Lutein Market Analysis: Key Players, Size, Share and Forecast

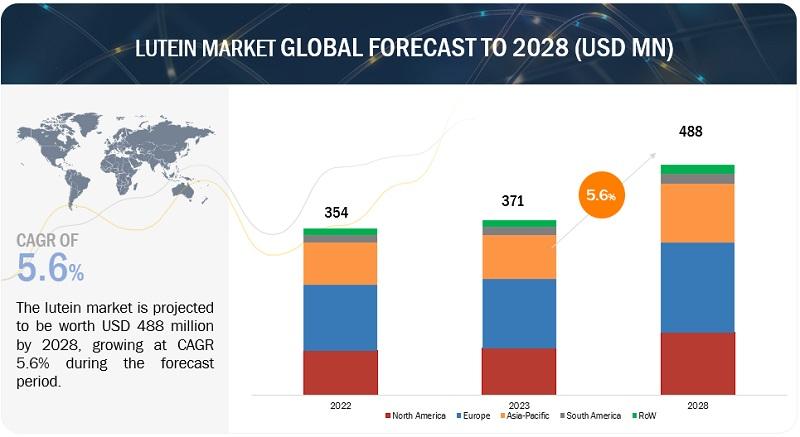

The global lutein market was valued at USD 371 million in 2023 and is projected to reach USD 488 million by 2028, at a CAGR of 5.6% during the forecast period. The market for lutein is driven by both the pharmaceutical and nutraceutical industries. In the pharmaceutical sector, lutein is used in the production of eye health supplements and medications. In the nutraceutical sector, lutein is included in various dietary supplements and functional foods that promote eye health. The nutraceutical industry refers to the sector that focuses on producing foods, beverages, and dietary supplements that provide health benefits beyond basic nutrition. Lutein is commonly included in nutraceutical products intended to support health. Lutein is added to various functional foods, such as cereals, bars, dairy products, and beverages, to enhance their nutritional value and promote eye health. These products are designed to be consumed as part of a regular diet and offer a convenient way to increase lutein intake. The nutraceutical industry leverages the growing consumer interest in preventive healthcare and the increasing awareness of the importance of eye health. Many consumers seek natural alternatives to support their well-being, and lutein has gained popularity as a safe and effective nutrient for maintaining healthy vision.

Download PDF brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=69753879

The Asia Pacific region accounted for the largest market share, in terms of value, of the global lutein market

Asia Pacific countries, particularly China and India, have well-established agricultural sectors and a strong supply chain infrastructure. These countries have the capability to cultivate lutein-rich crops and process them for various applications. This production capability, coupled with efficient supply chain networks, enables Asia Pacific countries to meet the growing demand for lutein both domestically and internationally, giving them a competitive advantage in the market.

Key players in the market are focusing on new deals and product launches. For example, Kemin Industries, Inc. (US) has expanded its distribution agreement with Diethelm Keller Siber Hegner (DKSH) to include distribution for Kemin Food Technologies - Asia in the Philippines and Indonesia.

The powder & crystalline in by form segment accounted for the largest share of the lutein market in terms of value

Powdered lutein offers versatility in its application. It can be easily blended with other ingredients, making it suitable for use in a wide range of products, such as dietary supplements, functional foods, and beverages. This versatility makes powdered lutein appealing to manufacturers who want to incorporate lutein into their formulations. Whereas crystalline lutein may have a higher demand in certain specialized applications. For example, in the production of lutein esters, crystalline lutein is preferred due to its purity and ability to form ester bonds. Industries requiring lutein esters for specific formulations or products may drive the demand for crystalline lutein.

The beverage products in by application segment is estimated to grow at the highest in the lutein market

Lutein is often added to functional beverages that aim to provide health benefits beyond basic hydration. Its antioxidant properties make it a valuable ingredient for products targeting eye health, skin health, and overall well-being. Lutein-fortified beverages can include juices, smoothies, and nutritional drinks. Lutein's vibrant yellow color makes it suitable as a natural colorant in beverages. It can be used to enhance the visual appeal of products such as fruit juices, energy drinks, and carbonated beverages, replacing artificial food colorings. With the growing demand for clean labels and natural ingredients, lutein serves as an attractive option for manufacturers.

Speak to Analyst: https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=69753879

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jogos

- Gardening

- Health

- Início

- Literature

- Music

- Networking

- Outro

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness