape livestock insurance, encouraging more producers to adopt it.

Regulatory Support and Subsidies:

Government policies are boosting the livestock insurance market. Countries see this insurance as vital for managing risks and ensuring food security. They offer subsidies, tax breaks, and partnerships to encourage farmers to buy insurance.

These efforts aim to ease financial strain and build resilience against disasters and market changes. Regulators are also setting standards for insurance, ensuring it is fair and transparent. This builds trust among livestock owners. With these supports, the market is expected to grow significantly, encouraging more farmers to protect their livelihoods.

Speak to An Analyst: https://www.imarcgroup.com/request?type=report&id=8024&flag=C

Livestock Insurance Market Report Segmentation:

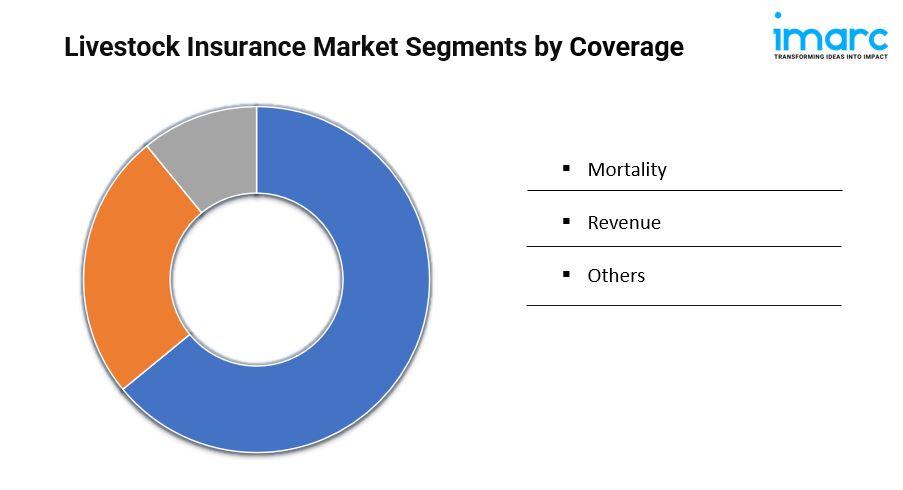

Breakup by Coverage:

- Mortality

- Revenue

- Others

Livestock mortality insurance, which covers losses due to animal death from various causes, is the most popular livestock insurance coverage, as it protects owners' investments in high-value animals.

Breakup by Animal Type:

- Bovine

- Swine

- Sheep and Goats

- Others

Bovine livestock insurance is the most popular type of livestock insurance, offering financial protection to farmers against losses due to various risks, including disease outbreaks, accidents, and theft.

Breakup by Distribution Channel:

- Direct

- Agency/Broker

- Bancassurance

Direct distribution is the most popular channel for selling livestock insurance, allowing insurers to directly interact with farmers and provide convenient and tailored solutions.

Breakup by Region:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America dominates the global livestock insurance market due to its large cattle industry, increasing farm commercialization, and adoption of advanced agricultural technologies.

Global Livestock Insurance Market Trends:

The livestock insurance market is evolving, driven by key trends. First, there's a growing demand for personalized insurance for livestock producers. Farmers face challenges like climate change and market fluctuations. So, insurers are offering more adaptable policies. Secondly, technology is becoming crucial in insurance. Companies now use data analytics to assess risks and speed up claims. This approach boosts customer satisfaction. Moreover, with the rise in demand for sustainable products, livestock insurance is now seen as essential for responsible farming. This trend is likely to continue in 2024, as more producers understand the need for effective risk management.

Top Companies Operated in Livestock Insurance Industry:

- AXA XL

- FBL Financial Group, Inc

- Future Generali India Insurance Company Ltd.

- HDFC ERGO General Insurance Company

- Howden Insurance & Reinsurance Brokers (Phil.), Inc.

- HUB International Limited (Hellman & Friedman LLC)

- ICICI Lombard General Insurance Company Limited

- Liberty Mutual Insurance Company (Liberty Mutual Group Inc.)

- Lloyd's

- Nationwide Mutual Insurance Company

- The Hartford

Key Highlights of the Report:

- Market Performance (2019–2024)

- Market Outlook (2025–2033)

- Market Trends

- Market Drivers and Success Factors

- Impact of COVID-19

- Value Chain Analysis

- Comprehensive mapping of the competitive landscape

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC’s information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company’s expertise.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1–631–791–1145