Obesity Epidemic Spurs Demand for Weight Loss Solutions

The global obesity epidemic has led to an overwhelming demand for effective weight loss treatments. As obesity rates continue to rise worldwide, pharmaceutical giants like Novo Nordisk and Eli Lilly are locked in an intense battle for dominance in the rapidly growing anti-obesity drug market. The competition between these two companies has escalated, with both investing heavily in research, clinical trials, and product innovation.

Saxenda (liraglutide): Novo Nordisk’s Initial Success in Obesity Treatment

Novo Nordisk’s journey into the weight management sector began with the introduction of Saxenda (liraglutide). This GLP-1 receptor agonist drug helped position Novo as a strong player in the obesity space. Despite its moderate effectiveness, Saxenda’s success provided Novo with valuable experience and momentum to develop even more effective therapies. It continues to be a key part of Novo Nordisk’s obesity drug portfolio, maintaining its relevance in the ongoing race with Eli Lilly.

Wegovy: Novo Nordisk’s Flagship Drug for Weight Loss

Wegovy, the blockbuster weight loss drug from Novo Nordisk, has set a new standard in obesity treatment. With superior efficacy compared to earlier products like Saxenda, Wegovy has quickly gained market leadership. This once-dominant treatment now faces tough competition, particularly from Eli Lilly. The ongoing Wegovy vs Eli Lilly battle highlights Wegovy’s role as a market leader and underscores Novo Nordisk's significant edge in the obesity drug race. Wegovy has become the treatment of choice for many physicians and patients, setting the bar for future weight loss therapies.

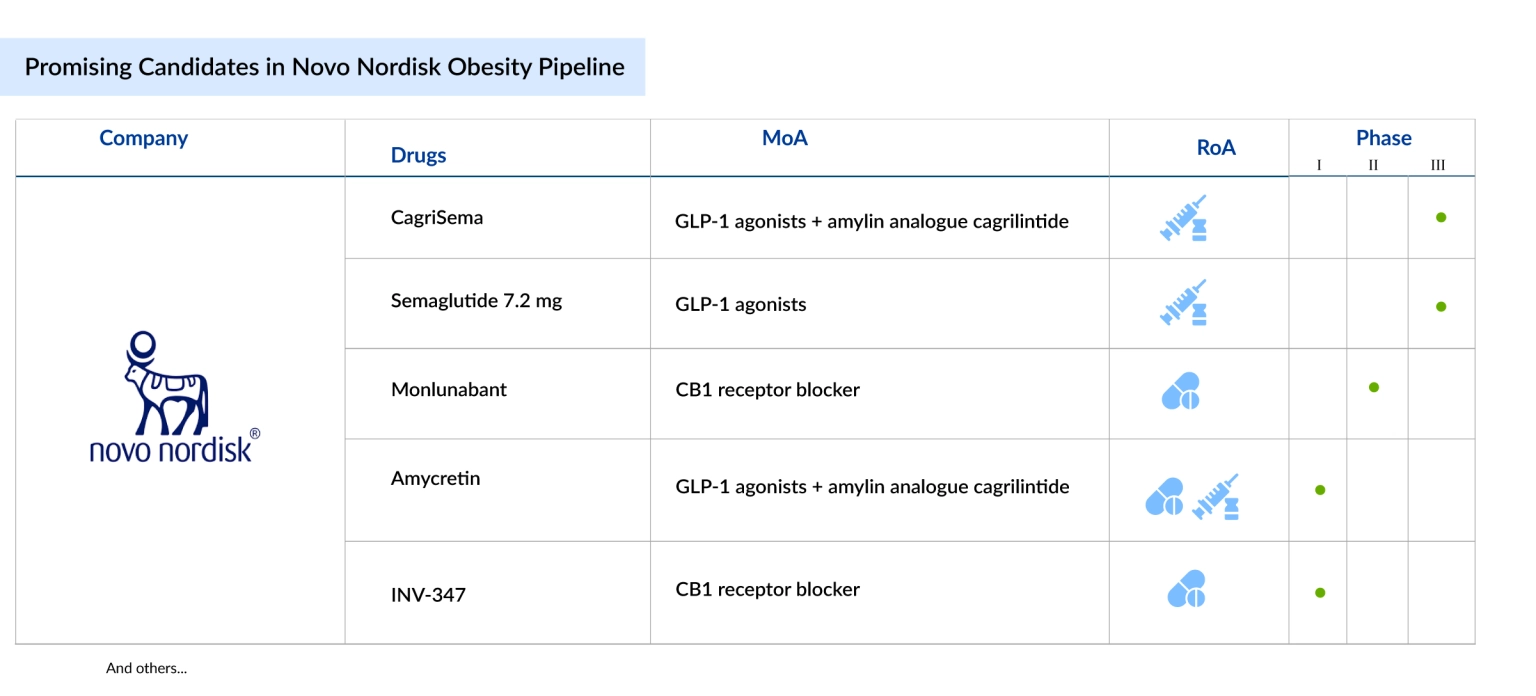

Amycretin: The Next Big Thing in Novo Nordisk’s Obesity Pipeline

While Wegovy is a major success, Novo Nordisk is not resting on its laurels. The company is expanding its pipeline with amycretin, a new drug that combines GLP-1 and amylin receptor agonists. This innovative combination therapy has the potential to revolutionize the treatment landscape for obesity. As the amycretin vs orforglipron rivalry intensifies, amycretin is expected to play a crucial role in determining Novo’s future in the weight loss drug market. If successful, amycretin could be the next breakthrough for Novo Nordisk and help it maintain a competitive edge.

Eli Lilly’s Growing Obesity Drug Pipeline

Eli Lilly has emerged as one of Novo Nordisk’s fiercest competitors in the obesity drug market. The company’s promising candidates, such as tirzepatide and orforglipron, have shown strong results in clinical trials. Tirzepatide, in particular, has been hailed for its superior weight loss potential, and its ability to offer oral delivery could give Eli Lilly an advantage over Novo Nordisk’s injectable treatments. The ongoing development of amycretin vs orforglipron will likely play a pivotal role in deciding who will ultimately lead the anti-obesity drug market.

Eli Lilly Beursduivel: Tracking the Financial Impact of the Obesity Drug Race

As the competition intensifies, analysts and investors are keeping a close eye on the rivalry between Novo Nordisk and Eli Lilly. Platforms like Eli Lilly beursduivel provide insights into the financial impact of each company’s developments in the obesity drug space. Investors are closely monitoring clinical trial results, regulatory approvals, and market adoption to gauge which company will come out on top in this competitive market. With the stakes so high, both companies are striving to maintain their competitive advantages.

Do Read The Latest Blogs By DelveInsight:

-

Huge Unmet Needs in the Glioblastoma Multiforme Treatment Market Driving the Market Size Growth

-

Glioblastoma Multiforme Market: Emerging Pipeline Therapies To Keep A Keen Eye On

-

13 of the most commonly asked questions about Glioblastoma multiforme, Answered

-

Glioblastoma Multiforme: Advancements in the Treatment Paradigm of the Malignant Condition

-

Glioma vs. Glioblastoma Therapeutics Space: Unveiling the Battlefront