Currency Exchange Bureau Software Market Size, Share, Growth and Forecast (2024–2032) | UnivDatos

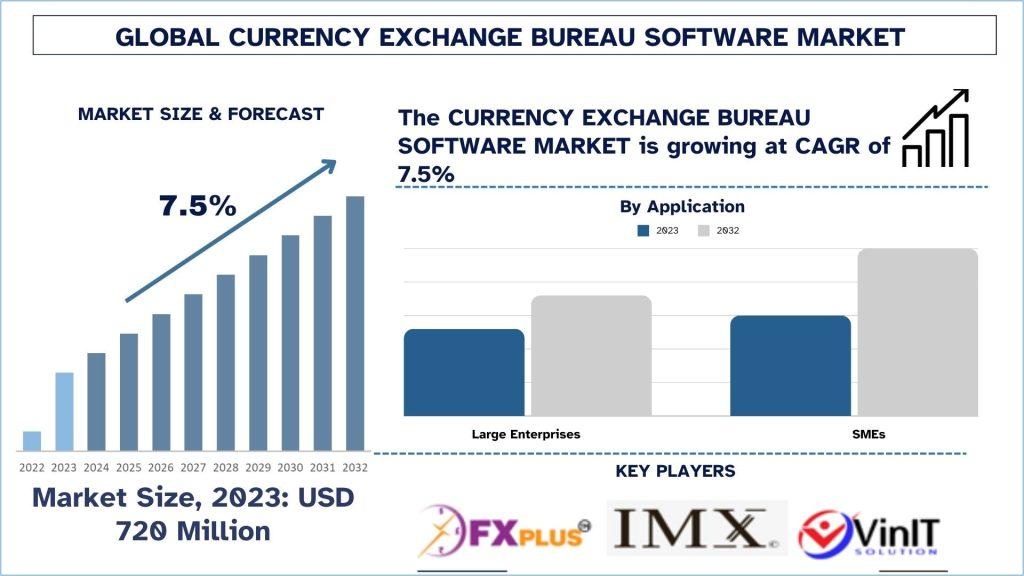

The Currency Exchange Bureau Software Market in the Asia Pacific region is steadily on the rise due to the growing economy, advanced technology, and increasing global and local business travel connecting different countries. In this article, a review of currency exchange bureau software in the Asia Pacific is carried out, and factors that are major determinants of the industry are discussed. According to the UnivDatos Market Insights, Advancements in technology, such as AI and machine learning, are driving innovation in currency exchange bureau software. As per their “Currency Exchange Bureau Software Market” report, the global market was valued at USD 720 Million in 2023, growing at a CAGR of 7.5% during the forecast period from 2024 - 2032 to reach USD Million by 2032.

Access sample report (including graphs, charts, and figures): https://univdatos.com/get-a-free-sample-form-php/?product_id=64302

Market Overview

Asia Pacific comprises many economies with different levels of development of financial markets and different legal systems. Money changers in this region are engaged by tourists, immigrants, traders in international business, and other financial institutions that deal with foreign currency business.

Current Trends Influencing the Market

· Technological Advancements: Some of the most savvy adopters of advanced technologies ranging from artificial intelligence, cloud computing, and mobile platforms are Japan, South Korea, Singapore, and Australia. These technologies are being implemented by currency exchange bureau software providers in Asia Pacific to transform its operations, improve customer satisfaction, and meet all regulatory standards.

· Rise of Digital Transactions: Digital payments and online transactions are gradually becoming the new trend in the Asia Pacific region. The currency exchange bureau software is getting integrated with online portals and mobile applications to enhance the demand for secure and convenient services.

· Regulatory Compliance: It is rather crucial to mention that financial services business is one of the most heavily regulated industries and, as a result, any violation of strict regulatory requirements is strictly prohibited. Software for currency exchange bureaus in Asia Pacific has incorporated moreover operational functionality for AML, KYC, and transaction monitoring to meet the regional legal requirements and global standards.

· Expansion of Cross-Border Transactions: Issues such as internationalization and free trade in Asia Pacific like AEC are the main factors that are creating cross-border trade. Software solutions that enable businesses to manage multiple currency operations and enable easy processing of international payments are the current trend.

Regional Challenges and Opportunities

· Diverse Regulatory Environments: Regulatory issues that might be unique to the Asia Pacific region are somewhat complex for software companies, where there is a need to address several jurisdictions at once. Yet, it opens opportunities for so-called agile solutions that can be developed taking into consideration the specifics of the given country and its regulations and requirements.

· Cybersecurity Concerns: Since there is a lot of adoption of digital services in the provision of financial services, there are challenges in the area of security. Software for currency exchange bureaus must have strong security features for the data privacy of their customers to gain their confidence.

· Market Competition: The Asia Pacific Currency Exchange Bureau software market has intense competition from local and international software development companies. Thus, differentiation by innovation, localization, and offering solutions to the various market needs should be made a priority.

Click here to view the Report Description & TOC https://univdatos.com/report/currency-exchange-bureau-software-market/

Future Outlook

This research therefore establishes that the Asia Pacific Currency Exchange Bureau Software Market will continue to grow as the region gets more economically and technologically advanced and as there is an increasing need for better financial services. As the area gradually moves to the digital level and deeper integration in world markets, software providers can build and develop more programs.

Therefore, the prospects of the Currency Exchange Bureau Software Market in Asia Pacific are expected to rise through modern technologies, changing the regulations and looking into the perspectives of the APAC. Therefore, the awareness of regional problems and perspectives enables stakeholders to direct their efforts to this active market and work on its further and sustainable growth, as well as enhance the sphere of financial services in the Asia Pacific area.

Contact Us:

UnivDatos Market Insights

Email - contact@univdatos.com

Contact Number - +1 9782263411

Website - https://univdatos.com/

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness