Introduction:

Motor insurance is a part of general insurance that offers comprehensive protection coverage to the owners of vehicles of different categories in case of repair and theft. These insurance policies are offered by various public and private sector financial institutions and Banks regulated under the Insurance Regulatory Development Authority of India (IRDAI). The insurance policy covers the majority of the non-consumable items and their damage repair for the insured period of time.

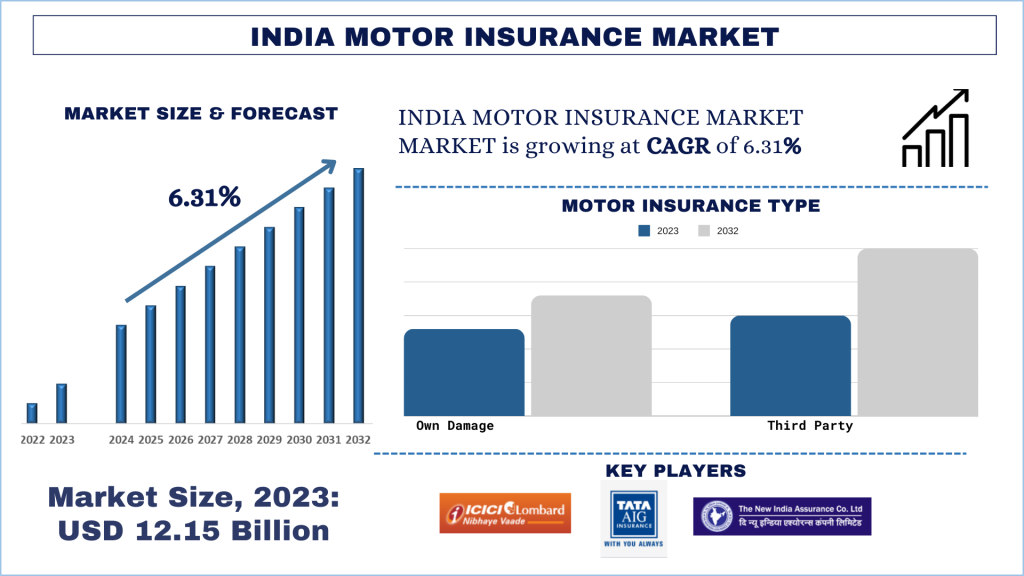

According to the UnivDatos Market Insights Analysis, growing demand for vehicle insurance with increased efficiency will drive the growth scenario of Motor Insurance and as per their “India Motor Insurance Market” report, the Indian market was valued at USD 12.15 billion in 2023, growing at a CAGR of 6.31% during the forecast period from 2024 - 2032.

Request Free Sample Pages with Graphs and Figures Here - https://univdatos.com/get-a-free-sample-form-php/?product_id=61705

Rising Trend of Motor Insurance from the Food & Beverages Industry:

The electric vehicle is a rising segment due to the growing focus of the customers towards sustainability. Electric cars offer various advantages over internal conventional fuel vehicles, such as lower operational costs over the long term, no tailpipe emission, etc. As electric vehicle sales in both the two-wheeler and four-wheeler categories have been witnessing higher sales, the demand for motor insurance is anticipated to rise in the coming years. As per the sales data for automobiles, the total sales of electric vehicles in 2023 accounted for 1.53 million, which is a 50% jump from 2022.

Additionally, the government initiatives offering free road tax in many of the states have further promoted the sales of electric vehicles in cars, two-wheelers, and e-rickshaw categories, which would contribute to a higher number of motor insurance markets in India.

Considering the rise of automotive in the electric vehicle category, the demand for motor insurance in the respective segment will grow further in the coming years, i.e., 2024-2032.

Rising Demand for Motor Insurance from the Automotive Sector:

Motor insurance is a part of general insurance that is subjected to offering comprehensive protection coverage to the owners of vehicles of various categories in case of repair and theft. These insurance policies are offered by various public and private sector financial institutions and Banks regulated under the Insurance Regulatory Development Authority of India (IRDAI). The insurance policy covers the majority of the non-consumable items and their damage repair for the insured period of time.

The India Motor Insurance market was valued at USD 12.15 Billion in 2023 and is expected to grow at a strong CAGR of around 6.31% during the forecast period (2024-2032).

For more information about this report visit- https://univdatos.com/report/india-motor-vehicle-insurance-market/

Considering the rise of the middle-class population as well as rising disposable income in the country, the automotive industry has benefitted from increasingly high sales in recent years.

Furthermore, private vehicles also have a stronghold in private vehicle ownership, which has strengthened their position in the motor insurance market. Private vehicle owners are also frequent buyers of motor vehicle insurance policies due to their inclination towards premium vehicles, which require insurance to avoid any hefty damages in case of accidents. According to Rushlane, an auto news website, the sales of 200-500 cc two-wheelers have witnessed a 6.82% sales increase in March 2023 as compared to March 2022. This exhibits an inclination of the buyers towards high-end vehicles in India with premium costs, which often leads to hefty repair costs, forcing the customers to opt for motor insurance for a long period of time.

These updates, along with technological updates, would be further conducive to the adoption of Motor Insurance in the coming period, i.e., 2024-2032.

Related Reports-

India Frozen Dessert Market: Current Analysis and Forecast (2024-2032)

India Digital Transformation in Energy Market: Current Analysis and Forecast (2024-2032)

Conclusion:

The India Motor Insurance market is experiencing a transformative phase driven by technological advancements, sustainability packaging operations, digitalization, market dynamics, and implementation of government policies. Stakeholders across the industry are embracing these trends to enhance operational efficiency, electric motor vehicle insurance alternatives, etc. As robust protection needs in the electric automobile sector to play a strategic role in improving insurance solutions and services, staying abreast of these trends and embracing innovation will be crucial for the India Motor Insurance market.