The Sweet Surge: Exploring the Frozen Dessert Market in India

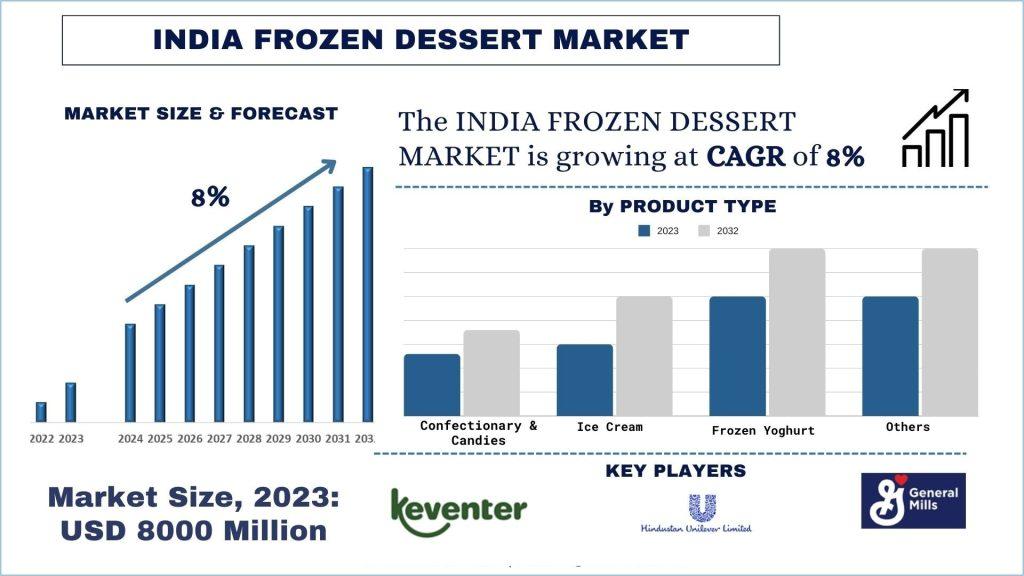

India's frozen dessert market is a fascinating landscape that blends tradition with innovation, catering to an increasingly health-conscious yet indulgent consumer base. As urbanization accelerates and disposable incomes rise, the demand for diverse and premium frozen desserts has soared. This blog delves into the various aspects of the Indian frozen dessert market, its growth drivers, challenges, key players, and future trends, painting a comprehensive picture of this dynamic industry. According to UnivDatos Market Insights Analysis, The India Frozen Dessert Market was valued at ~USD 8000 million in 2023 and is expected to grow at a strong CAGR of around 8% during the forecast period (2024-2032).

Request Free Sample Pages with Graphs and Figures Here - https://univdatos.com/get-a-free-sample-form-php/?product_id=60827

A Melting Pot of Flavors

The frozen dessert market in India is as diverse as its culture, offering a wide range of products including ice creams, gelatos, frozen yogurts, sorbets, and frozen custards. Traditional flavours like mango, coconut, and cardamom coexist with international favourites such as chocolate, vanilla, and strawberry. Additionally, innovative flavours that cater to local tastes—such as saffron, rose, and even spicy varieties—are becoming increasingly popular.

Market Dynamics

Growth Drivers

1. Rising Disposable Incomes: One of the primary drivers of the frozen dessert market in India is the increase in disposable incomes. As more Indians enter the middle class, their purchasing power allows them to indulge in premium and imported frozen desserts.

2. Urbanization: Urban areas, with their higher concentration of affluent consumers and modern retail formats, are major hubs for frozen dessert sales. The proliferation of shopping malls, hypermarkets, and specialty stores in cities has made these products more accessible.

3. Health and Wellness Trends: There is a growing preference for healthier dessert options. This has led to a surge in demand for products like frozen yogurt, low-fat ice creams, and dairy-free options. Companies are responding by launching products that cater to these health-conscious consumers.

4. Influence of Western Culture: The influence of Western culture and eating habits has significantly impacted the Indian frozen dessert market. The trend of dining out and the popularity of Western-style desserts have introduced consumers to a variety of frozen treats.

Challenges

1. Supply Chain and Storage: Maintaining the cold chain logistics necessary for frozen desserts can be challenging in a country with a tropical climate. Inadequate refrigeration infrastructure can lead to product spoilage and increased operational costs.

2. Regulatory Hurdles: Compliance with food safety and quality standards is essential but can be cumbersome. Navigating the complex regulatory landscape requires significant investment in quality assurance and control measures.

Key Players

1. Amul: A household name in India, Amul has a significant share of the frozen dessert market. Known for its wide range of affordable and premium ice creams, Amul continues to innovate with new flavours and product lines.

2. Kwality Wall's: A subsidiary of Unilever, Kwality Wall's offers a variety of frozen desserts, from classic ice creams to healthier options like frozen yogurts. Their marketing strategies and widespread distribution network have made them a dominant player.

3. Vadilal: Vadilal is another major player, known for its extensive flavour range and quality products. With a strong presence in both urban and rural areas, Vadilal caters to a diverse consumer base.

4. Mother Dairy: Mother Dairy's ice creams and frozen desserts are popular for their taste and affordability. The company focuses on using natural ingredients and innovative flavours to attract consumers.

5. International Brands: Brands like Häagen-Dazs, Baskin Robbins, and Gelato Italiano have carved a niche in the premium segment, offering high-quality products and unique flavours that appeal to the affluent urban population.

For more information about this report visit- https://univdatos.com/report/india-frozen-dessert-market/

Trends Shaping the Future

1. Innovation in Flavors and Ingredients: The frozen dessert market is witnessing a wave of innovation, with companies experimenting with exotic and gourmet flavours. Ingredients like organic fruits, superfoods, and traditional Indian spices are being used to create unique products.

2. Sustainable Practices: With the growing awareness of environmental issues, companies are adopting sustainable practices. This includes using eco-friendly packaging, sourcing ingredients responsibly, and reducing the carbon footprint of their operations.

3. Expansion of Distribution Channels: The rise of e-commerce and food delivery platforms has made frozen desserts more accessible. Companies are leveraging online channels to reach a wider audience and offer home delivery services.

4. Focus on Health: The demand for healthier frozen desserts is driving innovation in this segment. Products with reduced sugar, low fat, and added probiotics are becoming increasingly popular. Plant-based and dairy-free options are also gaining traction among vegan and lactose-intolerant consumers.

5. Customization and Personalization: Consumers are seeking personalized experiences, and companies are responding by offering customizable frozen desserts. This includes allowing customers to choose their base flavours, mix-ins, and toppings to create unique combinations.

Related Reports-

India Microgrid Market: Current Analysis and Forecast (2024-2032)

India Green Hydrogen Market: Current Analysis and Forecast (2024-2032)

The Café and Bakery Shop Segment

The café and bakery shop segment is a significant contributor to the frozen dessert market in India. These establishments offer a variety of frozen desserts, including artisanal ice creams, gelatos, and frozen yogurts. The café culture is booming, particularly among the younger demographic, who frequent these spots not just for the food but for the ambiance and social experience.

Recent News:

- Theobroma (April 2024): Theobroma launched a new range of frozen desserts, including premium ice creams and sorbets, available across all its outlets.

- Bombaykery (March 2024): Bombaykery introduced a selection of frozen cheesecakes and ice cream cakes, enhancing their dessert offerings for special occasions and celebrations.

- Smoor Chocolates (February 2024): Smoor Chocolates expanded its product line to include handcrafted gelatos, emphasizing the use of high-quality ingredients and innovative flavours.

- Naturals Ice Cream Café (January 2024): Naturals Ice Cream Café opened new outlets in Delhi and Bangalore, featuring exclusive café-style menus with a focus on freshly made frozen desserts.

- Häagen-Dazs Café (December 2023): Häagen-Dazs Café launched a new festive menu featuring limited-edition ice cream flavours and frozen dessert combos for the holiday season.

Conclusion

The frozen dessert market in India is on a growth trajectory, fuelled by increasing disposable incomes, urbanization, and changing consumer preferences. While challenges such as supply chain logistics and regulatory compliance persist, the market's future looks promising with continuous innovation and a focus on health and sustainability. As the market evolves, both domestic and international players will need to adapt to emerging trends and consumer demands to maintain their competitive edge. The café and bakery shop segment, with its emphasis on premium and artisanal products, will continue to play a pivotal role in shaping the market dynamics.