Trends Shaping the Future of the India MSME Payment Risk Management Solutions Market | UnivDatos

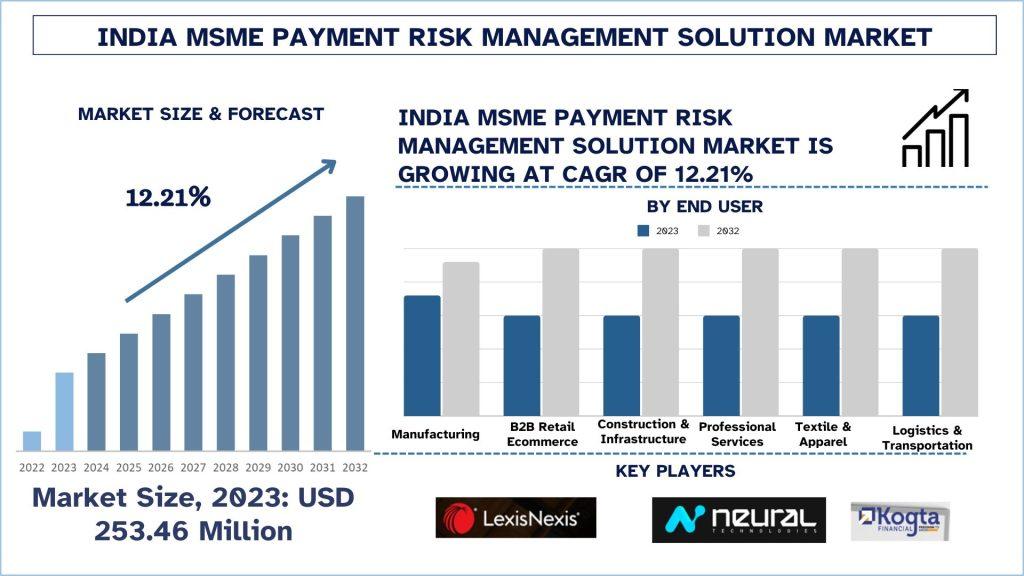

According to the Univdatos Market Insights analysis, growing demand for fraud detection systems with increased efficiency will drive the growth scenario of India MSME Payment Risk Management Solutions and as per their “India MSME Payment Risk Management Solutions Market” report, the market was valued at USD 253.46 million in 2023, growing at a CAGR of 12.21% during the forecast period from 2024 - 2032 to reach USD million by 2032. India MSME Payment Risk Management Solutions refers to the sharing of technology that provides ease of payment solutions and reduces the chances of deferred payments. Micro Small and Medium Enterprises hold a sizable share in the GDP of the country. These enterprises apart from their high relevance often face difficulty in receiving payments and identifying certain fraudulent customers due to which the requirement for the companies offering various security and payment tracking services has become crucial. To address these issues certain centralized systems, blacklist systems, blockchain-based smart contracts, etc., are being implemented which would alleviate the cases of fraudulent activities and help MSMEs to operate smoothly.

Access sample report (including graphs, charts, and figures): https://univdatos.com/get-a-free-sample-form-php/?product_id=67013

AI-Powered Risk Assessment:

There is a rising demand for AI-powered risk assessment for payment-related issues for MSMEs. As AI Powered Risk Assessment Solutions mitigates defaults, and payment delays and improves financial stability the demand for such systems among the MSMEs has increased significantly. Various services such as data aggregation and analysis, predictive analytics for payment risk, custom risk profiles, automated payment solutions, fraud detection and prevention, integration with the credit bureau, buyer blacklisting, etc., are some of the key features that the AI-Powered risk assessment software provide to the users. As with the high data availability and integration of AI with the existing payment and credit bureau infrastructure the implantation of a proactive and predictive model comes into the picture further ensuring long-term financial stability for the MSMEs.

Adoption of Blockchain and Smart Contracts:

The adoption of blockchain and smart contracts is emerging as a trend among payment risk management solution providers. These technological changes have helped industries such as finance, supply chain, etc., to optimize their payment-related issues. Blockchain technology offers increased efficiency, transparency, and upgraded security solutions. Various benefits such as transparency and trust, enhanced security, increased efficiency, cost reduction, real-time settlement, automation process, etc.

The adoption of blockchain and smart contracts also offers automated payments and settlements once the material/goods are being shipped to the client. The blockchain technology also helps in providing decentralized credit score to the MSMEs to help make them informed decisions. Additionally, these technologies also help to enhance the security of payments.

Click here to view the Report Description & TOC https://univdatos.com/report/india-msme-payment-risk-management-solution-market/

Conclusion:

The India MSME Payment Risk Management Solutions market is experiencing a transformative phase driven by technological advancements, sustainability aviation, digitalization, market dynamics, and implementation of government policies. Stakeholders across the industry are embracing these trends to enhance operational efficiency, integrating digital advancements, fraud detection systems, etc. The rising number of MSMEs in the country as well as the rising cases of NPAs will be crucial for the India MSME Payment Risk Management Solutions market.

Related Report

Cyber Insurance Market: Current Analysis and Forecast (2024-2032)

Digital Human Avatar Market: Current Analysis and Forecast (2024-2032)

Virtual Influencers Market: Current Analysis and Forecast (2024-2032)

Diversity and Inclusion (D&I) Market: Current Analysis and Forecast (2024-2032)

Container Orchestration Market: Current Analysis and Forecast (2024-2032)

Contact Us:

UnivDatos Market Insights

Email - contact@univdatos.com

Contact Number - +1 9782263411

Website - https://univdatos.com/

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jogos

- Gardening

- Health

- Início

- Literature

- Music

- Networking

- Outro

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness