Wafer Processing and Assembly Equipment Market Analysis Near Future To 2030

According to the Market Statsville Group (MSG), the global wafer processing and assembly equipment market size is expected to grow at a CAGR of 7.9% from 2023 to 2033.

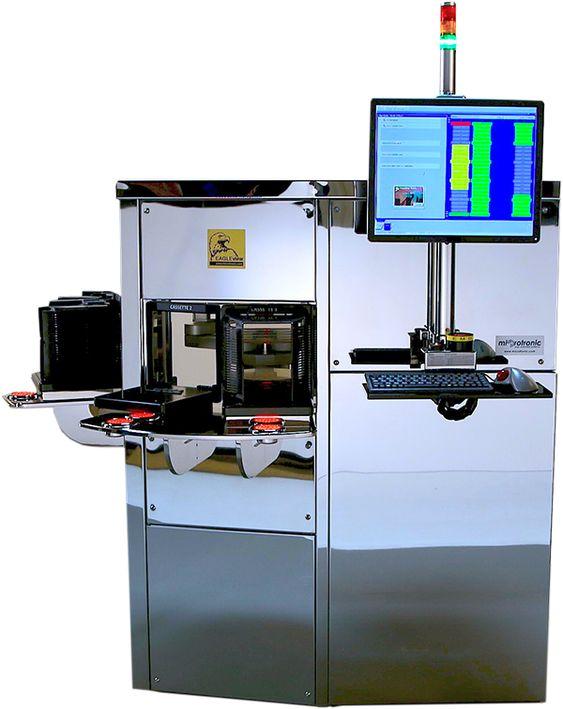

Wafer processing and assembly equipment are used to slice semiconductors like gallium arsenide and crystalline silicon germanium into thin, circular slices that can serve as a substrate for microelectronic devices. Activities including forming, texturing, cleaning, dicing, and etching are part of wafer processing. Wafers are texturized according to how they will be used. For solar cell application, for instance, wafers are given rough surfaces.

In the upcoming years, it's anticipated that the market for wafer processing and assembly equipment will expand quickly. A wafer is a thin piece of a semiconductor, such as gallium arsenide or crystalline silicon germanium. Additionally, semiconductor possesses characteristics like changeable resistance, easy current flow in one direction as opposed to the other, and sensitivity to light and heat. It can be used for switching, amplification, and energy efficiency thanks to these characteristics. The semiconductors must first be transformed into thin wafers that can be used to create solar cells, integrated circuits, and photovoltaic systems.

Request Sample Copy of this Report: https://www.marketstatsville.com/request-sample/wafer-processing-and-assembly-equipment-market?utm_source=free&utm_medium=harsh

Scope of the Global Wafer Processing and Assembly Equipment Market

The study categorizes the wafer processing and assembly equipment market based on business type, type, application, and end-users at the regional and global levels.

By Type Outlook (Sales, USD Billion, 2019-2033)

- Oxidation Systems

- Diffusion Systems

- Epitaxial Reactors

- Photolithography Equipment

- Others

By Business Type Outlook (Sales, USD Billion, 2019-2033)

- Original Equipment Manufacturers (OEM)

- Aftermarket

By Application Outlook (Sales, USD Billion, 2019-2033)

- Assembly

- Packaging

- Dicing

- Bonding

- Metrology

- Testing

By End-Users Outlook (Sales, USD Billion, 2019-2033)

- Consumer Electronics

- Automotive

- Industrial

- Telecommunication

- Security

- Others

By Region Outlook (Sales, USD Billion, 2019-2033)

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Italy

- France

- UK

- Spain

- Poland

- Russia

- The Netherlands

- Norway

- Czech Republic

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Indonesia

- Malaysia

- Thailand

- Singapore

- Australia & New Zealand

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Colombia

- Rest of South America

- The Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Northern Africa

- Rest of MEA

Direct Purchase Report: https://www.marketstatsville.com/buy-now/wafer-processing-and-assembly-equipment-market?opt=3338&utm_source=free&utm_medium=harsh

Dicing segment accounts for the highest CAGR during the forecast period by application

Based on the application, the market is bifurcated into the assembly, packaging, dicing, bonding, metrology, and testing. The dicing segment accounts for the highest CAGR during the forecast period. In the context of making integrated circuits, wafer dicing is the process by which die are removed from a semiconductor wafer after the wafer has been processed. Scribing, breaking, and mechanical sawing are all possible steps in the dicing process. For gaining accuracy and precision, all techniques are often automated. The individual silicon chips are divided into chip carriers, which are ready for use in the construction of electronic devices like computers and other devices.

Asia Pacific is projected to account for the highest market share by Region

Based on the regions, the global wafer processing and assembly equipment market has been segmented across North America, Asia-Pacific, Europe, South America, and the Middle East & Africa. In 2022, Asia Pacific was expected to witness the highest market share in the global wafer processing and assembly equipment market. Due to the high demand for smartphones and other consumer electronics products from countries like China, the Republic of Korea, and Singapore, several vendors are establishing manufacturing facilities in the area. In order to meet the varied client needs, the businesses are growing their presence in the area by launching new initiatives. Public organizations and commercial businesses are investing more in new goods and R&D facilities. For instance, Semiconductor Manufacturing International Corp (SMIC), the largest contract chip manufacturer in China, announced its agreement with the Lin-Gang Special area, a free trade zone in Shanghai, in September 2021. With the help of this partnership, SMIC is now able to build a new foundry with a monthly capacity of 100,000 12-inch wafers.

Key Market Players in the Global Wafer Processing and Assembly Equipment Market

The wafer processing and assembly equipment market is extremely cutthroat, and significant competitors in the sector are using tactics including product development, collaborations, acquisitions, agreements, and growth to bolster their market positions. Most sector businesses focus on growing their operations worldwide and cultivating long-lasting partnerships.

Major key players in the global wafer processing and assembly equipment market are:

- Applied Materials Inc

- ASML Holding Semiconductor Company

- Tokyo Electron Limited

- Lam Research Corporation

- KLA Corporation

- Hitachi High-Technologies Corporation

- Disco Corporation

- ASM Pacific Technology

- Kulicke and Soffa Industries, Inc

- BE Semiconductor Industries N.V

- Towa Corporation

Request For Report Discount: https://www.marketstatsville.com/table-of-content/wafer-processing-and-assembly-equipment-market

Recent Developments

- In June 2021, A contract was signed by Texas Instruments Incorporated to buy Micron Technology's 300-mm semiconductor facility in Lehi, Utah. This acquisition is part of Texas Instruments' long-term capacity planning and bolsters the company's technological and manufacturing competitive edge. The Lehi fab, which will join DMOS6, RFAB1, and the soon-to-be-completed RFAB2 in TI's wafer fab manufacturing activities, will be the company's fourth 300-mm fab.

- In August 2021, Hon Hai Technology Group (Foxconn) and Macronix, a producer of non-volatile memory (NVM), agreed to a six-inch wafer fab transaction. According to reports, the action also opens the way for a long-term commitment to semiconductor development, keeping with Foxconn's 3+3 strategy, which focuses on advanced communication, robotics + artificial intelligence, semiconductor, and electric vehicles (EV).

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jocuri

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Alte

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness