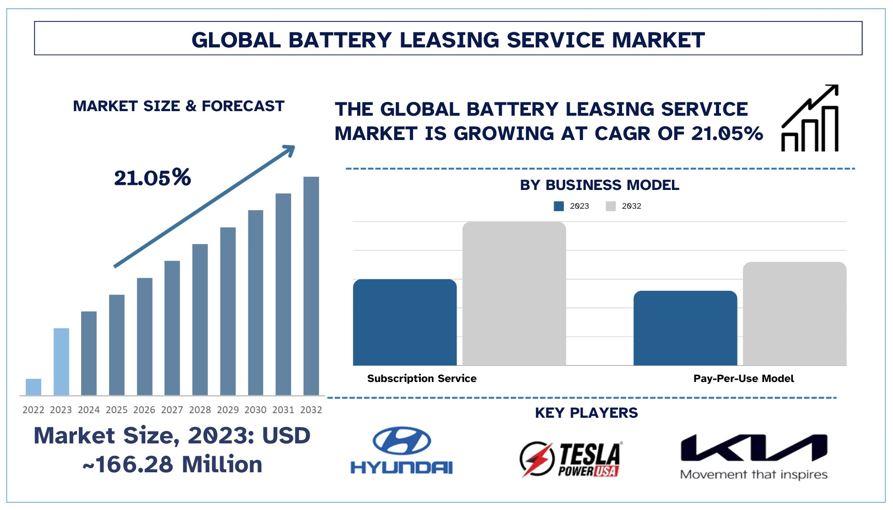

According to a new report by Univdatos Market Insights, the Battery Leasing Service Market was valued at USD 166.28 Million in 2023 and growing at a CAGR of 21.05%. With the global shift towards the use of environmentally friendly means of transport, electric vehicles or EVs have presented a possible replacement for the conventional Internal Combustion Engine or ICE vehicles. One of the key aspects of this transition is the battery itself which is the expensive element within an electric vehicle hence the need for more affordable models of ownership. One such model is battery leasing, similar to leasing cars, instead of owning a battery and hence lowering the cost of EVs tremendously. This business model is growing popular globally for car manufacturers, especially because the battery prices and its durability are still an issue for both individuals and companies.

Request Free Sample Pages with Graphs and Figures Here - https://univdatos.com/get-a-free-sample-form-php/?product_id=65482

Rising Demand for Battery Leasing Services:

In the past decade, global EV adoption has increased significantly with both countries and industries actively progressing in the electrification of transport. As stated by the IEA, the global EV stock crossed 10 million in 2020 and there is a growing trend where governments have set out strict policies regarding CO2 emissions and providing incentives to EV buyers. The largest market for private EVs is located in China taking almost 50 percent of the landmark share of the global market due in large part to China’s robust automotive production line, policies, and scales of charging points. Europe and North America are closely behind; with several countries such as Norway, the Netherlands, and Germany experiencing high growth due to the better policies and high concern for the environment. However, one of the key challenges and barriers to wider EV adoption is the relatively high cost of the batteries. The expenditure on battery packs can range from 30 percent to 50 percent of the cost of EVs. Therefore, new models such as battery leasing have been developed in a way that will reduce customer’s costs, making it easier for them to own EVs.

Key Trends in the Battery Leasing Market

Several key trends are shaping the future of the battery leasing service market:

Battery Swapping Technology: Currently, some players such as Nio and Gogoro (in Taiwan) are implementing battery swapping services whereby consumers swap depleted batteries with charged ones within the shortest time possible. This trend is on the rise, especially in areas where the charging networks are scarce or where time is a critical factor for charging.

Integration with Energy Storage: While solar and wind as renewable energy sources are becoming more popular battery leasing models are finding their place in the energy storage sector. By leasing the batteries, energy producers can store excess energy produced during the day for use during peak production hours by consumers such as homes and business establishments.

Subscription-Based Services: There are other new business models such as the subscription model where users pay a monthly fee for batteries and their related services, maintenance, and upgrades. This model is more convenient for urban EV owners who may not require a fixed battery and frequent access to it but rather want freedom and convenience.

Increased Focus on Sustainability: They found that the reasons for battery leasing are relevant to the significance of the circular economy which considers recycling and sustainability significant. Third, leased batteries can mainly be repurposed for secondary uses including those in stationary energy storage after their deployment in EVs.

Related Reports-

Inflatable Boats Market: Current Analysis and Forecast (2024-2032)

Automotive Green Tires Market: Current Analysis and Forecast (2024-2032)

Conclusion

In conclusion, the future of the battery leasing service market is promising since industries and governments are focusing on efficient and environmentally friendly energy sources. Battery leasing service is an integral participant in the energy transition as it offers the flexibility of production while offering opportunities to minimize carbon emissions and provide energy security. In the future energy mix considering the future growth of the hydrogen economy and other technical advancements, battery leasing service will most likely become an important player.