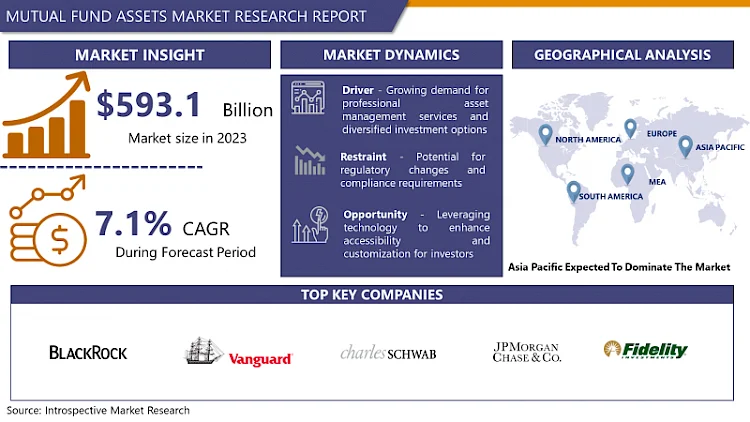

Mutual Fund Assets Market Size Was Valued at USD 593.1 Billion in 2023, and is Projected to Reach USD 1099.6 Billion by 2032, Growing at a CAGR of 7.1% From 2024–2032.

The mutual fund assets market represents the collective investments pooled from individual and institutional investors to invest in securities such as stocks, bonds, and other assets. As of 2023, the global mutual fund market is growing steadily due to increasing demand for diversified investment portfolios and rising financial literacy among investors. Key drivers include economic recovery post-pandemic, growth in equity markets, and the popularity of index funds. Regulatory developments, digital platforms, and sustainable or ESG (Environmental, Social, Governance) investments also shape the market. Challenges include volatility in financial markets and competition from alternative investment vehicles like ETFs.

Drivers and Dynamics of the Mutual Fund Assets Market:

· Increasing Financial Literacy: As more individuals become aware of investment options and the importance of financial planning, the demand for mutual funds has grown, particularly in emerging markets.

· Economic Growth and Rising Disposable Income: With economic recovery and increasing disposable income in several regions, more individuals are seeking investment opportunities through mutual funds.

· Diversification Benefits: Mutual funds offer diversified portfolios, attracting investors looking for risk management and stable returns. This has led to consistent growth in asset inflows.

· Growth in Equity Markets: The global surge in equity markets boosts mutual fund investments, especially equity-based funds, as investors seek higher returns.

· Technological Advancements: Digital platforms and robo-advisors make it easier for investors to access and manage mutual fund investments, contributing to market expansion.

· Sustainable and ESG Investing: Growing interest in ethical and sustainable investments has spurred the development of ESG mutual funds, attracting socially-conscious investors.

Get Full PDF Sample Copy of Report: (Including Full TOC, List of Tables & Figures, Chart) @

https://introspectivemarketresearch.com/request/15686

Leading players involved in the Mutual Fund Assets Market include:

· BlackRock, Inc. (United States)

· The Vanguard Group, Inc. (United States)

· Charles Schwab & Co., Inc. (United States)

· JPMorgan Chase & Co. (United States)

· FMR LLC (United States)

· State Street Corporation (United States)

· Morgan Stanley (United States)

· BNY Mellon Securities Corp. (United States)

· Amundi US (United States)

· Goldman Sachs (United States)

· Franklin Templeton (United States)

· Other key Players

The latest report on the Mutual Fund Assets Market provides a detailed analysis of the market for the years 2024 to 2032. It presents a comprehensive overview of the global Mutual Fund Assets industry, incorporating all key industry trends, market dynamics, competitive landscape, and market analysis tools such as Porter’s five forces analysis, Industry Value chain analysis, and PESTEL analysis of the Mutual Fund Assets market. Moreover, the research covers crucial chapters such as Patent Analysis, Regulatory Framework, Technology Roadmap, BCG Matrix, Heat Map Analysis, Price Trend Analysis, and Investment Analysis which help to grasp the market direction and development in the present and forthcoming years.

Dynamics:

· Market Volatility: Fluctuations in global financial markets can influence investor behavior and affect mutual fund asset values, leading to shifts in fund allocations.

· Competition from ETFs: Exchange-Traded Funds (ETFs), offering similar benefits with lower fees, pose significant competition to traditional mutual funds.

· Regulatory Changes: Regulatory reforms in various regions, such as fee transparency and investor protection measures, impact the operational dynamics and growth strategies of mutual funds.

If You Have Any Query Mutual Fund Assets Market Report, Visit:

https://introspectivemarketresearch.com/inquiry/15686

Segmentation of Mutual Fund Assets Market:

By Fund Type

· EQUITY FUNDS

· BOND FUNDS

· MONEY MARKET FUNDS

· HYBRID & OTHER FUNDS

By Investor Type

· INSTITUTIONAL

· INDIVIDUAL

By Distribution Channel

· BANKS

· FINANCIAL ADVISORS/BROKERS

· DIRECT SELLERS

· OTHERS

An in-depth study of the Mutual Fund Assets industry for the years 2024–2032 is provided in the latest research. North America, Europe, Asia-Pacific, South America, the Middle East, and Africa are only some of the regions included in the report’s segmented and regional analyses. The research also includes key insights including market trends and potential opportunities based on these major insights. All these quantitative data, such as market size and revenue forecasts, and qualitative data, such as customers’ values, needs, and buying inclinations, are integral parts of any thorough market analysis.

By Regions: -

- North America (US, Canada, Mexico)

- Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe)

- Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe)

- Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New Zealand, Rest of APAC)

- Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa)

- South America (Brazil, Argentina, Rest of SA)

Key Benefits of Mutual Fund Assets Market Research:

- Research Report covers the Industry drivers, restraints, opportunities and challenges

- Competitive landscape & strategies of leading key players

- Potential & niche segments and regional analysis exhibiting promising growth covered in the study

- Recent industry trends and market developments

- Research provides historical, current, and projected market size & share, in terms of value

- Market intelligence to enable effective decision making

- Growth opportunities and trend analysis

- Covid-19 Impact analysis and analysis to Mutual Fund Assets market

Acquire This Reports: -

https://introspectivemarketresearch.com/checkout/?user=1&_sid=15686

About us:

Introspective Market Research Private Limited (introspectivemarketresearch.com) is a visionary research consulting firm dedicated to assisting our clients to grow and have a successful impact on the market. Our team at IMR is ready to assist our clients to flourish their business by offering strategies to gain success and monopoly in their respective fields. We are a global market research company, that specializes in using big data and advanced analytics to show the bigger picture of the market trends. We help our clients to think differently and build better tomorrow for all of us. We are a technology-driven research company, we analyze extremely large sets of data to discover deeper insights and provide conclusive consulting. We not only provide intelligence solutions, but we help our clients in how they can achieve their goals.

Contact us:

Canada Office

Introspective Market Research Private Limited, 138 Downes Street Unit 6203- M5E 0E4, Toronto, Canada.

APAC Office

Introspective Market Research Private Limited, Office №401, Saudamini Commercial Complex, Chandani Chowk, Kothrud, Pune India 411038

Ph no: +1–773–382–1049

Email: sales@introspectivemarketresearch.com