The Convenience of a Bill Maker Online: Revolutionizing Financial Management

In the fast-paced world, today, businesses and people alike are looking for devices that can make their work as simple as possible. Finances management, especially creating bills and tracking them, would be a chore for too many people. That's where the idea of bill maker online comes in-to streamline the billing process that has been changing the nature of invoicing and payments record keeping. Let's get into how these platforms can help you and why they are essential in modern financial management.

What is a Bill Maker Online?

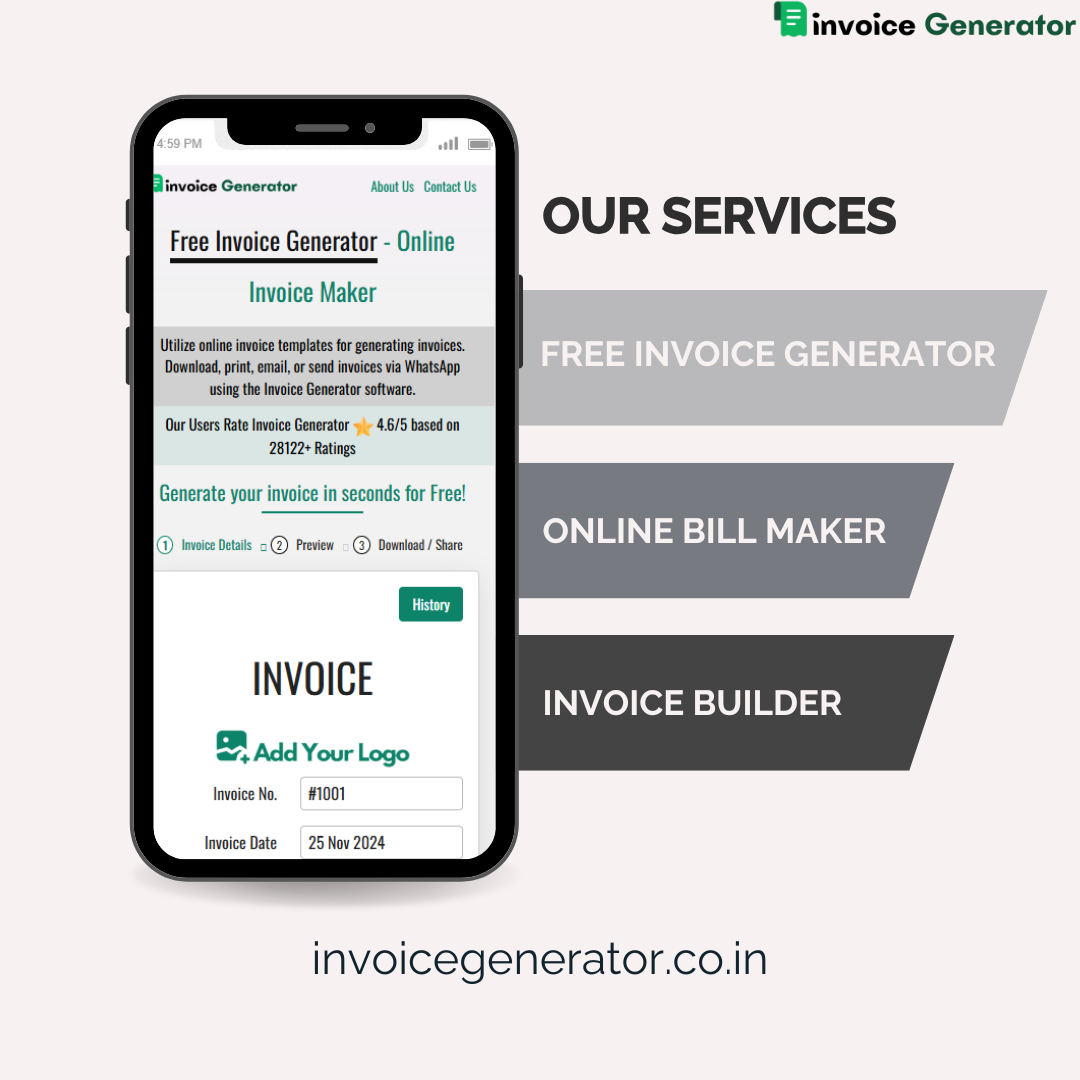

An online bill maker is a tool that provides users with the convenience of making, customizing, and managing bills easily. Usually, access to such tools is available through a web browser or mobile application and is user-friendly for the creation of professional invoices. Regardless of whether you are a freelancer, small business owner, or individual keeping household expenses, an online bill maker saves you so much time and effort.

Key Features of an Online Bill Maker

Ease of use: The best online bill maker sites offer very intuitive interfaces so even a nontech person can navigate it and effectively utilize it.

Personalization: Bills can be customized to suit brand requirements. Users can add company logos, contact details, or personal remarks on the bill.

Automation: Most provide recurring invoice generation, auto-calculated taxes, or even send payment reminders for customers to make timely payments.

Accessibility: As they are cloud-based, you can access them anywhere and anytime as long as you have an internet connection.

Secure Storage: Online bill makers usually come with secure storage options, so your financial data remains safe from unauthorized access.

They usually integrate with accounting software and payment gateways, which simplifies the entire financial workflow.

Advantages of a Bill Maker Online

1. Saves Time

The traditional way of creating bills is tedious and error-prone, especially when using spreadsheets or even writing out invoices. An online bill maker automates much of the process, saving valuable time and reducing the risk of mistakes.

2. Professionalism

Using a bill maker online ensures that your bills will be professional, which would impress your clients. An organized bill reflects the credibility and care of your business.

3. Cost-Effective

Although some online bill makers have their subscription fees, they are usually cheaper compared to hiring a professional accountant or buying expensive software. Also, there are free versions with basic features, which can be used for personal or small business ventures.

4. Real-Time Tracking

Most of the platforms will give you the tracking feature to see the status of your invoices, whether it has been sent, viewed, or paid. This will help you maintain transparency and improve cash flow management.

5. Environmentally Friendly

With the elimination of paper-based invoicing, a bill maker online ensures environmental sustainability. Going digital reduces paper waste and minimizes your carbon footprint.

Selecting the Right Bill Maker Online

With numerous options available, it’s essential to choose a platform that aligns with your specific needs. Consider the following factors:

Features: Identify the features you require, such as multi-currency support, tax compliance, or recurring billing.

Pricing: Look for a tool that fits your budget. Some platforms offer free trials, allowing you to test their features before committing.

User Reviews: Read reviews to gauge the reliability and functionality of the platform.

Customer Support: Make sure the tool offers full support to the customer about his or her issues.

Conclusion

A bill maker online added to your financial routine may well be a game-changer. These tools don't only make the billing process more accessible but also productive, professional, and precise. Whether it is about your business or personal financial needs, an online bill maker is one of the very valuable tools in this new digital world.

Take the ease of a bill maker online and ensure that you enjoy the convenience to manage your finances without much headache. With the right tool, you can focus only on what matters—furthering your business growth or achieving personal financial milestones.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Игры

- Gardening

- Health

- Главная

- Literature

- Music

- Networking

- Другое

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness