FinTech Blockchain Market Forecast: Key Trends and Emerging Opportunities

In-Depth Market Overview

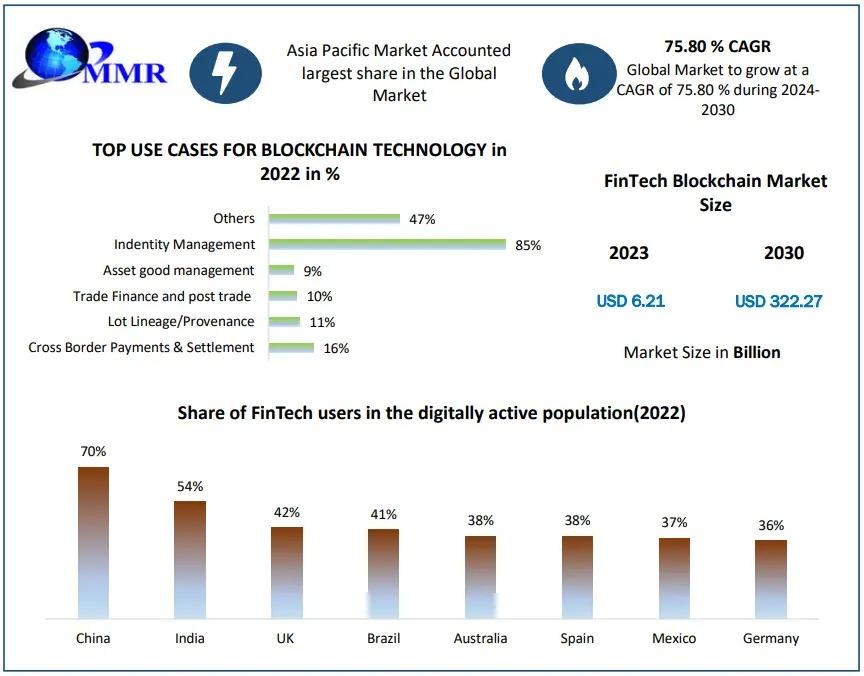

Welcome to the realm of the global FinTech Blockchain market with our latest report from Maximize Market Research. This comprehensive analysis not only captures current trends but also anticipates future developments, empowering you to make strategic decisions in a rapidly evolving landscape.

Download PDF Brochure:

https://www.maximizemarketresearch.com/request-sample/13770/

Detailed Report Scope & Methodology

Our report provides a meticulous examination of the FinTech Blockchain industry, emphasizing strategic insights and competitive dynamics of key players. The analysis includes:

- Trade Patterns: A deep dive into import/export dynamics that shape market viability.

- Supply & Demand Insights: Identifying the key drivers influencing pricing and market behaviours.

- Emerging Opportunities: Highlighting potential growth areas in various regions.

Utilizing a combination of primary and secondary research methods, along with a thorough SWOT analysis, we ensure you have a solid foundation for making informed business decisions.

Regional Insights: A Global Perspective

Our extensive regional analysis encompasses critical markets in North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. By evaluating market size, growth trajectories, and trade activities, we provide a holistic view of the FinTech Blockchain market's global dynamics.

Request Sample Pages:

https://www.maximizemarketresearch.com/request-sample/13770/

Key Regional Highlights:

- North America: A hub for innovation with a well-established infrastructure.

- Asia Pacific: Rapid expansion driven by urbanization and economic development.

- Europe: A diverse market integrating sustainability with technological innovation.

Market Segmentation: Targeted Insights

by Application

Payments, clearing, and settlement

Exchanges and remittance

Smart contracts

Identity management

Compliance management/Know Your Customer (KYC)

Others (cyber liability and content storage management

by Provider

Application and solution providers

Middleware providers

Infrastructure and protocols providers

by Organization Size

Small and Medium-Sized Enterprises (SMEs)

Large enterprises

by Industry Vertical

Banking

Non-banking financial services

Insurance

The market is divided into three industry verticals: banking, nonbanking financial services, and insurance. The banking category dominated the market in 2023 and is predicted to hold the highest FinTech Blockchain Market share during the forecast period. To facilitate financial transactions, digital payments and banking were developed using global technical achievements. Electronic banking is no longer the exclusive type of digital banking. It involves, among other things, internet banking, mobile banking, and the usage of electronic cards as payment. Similarly, the worldwide digital payments market is projected to increase by USD 360 billion by 2030. The payments industry comprises any transaction that enables a payment to be made digitally.

We segment the FinTech Blockchain market into distinct categories, allowing for focused analysis and strategy development. Each segment possesses unique dynamics and opportunities that can be leveraged for growth.

Browse Premium Research insights:

https://www.maximizemarketresearch.com/request-sample/13770/

Key Players: Leaders in the FinTech Blockchain Market

North America:

1. Ripple Labs Inc. (San Francisco, California, USA)

2. Coinbase (San Francisco, California, USA)

3. Gemini Trust Company (New York, New York, USA)

4. Chain Inc. (San Francisco, California, USA)

5. Digital Asset Holdings (New York, New York, USA)

6. Circle Internet Financial (Boston, Massachusetts, USA)

7. Consensys (Brooklyn, New York, USA)

8. BitPay (Atlanta, Georgia, USA)

9. Corda (R3) (New York, New York, USA)

10. Kraken (San Francisco, California, USA)

Europe:

11. Adyen (Amsterdam, Netherlands)

12. Wirex (London, United Kingdom)

13. Bitstamp (Luxembourg)

14. Revolut (London, United Kingdom)

15. Blockchain.com (London, United Kingdom)

16. eToro (London, United Kingdom)

17. Santander InnoVentures London, United Kingdom

18. Fidor Bank (Munich, Germany)

19. SolarisBank (Berlin, Germany)

20. Binance (Valletta, Malta)

Asia Pacific:

21. Ant Group (Hangzhou, Zhejiang, China)

22. Binance Asia Services Pte Ltd (Singapore)

23. Coinone (Seoul, South Korea)

24. QUOINE (Tokyo, Japan)

25. Huobi Global (Singapore)

26. ZebPay (Singapore)

27. OKCoin (Hong Kong)

28. Coins.ph (Manila, Philippines)

29. Liquid (Quoine) (Tokyo, Japan)

30. Korbit (Seoul, South Korea)

Identify the key players shaping the future of the FinTech Blockchain market. Our report addresses critical questions such as:

What is the current state of the FinTech Blockchain market?

What was the market size in 2023?

What strategies are industry leaders implementing for growth?

Check Out the Full Global Secondary Report:

https://www.maximizemarketresearch.com/market-report/fintech-blockchain-market/13770/

Key Offerings: What to Expect

- Historical Market Size & Competitive Landscape (2018-2023)

- Pricing Trends Across Regions

- Market Forecast (2024-2030) by Segment

- Market Dynamics: Drivers, Restraints, and Opportunities

- PESTLE & PORTER Analysis for Strategic Insight

- SWOT Analysis of Emerging Opportunities

- Legal and Regulatory Considerations by Region

- Actionable Recommendations for Strategic Engagement

About Maximize Market Research

At Maximize Market Research, we specialize in delivering impactful market insights across a variety of sectors—from healthcare to technology. Our expert team provides validated estimations, strategic analysis, and actionable recommendations to support your business decisions.

Connect with Us

Maximize Market Research

3rd Floor, Navale IT Park, Phase 2

Pune Banglore Highway, Narhe,

Pune, Maharashtra 411041, India

Email: sales@maximizemarketresearch.com

Phone: +91 96071 95908 | +91 9607365656

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Spellen

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness