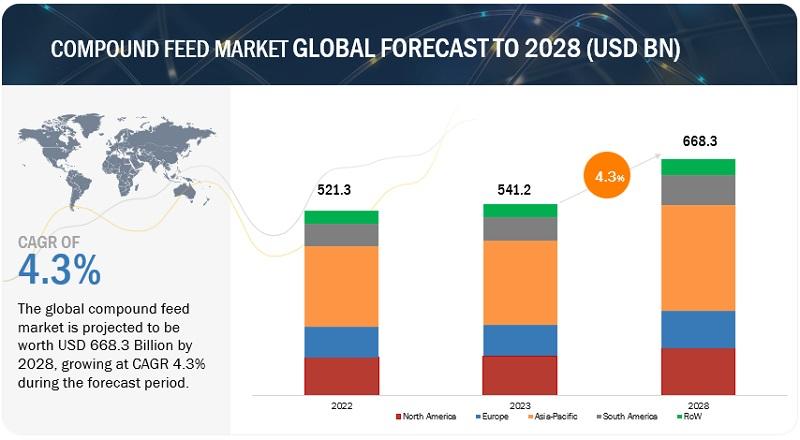

The compound feed market is estimated at USD 541.2 billion in 2023 and is projected to reach USD 668.3 billion by 2028, at a CAGR of 4.3% from 2023 to 2028. The world's population is steadily increasing, which leads to higher demand for food, including meat, dairy, and poultry products. Compound feed is an efficient way to provide essential nutrients to livestock and improve their growth and productivity. As standards of living improve in many developing countries, there is an increase in meat consumption. Livestock, such as poultry, pigs, and cattle, require compound feed for their optimal growth and production. This surge in meat consumption has led to a greater demand for compound feed. Compound feed is designed to optimize nutrient utilization and improve feed conversion efficiency in livestock. It allows for precise control of nutrient composition, ensuring that animals receive the necessary nutrients for their growth and development.

Download PDF brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=12564156

The Asia Pacific region accounted for the largest share and fastest growing market, in terms of value, of the global compound feed market

The Asia Pacific region, comprising countries like China and India, holds 60% of the global population, amounting to around 4.3 billion people. This densely populated region has witnessed continuous population growth, resulting in an escalating demand for animal-derived products like meat, milk, and eggs. Consequently, there is an increased need for compound feed to sustain the growing demand for livestock and poultry production. As incomes rise and dietary preferences evolve, there is a notable shift towards greater consumption of animal protein, propelling the expansion of the livestock and poultry sectors and further driving the demand for compound feed.

Key Players in the Market

Major key players operating in the compound feed market Cargill, Inc. (US), ADM (US), Charoen Pokphand Foods (Thailand), New Hope Group (China), Land O’Lakes (US), Nutreco N.V (Netherlands), Alltech, Inc. (US), Guangdong Haid Group Co., Ltd (China), Weston Milling Group (Australia), and Feed One Co. (Japan).

The poultry in by livestock segment accounted for the largest share of the compound feed market in terms of value

Poultry, especially chicken, is one of the most widely consumed meats globally. The demand for poultry products, such as meat and eggs, is consistently high due to factors like affordability, versatility, and nutritional value. This high demand for poultry products drives the need for poultry compound feed. The compound feed market is influenced by the high demand for poultry products, including meat and eggs, which are widely consumed globally. Poultry, particularly chicken, stands out as one of the most popular meats, with a significant consumption rate per capita. According to the OECD, poultry meat consumption in 2022 reached 32 kg per capita, compared to 1.3 kg for sheep meat, 14.2 kg for beef and veal, and 22.8 kg for pork meat.

The cereals in by ingredient segment accounted for the largest share of the compound feed market in terms of value

Cereals are rich in carbohydrates and provide energy to animals. They also contain varying levels of protein, fiber, and essential minerals. Due to their nutritional composition, cereals serve as important sources of energy and nutrients in compound feed formulations. Cereal crops, such as corn and wheat, are widely grown and easily accessible in many parts of the world. Their availability in large quantities makes them a cost-effective option for inclusion in compound feed formulations. Thus, making them dominate the ingredients segment.

Make an Inquiry: https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=12564156