Key Highlights of the Report:

· Growing Health Awareness: The trend of healthy living is changing the preference for chocolates in vegan form in the confectionery market of the MENA area.

· Cultural Integration: The MENA vegan chocolates contain elements of regional culinary culture, such as dates and pistachios, to appeal to the local market but reflect global food trends.

· Innovation in Ingredients: Innovations include chocolate made from plant-based milk and natural sugars, which provides consumers with quality, lactose-free chocolate.

· Market Expansion: The market for vegan chocolate in MENA is growing significantly due to the inclination toward plant-based diets and ethical consumption.

· Sustainability Focus: Organic vegan chocolate manufacturing is in high demand in the MENA because of the increased awareness of the effects of climate change and the turnover of deforestation caused by cocoa importation.

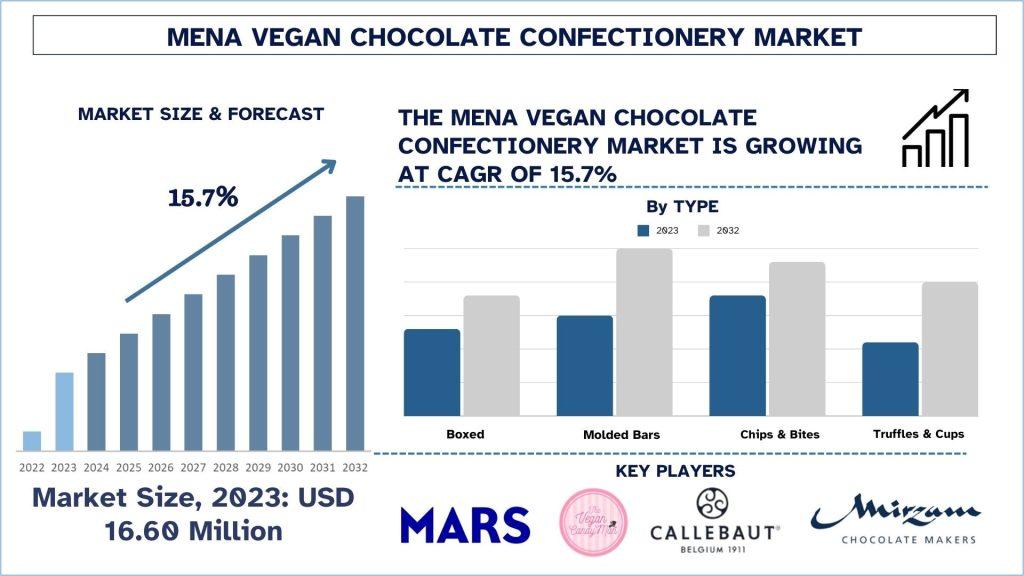

According to a new report by Univdatos Market Insights, The MENA Vegan Chocolate Confectionery Market was valued at USD 16.60 million in the year 2023 and is expected to grow at a strong CAGR of around 15.7% during the forecast period. Owing to the growing awareness and adoption of healthier lifestyles across the MENA region. However, the increasing vegan population results from people opting for such a diet not only for ethical reasons or environmental concerns but also for their health interests, which means a larger client base. The increasing availability of vegan products in traditional grocery stores and through Internet sales makes it easier for consumers in the MENA region to purchase vegan chocolate. Besides, e-commerce web platforms have emerged that enable broad market coverage in the MENA region. As per the Emirates NBD, in September 2023, estimates for 2022 that within the MENA region, Israel remains the largest e-commerce market – in terms of both absolute size and penetration rates - followed by KSA and the UAE. These three countries accounted for just over 72% of the MENA region’s total e-commerce market in 2022.

The report suggests that vegan chocolate confectionery resources in the MENA region had a significant impact on the vegan chocolate confectionery industry. Some of how this impact has been felt include:

· In August 2022: Nestle SA, the Swiss food giant, is launching KitKat V, a plant-based version of one of the world's most popular chocolate bars, from Friday with a rollout planned across 15 European countries including the UK and Middle East.

· In October 2022, Callebaut launched 100% dairy-free and plant-based chocolate NXT in Saudi Arabia. Callebaut, the chocolate maker preferred by artisans and chefs around the world, has debuted its game-changing Callebaut NXT series to the Kingdom of Saudi Arabia. NXT offers 100 percent plant-based dark and milky chocolates and is free from any traces of dairy.

· In July 2021, Upfield launched its plant-based cheese brand Violife into the Middle East, following the introduction of its Flora spread last year, with Asia markets set to follow suit. The products are sold to food service as well as retail sectors across the UAE, Saudi Arabia, Qatar, Oman and Bahrain.

Request Free Sample Pages with Graphs and Figures Here https://univdatos.com/get-a-free-sample-form-php/?product_id=63780

Apart from this, in recent years, the UAE has had significant growth in MENA, and North Africa has enhanced the growth of the Vegan chocolate confectionery industry:

The UAE is expected to grow with a significant CAGR during the forecast period (2024-2032). This is mainly due to its affluent and cosmopolitan population increasingly prioritizing health and sustainability. In recent years, there has been an increase in the adoption of veganism and plant-based diets amongst the UAE population, which is in line with global trends and local, healthy living campaigns. Currently, the UAE has over 18 eateries that are 100% vegan-friendly, and even popular fast-food franchises provide vegan options by 2021. Furthermore, the UAE market for the retail sale of chocolates and confectionery products is still expanding, with consumers shifting towards healthier products, including vegan chocolates. The current retail environment in the country, which includes advanced supermarkets and specific shops, ensures the availability and visibility of vegan products. Thus, vital programs such as Dubai’s Future Food Forum show the UAE’s aspiration to incubate ingenuity in sustainable and plant-based food sectors, increasing the demand for vegan chocolate confectionery.

Conclusion

In conclusion, the rise of vegan chocolate confectionery in the Middle East and North Africa region reflects a dynamic convergence of culinary innovation, cultural adaptation, and ethical consciousness. Chocolatiers and confectioners are meeting consumers' evolving demands and reshaping the confectionery landscape with delicious and sustainable products. As the trend towards veganism continues to gain momentum, MENA's rich tradition of culinary excellence is poised to flourish in new and exciting ways within the realm of vegan chocolate confectionery.

Key Offerings of the Report

Market Size, Trends, & Forecast by Revenue | 2024−2032

Market Dynamics – Leading Trends, Growth Drivers, Restraints, and Investment Opportunities

Market Segmentation – A detailed analysis By Product; By Distribution Channel

Competitive Landscape – Top Key Vendors and Other Prominent Vendors

Contact Us:

UnivDatos Market Insights

Email - contact@univdatos.com

Contact Number - +1 9782263411

Website -www.univdatos.com