Navigating Tomorrow's Shopping: The Rise of Buy Now Pay Later in the Middle East

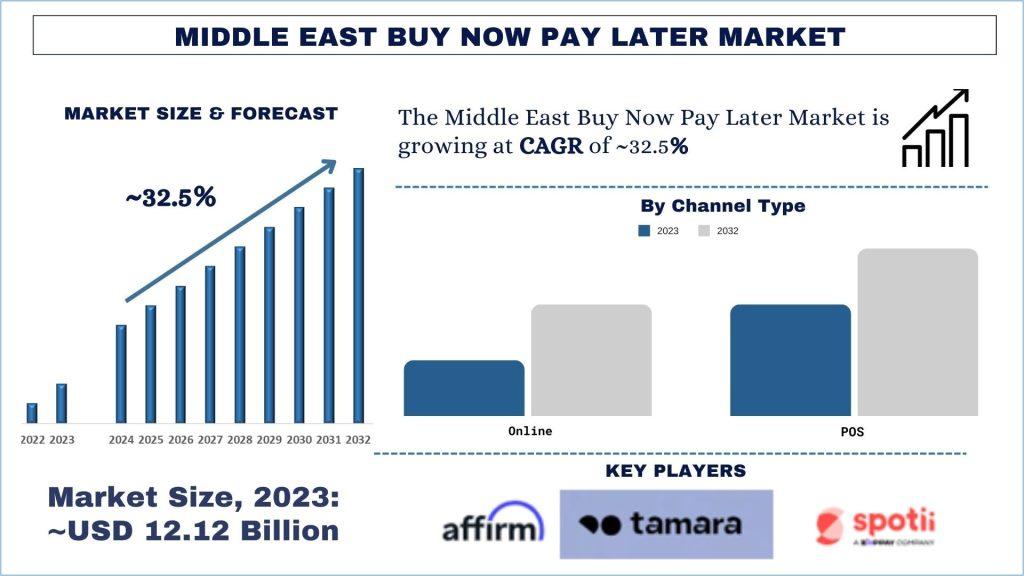

According to the UnivDatos Market Insights analysis, the swift approval process and accessibility, regardless of credit score, has been a primary driver of the Buy Now Pay Later Market. As per their “Middle East Buy Now Pay Later Market” report, the global market was valued at USD 12.12 Billion in 2023, growing at a CAGR of 32.5 % during the forecast period from 2024 – 2032.

In the ever-evolving consumer finance landscape, Buy Now Pay Later (BNPL) services have emerged as a transformative force, reshaping how people shop and pay for goods in the Middle East. This innovative payment solution offers consumers the flexibility to make purchases instantly and pay in installments over time without the traditional constraints of credit scores or high interest charges.

A Paradigm Shift in Consumer Finance

The Middle East BNPL market is experiencing rapid growth, driven by its user-friendly approach and widespread adoption among diverse demographics. Unlike conventional credit cards, BNPL services often feature low or zero interest rates, making them an attractive alternative for budget-conscious shoppers seeking manageable repayment options.

Fueling Growth Factors

Several factors have contributed to the burgeoning popularity of BNPL in the Middle East. The COVID-19 pandemic accelerated digital transformation across the region, prompting a surge in online shopping and the need for flexible payment methods. This shift has been further bolstered by increased internet penetration and the rapid expansion of e-commerce platforms, which have broadened the accessibility and appeal of BNPL services.

Market Dynamics and Expansion

The Middle East BNPL market is projected to expand significantly in the coming years, supported by favorable economic conditions and a growing preference for digital payment solutions. For example, Tabby, a leading BNPL provider in the Middle East, exemplifies the region's burgeoning digital payment trend. Founded in 2019, Tabby has expanded across the UAE and Saudi Arabia by partnering with major retailers and offering interest-free installment plans. Its success highlights increasing consumer preference for convenient, budget-friendly payment options post-COVID-19. Tabby's approach enhances customer satisfaction and boosts business transaction volumes and conversion rates. As the Middle East embraces digital transformation, Tabby's rapid growth underscores the region's promising BNPL market, driven by economic resilience and evolving consumer behaviors.

Request Free Sample Pages with Graphs and Figures Here https://univdatos.com/get-a-free-sample-form-php/?product_id=60495

Key Players and Innovation

Leading BNPL providers such as Tabby and Spotii and global giants like Klarna have made strategic inroads into the Middle East market, offering seamless payment experiences and forging partnerships with major retailers. These collaborations enhance consumer access and contribute to the market's competitive dynamics and service innovation.

The Future Outlook

As consumer expectations continue to evolve, BNPL services are poised to play an integral role in shaping the future of retail in the Middle East. Businesses that embrace these innovative payment solutions benefit from increased customer acquisition, higher conversion rates and enhanced customer loyalty.

Conclusion

The Middle East's Buy Now Pay Later revolution represents more than just a financial trend—it embodies a fundamental shift towards consumer empowerment and convenience. As businesses and consumers navigate the complexities of a digital economy, BNPL services offer a gateway to more significant financial flexibility and shopping convenience.

Contact Us:

UnivDatos Market Insights

Email - contact@univdatos.com

Contact Number - +1 9782263411

Website -www.univdatos.com

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Oyunlar

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness