Trade Finance Market Size, Share Industry Report 2030

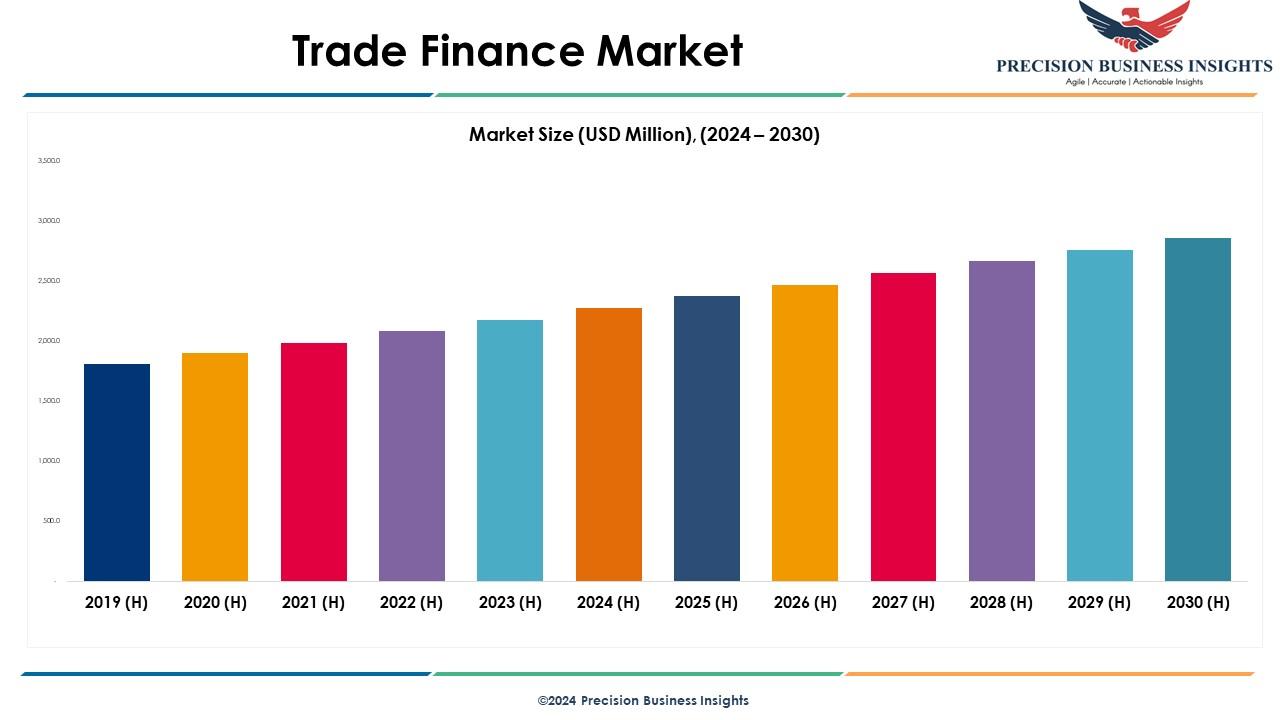

The global Trade Finance Market size was valued at USD 47,867.1 million in 2023 and is expected to grow at a CAGR of 3.9% from 2024-2030. It also includes market size and projection estimations for each of the five major regions from 2023 to 2029. The research report includes historical data, trending features, and market growth estimates for the future. Furthermore, the study includes a global and regional estimation and further split by nations and categories within each region. The research also includes factors and barriers to the Trade Finance Market growth, as well as their impact on the market's future growth. The report gives a comprehensive overview of both primary and secondary data.

View the detailed report description here - https://www.precisionbusinessinsights.com/market-reports/trade-finance-market

The global Trade Finance Market segmentation:

1) By Product Type: Commercial Letters of Credit (LCs), Standby Letters of Credit (LCs), Guarantees, and Others.

2) By Provider: Banks, Trade Finance Houses, and Others), by Application (Domestic and International.

3) By End User: Traders, Importers, and Exporters.

The primary factors of the Trade Finance Market drivers are the demand for innovative financing solutions. The Trade Finance Market report helps to provide the best results for business enhancement and business growth. It further helps to obtain the reactions of consumers to a novel product or service. It becomes possible for business players to take action for changing perceptions. It uncovers and identifies potential issues of the customers. It becomes easy to obtain the reactions of the customers to a novel product or service. It also enlightens further advancement, so it suits its intended market.

The Trade Finance Market research report gives a comprehensive outlook across the region with special emphasis on key regions such as North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. Europe was the largest region in the Trade Finance Market report, accounting for the highest share in 2021. It was followed by Asia Pacific, and then the other regions.

Request sample report at https://www.precisionbusinessinsights.com/request-sample/?product_id=584419

The important profiles and strategies adopted by Trade Finance Market key players are Citigroup Inc., HSBC Holdings plc, JPMorgan Chase & Co., BNP Paribas, Standard Chartered plc, Deutsche Bank AG, Crédit Agricole Group, Santander Group, Mizuho Financial Group, Inc., Bank of America Corporation, Sumitomo Mitsui Financial Group, Inc., Barclays plc, Wells Fargo & Company, UBS Group AG, ING Group covered here to help them in strengthening their place in the market.

About Precision Business Insights:

We are a market research company that strives to provide the highest quality market research insights. Our diverse market research experts are enthusiastic about market research and therefore produce high-quality research reports. We have over 500 clients with whom we have a good business partnership and capacity to provide in-depth research analysis for more than 30 countries. In addition to deliver more than 150 custom solutions, we already have accounts with the top five medical device manufacturers.

Precision Business Insights offers a variety of cost-effective and customized research services to meet research requirements. We are a leading research service provider because of our extensive database built by our experts and the services we provide.

Contact:

Mr. Satya

Precision Business Insights | Toll Free: +1 866 598 1553

Email: sales@precisionbusinessinsights.com

Kemp House, 152 – 160 City Road, London EC1V 2NX

Web: https://precisionbusinessinsights.com/ | D U N S® Number: 852781747

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- الألعاب

- Gardening

- Health

- الرئيسية

- Literature

- Music

- Networking

- أخرى

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness