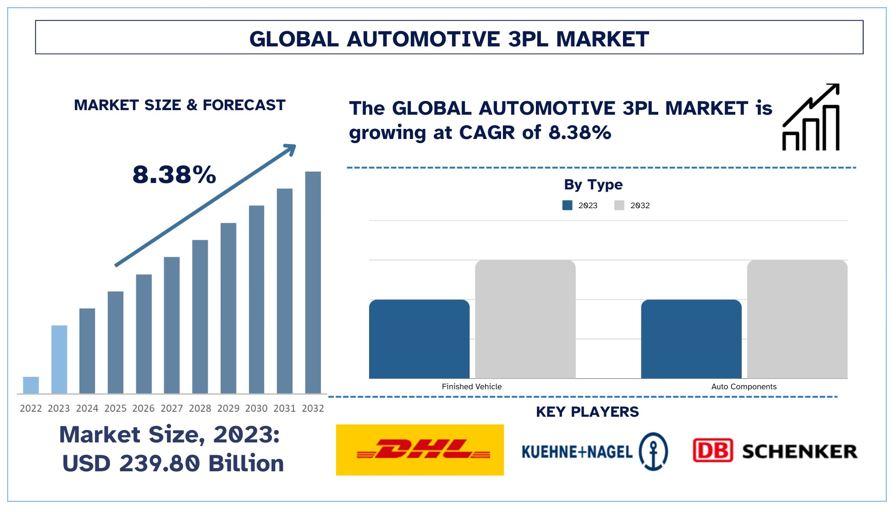

According to a new report by Univdatos Market Insights, the Automotive 3PL Market is expected to reach USD 494.75 billion in 2032 by growing at a CAGR of 8.38%. Outsourcing of logistics and supply chain management activities is on the rise in the automotive industry as manufacturers and suppliers look for ways to cut costs and improve the efficiency and flexibility of the automotive supply chain. Third-party logistics providers have seen increased business from automotive makers and suppliers of auto components because the latter are outsourcing their warehousing, transportation, customs brokerage, and distribution activities, thus enabling them to concentrate on value-added activities such as designing, developing, and producing automobiles.

For More Detailed Analysis in PDF Format, Visit- https://univdatos.com/get-a-free-sample-form-php/?product_id=67444

KEY GROWTH DRIVERS:

The Automotive 3PL market is on the rise for several reasons such as the increased supply chain operations’ complications, inventory tracking requirements that are becoming more and more real-time, and the ever-increasing pressure toward cost reduction. This latest trend has therefore seen manufacturers outsourcing their complex supply chain systems involving suppliers of automotive parts, assembly plants, and distribution networks from 3PL services. Furthermore, the emergence of EVs and self-driving vehicles as new logistics models also presents added complexity that only a few third-party logistics know-how and technology address. To this, supply chain management companies are beginning to adopt automation systems, IoT devices, and AI solutions for demand forecasting for precise delivery of supplies, shortening of delivery times, and prevention of possible mistakes. They are important in meeting just-in-time delivery systems which are important for the automobile industry to keep its inventory expenses low while orders continue to be processed.

Latest Developments

In October 2024, CEVA Logistics acquired a joint venture company from Bolloré Logistics and Horoz Logistics named Horoz Bolloré Logistics founded back in 2000. The full acquisition of Horoz Bolloré Logistics as CEVA has the potential to further strengthen the range of services we provide in Turkey that will help enhance our In October 2024, CEVA Logistics, a global third-party logistics company, and Almajdouie Logistics, one of the most prominent end-to-end logistics solution providers in the Middle East region agreed to form a joint venture in the Kingdom of Saudi Arabia (KSA).

In July 2024, The DHL Supply Chain penetrated the United States retail out zone with new additional stock in Troy Michigan. The new facility also provides touch-screen kiosks for staff-assisted and automated self-service besides other services and DHL branded products such as Bubble packing material, packing tapes, and branded moving boxes among others that will make and create the right customer retail sensation.

In December 2023, CEVA Logistics of the CMA group closed the acquisition of GEFCO. As a part of this adjustment and in line with its deal with GEFCO, CEVA Logistics has said that it creates a specific finished vehicle logistics organization.

Transport SegmentGaining Maximum Traction in the Market

The transportation segment is expected to experience significant growth in the forecast period owing to core functionality, as it moves raw materials, goods, auto components, and finished products from one place to another. This is happening due to increased globalization, as it allows components to be manufactured components in one part of the world and sold to another part of the world. This requires a smooth and efficient transportation system and hence, the services for the automotive 3PL increase. Moreover, the automobile and transportation industry are booming due to the emergence of electric vehicles. Major countries around the world are accepting these new energy vehicles and providing subsidies for greater adoption, which has boosted the demand for automotive 3 PL services. Developing countries such as India, and Indonesia may have manufacturing units for these vehicles, but mainly they are importing from other nations. For instance, in 2023, according to the report by Volza, India imported 12,967 shipments of electric vehicles from Mar 2023 to Feb 2024 (TTM). Companies operating in the market are expanding their logistic services to fulfill the market demand. For instance, in April 2024, Kuehne+Nagel expanded its spare parts logistics for BMW. The company is one of the leading logistic providers and now manages a 170,000m² spare parts fulfillment and delivery centre in Wallersdorf, Germany.

Explore the Comprehensive Research Overview – https://univdatos.com/report/automotive-3pl-market

Conclusion

The automotive 3PL market is on pace for steady growth around the globe due to the adoption of new technologies and emphasis on efficiency in supply chains typical of the automotive sector. Emerging trends such as increased demand for electric cars, increasing trends of e-commerce in auto parts, and the adoption of sustainable solutions are new opportunities for 3PL providers. Based on the current developments, it is evident that the establishment of strategic partnerships, and investment in sound technologies will be the key force in sustaining growth in this fast-growing market.

Related Automotive Market Research Report

Automotive Green Tires Market: Current Analysis and Forecast (2024-2032)

Electric Vehicle Maintenance Market: Current Analysis and Forecast (2024-2032)

Automotive Antifreeze Market: Current Analysis and Forecast (2024-2032)

Automotive Snow Tire Chains Market: Current Analysis and Forecast (2024-2032)

Contact Us:

UnivDatos Market Insights

Email - contact@univdatos.com

Contact Number - +1 9782263411

Website - https://univdatos.com/