Architecture Software Market Sees Surge in Demand for 3D Modeling 2030

Architecture Software Market Set to Reach USD 2.89 Billion by 2030, Driven by Digital Innovation and Construction Boom

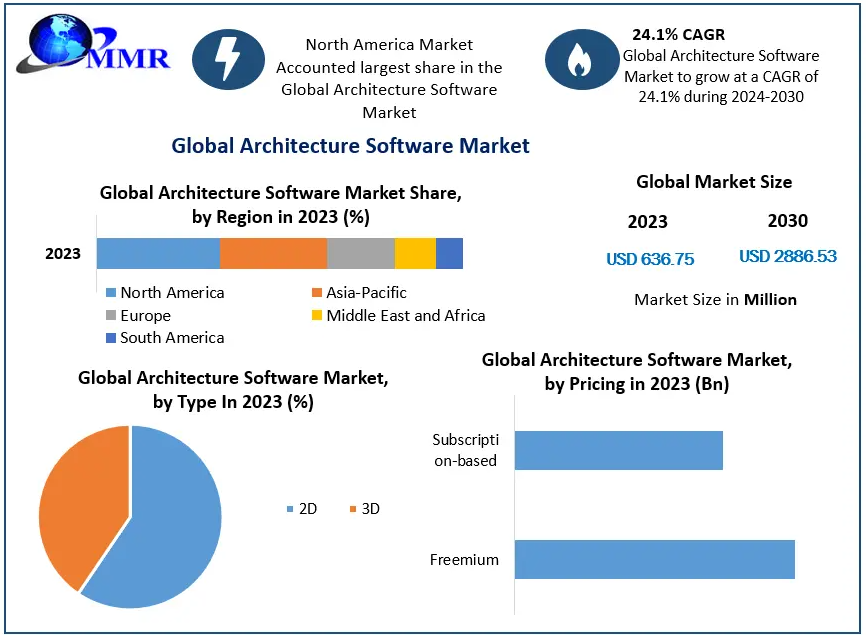

The global Architecture Software Market is poised for transformative growth, expanding from USD 636.75 million in 2023 to USD 2,886.53 million by 2030, at a compelling CAGR of 24.1%. This surge reflects the increasing importance of digital tools in modern architecture, fueled by rising demand for efficient design processes, remote collaboration, and advanced modeling capabilities across industries.

Market Estimation & Definition

The architecture software market includes a wide range of digital platforms and tools designed to assist professionals in architecture, engineering, and construction. These software solutions help in designing, visualizing, simulating, and managing buildings and infrastructure projects. They cover functionalities such as 2D drafting, 3D modeling, Building Information Modeling (BIM), and rendering.

The market was valued at USD 636.75 million in 2023, and it is projected to reach USD 2,886.53 million by 2030, growing at a 24.1% CAGR during the forecast period. The report evaluates this growth through historical trends (2018–2023), current market dynamics, and future forecasts (2024–2030).

To access more comprehensive information, click here :https://www.maximizemarketresearch.com/request-sample/74680/

Market Growth Drivers & Opportunities

The rapid expansion of the architecture software market is being driven by several major forces:

a. Rising Digitalization in Architecture

With the increasing complexity of construction projects, there is a growing shift from manual methods to digital tools for improved accuracy, visualization, and collaboration. Architecture software enables real-time editing, cloud sharing, and automated design processes, making it an essential part of modern architectural workflows.

b. Growth of Building Information Modeling (BIM)

BIM tools are revolutionizing architectural practices by providing comprehensive digital representations of physical and functional characteristics. They allow stakeholders to visualize every aspect of a structure before construction begins, reducing errors, delays, and costs.

c. Surge in Infrastructure Development

Governments and private entities are investing heavily in infrastructure, especially in developing regions. The rise in smart cities, urbanization, and mega-construction projects is creating a demand for advanced design tools that can handle complex planning requirements.

d. Cloud-Based and Subscription Models

Architecture software vendors are moving to cloud-based solutions, offering subscription-based pricing models. This approach increases affordability, enhances collaboration, and ensures regular updates. It also enables smaller firms to access high-end tools without large upfront investments.

e. Integration with Emerging Technologies

Innovations such as artificial intelligence (AI), augmented reality (AR), virtual reality (VR), and digital twins are being integrated into architecture software platforms. These technologies are improving design accuracy, customer engagement, and real-time decision-making.

f. Growing Adoption by Small and Medium Enterprises (SMEs)

With decreasing cost barriers and more flexible software plans, SMEs are adopting architecture software to compete effectively with large enterprises. The trend is especially noticeable in interior design, small construction firms, and academic institutions.

Segmentation Analysis

The architecture software market is segmented based on type, pricing model, industry vertical, organization size, and device usage.

By Type

-

2D Architecture Software:

This segment holds the largest market share. It is widely used for basic drafting, sketching, and layout planning. Its user-friendliness and compatibility with mobile devices contribute to its popularity. -

3D Architecture Software:

This segment is growing rapidly due to its advanced capabilities like 3D rendering, BIM, and simulation. It is used for detailed designs and immersive presentations.

By Pricing Model

-

Freemium:

Ideal for beginners or small teams, freemium models offer limited features with optional upgrades. -

Subscription-Based:

Gaining dominance due to affordability, flexibility, and regular updates. Enterprises prefer subscription plans for cost control and software scalability.

By Industry Vertical

-

Automotive & Manufacturing:

This segment leads the market owing to its requirement for detailed architectural planning for factories and assembly lines. -

Other Verticals Include:

Education, Gaming, Transportation, Government, Aerospace & Defense, Media & Entertainment, Energy & Utilities.

By Organization Size

-

Large Enterprises:

Use enterprise-grade architecture platforms for multi-project environments, advanced rendering, and integration with engineering systems. -

Small and Medium Enterprises (SMEs):

Adoption is increasing through affordable cloud-based software and freemium models.

By Device

-

Desktop:

Preferred for high-performance requirements such as rendering, modeling, and CAD. -

Mobile:

Gaining traction among on-site teams for plan access, markups, and real-time collaboration.

To access more comprehensive information, click here :https://www.maximizemarketresearch.com/request-sample/74680/

Country-Level Analysis

United States

The U.S. dominates the architecture software market in North America. Factors such as early adoption of BIM, government mandates for digital construction, and the presence of global software providers contribute to its leadership. The country also leads in integrating AI, AR/VR, and digital twin technology into architectural workflows. Ongoing infrastructure investments and the growth of smart city projects further boost market demand.

Germany

Germany is one of the largest markets in Europe for architecture software. With its strong industrial base, engineering expertise, and digital transformation in construction, the demand for advanced design tools is growing. Germany is home to leading BIM software vendors and has made significant progress in adopting digital planning solutions in public infrastructure projects.

Competitor Analysis

The architecture software market is moderately concentrated, with a mix of global players and regional vendors offering diverse solutions.

Autodesk

A dominant force with a wide range of products, including AutoCAD and Revit. Autodesk sets the benchmark for CAD and BIM solutions globally and continues to expand through AI, cloud, and mobile capabilities.

Nemetschek Group

A European powerhouse with brands like Allplan and Graphisoft (developer of Archicad). The company offers robust BIM capabilities and strong integration across its product suite, making it a preferred choice in many European countries.

Graphisoft

Known for its Archicad platform, Graphisoft focuses on design-centric BIM workflows. It is particularly strong in academic institutions and among architectural purists who value precision and creativity.

Bentley Systems

Specializes in infrastructure modeling and engineering design. Bentley’s strength lies in transportation, utilities, and government projects, with a focus on end-to-end project lifecycle management.

Other Players

-

Trimble: Offers SketchUp and other design tools popular among architects and designers.

-

Vectorworks: Known for its creative design capabilities.

-

Dassault Systèmes: Provides high-end 3D design software used in both industrial and architectural design.

New entrants and startups are also introducing cloud-native and AI-driven platforms that focus on collaboration, affordability, and simplicity, aiming to disrupt the market and capture the growing SME segment.

Press Release Conclusion

The architecture software market is undergoing a period of rapid evolution. Driven by digital transformation, rising construction demand, and a push for smarter, faster, and more collaborative design, the market is set to nearly quintuple in size by 2030.

Major players are investing heavily in cloud-based platforms, AI-powered design tools, and immersive 3D visualization to stay competitive. At the same time, SMEs are increasingly joining the digital revolution, enabled by flexible licensing models and affordable tools.

As architecture merges with technology, firms that leverage advanced software solutions will gain a significant competitive edge in design accuracy, cost efficiency, and project turnaround. The future of architecture lies not only in brick and mortar but in code, cloud, and computation.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness