IMARC Group, a leading market research company, has recently released a report titled “Contactless Payment Market Report by Technology (Near Field Communication (NFC), Radio Frequency Identification (RFID), Infrared (IR), and Others), Device (Smartphones and Wearables, Point-of-Sales Terminals, Smart Cards), Solution (Payment Terminal Solution, Transaction Management, Security and Fraud Management, Hosted Point-of-Sales, Payment Analytics), Application (BFSI, Retail, Transportation, Healthcare, and Others), and Region 2025-2033”. The study provides a detailed analysis of the industry, including the global contactless payment market trends, share, size, and industry trends forecast. The report also includes competitor and regional analysis and highlights the latest advancements in the market.

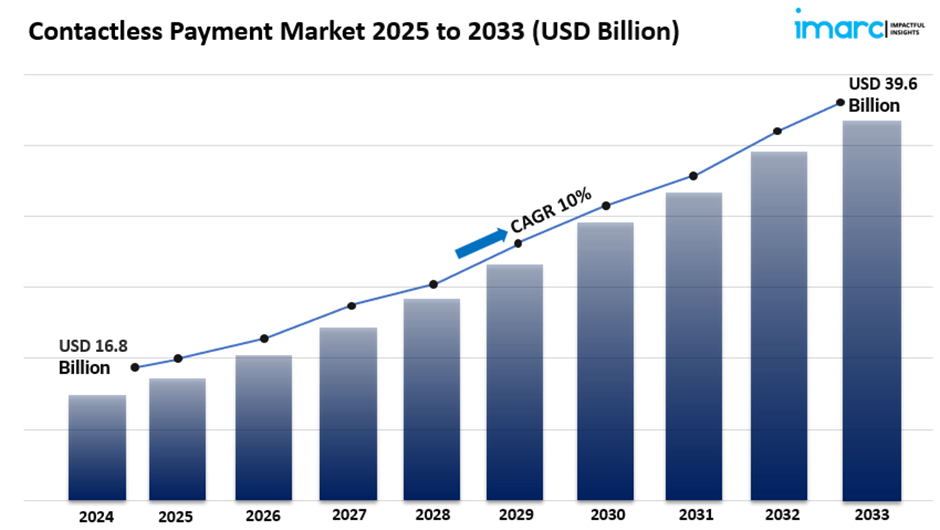

The global contactless payment market size reached USD 16.8 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 39.6 Billion by 2033, exhibiting a growth rate (CAGR) of 10% during 2025-2033.

Request to Get the Sample Report:

https://www.imarcgroup.com/contactless-payment-market/requestsample

Contactless Payment Market Trends

The contactless payment market is evolving due to changing consumer habits and new technologies. The trend towards contactless transactions, boosted by the pandemic, is set to continue in 2023. By 2024, biometric security and mobile wallets will make payments safer and easier. This will encourage more people to adopt them.

Also, sectors like transportation, hospitality, and healthcare are using contactless payments more. This shift opens new growth opportunities. As businesses upgrade to meet consumer demands, the market will likely see strong growth, moving towards digital solutions. In summary, the combination of consumer demand, technological progress, and industry growth will significantly boost the contactless payment market, leading to smoother, more efficient transactions.

Market Dynamics 1: Accelerated Adoption Due to Pandemic

The COVID-19 pandemic made contactless payments more popular. Both consumers and businesses wanted safer ways to transact. This trend is likely to continue. Many will prefer contactless payments even after health concerns ease. Retailers and service providers are now investing in contactless systems, like NFC terminals and mobile solutions, to meet changing demands. These payments are quick and don't need cash or card insertion. This convenience especially appeals to younger consumers who value speed.

Businesses, too, benefit from faster transactions and happier customers. This encourages more to adopt contactless systems. Also, partnerships between payment providers and tech firms are rising. They are leading to better solutions.

Market Dynamics 2: Technological Innovations and Integration

Innovations are enhancing contactless payments, making them more user-friendly and secure. By 2024, mobile wallets, biometric methods, and blockchain will lead the way. Wallets like Apple Pay and Google Pay will add loyalty programs, making them more appealing. Biometric methods, such as fingerprint and facial recognition, will increase security. Meanwhile, blockchain will improve transparency and reduce fraud. These advancements will attract more consumers and merchants. They will expand into e-commerce and point-of-sale systems. As people adopt these innovations, the demand for secure, seamless payments will grow.

Market Dynamics 3: Expansion of Use Cases Across Industries

The contactless payment market is expanding beyond retail into transportation, hospitality, and healthcare. By 2024, public transportation will likely see a significant rise in contactless payments. Commuters will be able to pay with their phones or cards quickly. The hospitality sector is adopting contactless solutions for check-ins, room access, and payments. This move enhances the guest experience while ensuring safety and efficiency.

In healthcare, contactless payments are being integrated into patient management systems. This integration streamlines billing and reduces wait times, boosting patient satisfaction. As more industries recognize the benefits, the market will continue to grow. These benefits include lower costs, faster transactions, and better customer experiences. Growth will, in turn, spark more demand and innovation in contactless payment solutions.

Contactless Payment Market Report Segmentation:

By Technology:

· Near Field Communication (NFC)

· Radio Frequency Identification (RFID)

· Infrared (IR)

· Others

Based on technology, the market is divided into near field communication (NFC), radio frequency identification (RFID), infrared (IR), and others.

By Device:

· Smartphones and Wearables

· Point-of-Sale Terminals

· Smart Cards

Based on the device, the market is segmented into smartphones and wearables, point-of-sale terminals, and smart cards.

By Solution:

· Payment Terminal Solution

· Transaction Management

· Security and Fraud Management

· Hosted Point-of-Sales

· Payment Analytics

Based on solution, the market is classified into payment terminal solutions, transaction management, security and fraud management, hosted point-of-sales, and payment analytics.

By Application:

· BFSI

· Retail

· Transportation

· Healthcare

· Others

Based on the application, the market is bifurcated into BFSI, retail, transportation, healthcare, and others.

Regional Insights:

· North America

· Asia-Pacific

· Europe

· Latin America

· Middle East and Africa

Based on the region, the market is segregated into North America (the United States and Canada), Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others), Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others), Latin America (Brazil, Mexico, and others), and Middle East and Africa.

Competitive Landscape with Key Players:

The competitive landscape of the contactless payment market size has been studied in the report with the detailed profiles of the key players operating in the market.

Some of These Key Players Include:

· Giesecke & Devrient GmbH

· Heartland Payment Systems (Global Payments Inc.)

· IDEMIA (Advent International)

· Ingenico Group (Worldline S.A.),

· On Track Innovations Ltd.

· Pax Technology

· Setomatic Systems

· Thales Group

· Valitor

· Verifone Systems Inc.

· (Francisco Partners) and Visa Inc.

Ask Analyst for Customized Report:

https://www.imarcgroup.com/request?type=report&id=3514&flag=C

Key Highlights of the Report:

· Market Performance (2018-2023)

· Market Outlook (2024-2032)

· Market Trends

· Market Drivers and Success Factors

· Impact of COVID-19

· Value Chain Analysis

If you need specific information that is not currently within the scope of the report, we will provide it to you as a part of the customization.

About Us

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC’s information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company’s expertise.

Contact Us:

IMARC Group

134 N 4th St

Brooklyn, NY 11249, USA

Website: imarcgroup.com

Email: sales@imarcgroup.com

Americas: +1-631-791-1145 | Europe & Africa: +44-753-713-2163 | Asia: +91-120-433-0800