Trade Finance Market Size, Share Trends Report

IMARC Group, a leading market research company, has recently released a report titled “Trade Finance Market Report by Finance Type (Structured Trade Finance, Supply Chain Finance, Traditional Trade Finance), Offering (Letters of Credit, Bill of Lading, Export Factoring, Insurance, and Others), Service Provider (Banks, Trade Finance Houses), End-User (Small and Medium Sized Enterprises (SMEs), Large Enterprises), and Region 2025-2033”. The study provides a detailed analysis of the industry, including the global trade finance market trends, share, size, and industry trends forecast. The report also includes competitor and regional analysis and highlights the latest advancements in the market.

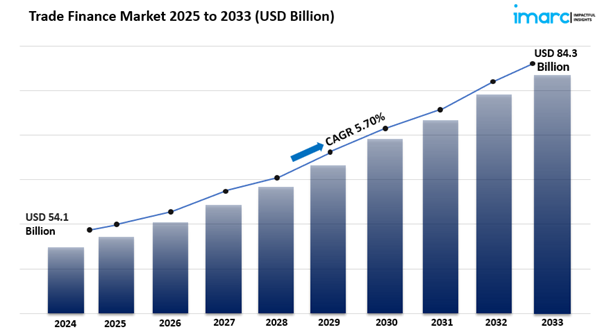

The global trade finance market size reached USD 54.1 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 84.3 Billion by 2033, exhibiting a growth rate (CAGR) of 5.70% during 2025-2033.

Request to Get the Sample Report:

https://www.imarcgroup.com/trade-finance-market/requestsample

Trade Finance Market Trends in 2025

A prominent trend in the trade finance market is the increasing emphasis on sustainability and responsible financing. As businesses and consumers become more environmentally conscious, there is a growing demand for trade finance solutions that align with sustainability goals. By 2025, it is anticipated that financial institutions will prioritize green trade finance products that support environmentally friendly projects and initiatives. This includes financing for renewable energy projects, sustainable supply chains, and eco-friendly goods.

The adoption of Environmental, Social, and Governance (ESG) criteria in trade finance is expected to gain traction, with companies seeking financing options that not only provide economic benefits but also contribute positively to the environment and society. Financial institutions are likely to develop innovative products that incorporate ESG considerations, offering incentives for businesses to engage in sustainable practices. This trend not only reflects changing consumer preferences but also aligns with global efforts to combat climate change and promote sustainable development. As a result, the trade finance market is poised to evolve, with sustainability becoming a central theme in the development of new financing solutions and partnerships.

Market Dynamics of the Trade Finance Market

Digital Transformation and Technology Adoption

A key dynamic reshaping the trade finance market is the rapid digital transformation and the adoption of advanced technologies. As businesses increasingly seek efficiency and speed in their operations, the demand for digital solutions in trade finance is growing. By 2025, it is expected that technologies such as blockchain, artificial intelligence (AI), and machine learning will play a pivotal role in streamlining trade finance processes. Blockchain technology, in particular, offers enhanced transparency and security, allowing for real-time tracking of transactions and reducing the risks associated with fraud. AI and machine learning can analyze vast amounts of data to assess credit risk more accurately and expedite decision-making processes.

Financial institutions are investing heavily in these technologies to improve their service offerings and meet the evolving needs of their clients. This digital shift not only enhances operational efficiency but also opens up new opportunities for small and medium-sized enterprises (SMEs) to access trade finance solutions that were previously out of reach, thereby expanding the overall market.

Increasing Global Trade and Economic Recovery

The trade finance market is also being significantly influenced by the resurgence of global trade and economic recovery following disruptions caused by the COVID-19 pandemic. As economies rebound, international trade volumes are projected to increase, leading to a higher demand for trade finance solutions. By 2025, it is anticipated that the global economy will be more interconnected, with businesses looking to capitalize on new markets and diversify their supply chains. This trend will drive the need for various trade finance products, including letters of credit, supply chain financing, and export financing.

Additionally, the rise of e-commerce and digital marketplaces is facilitating cross-border transactions, further fueling the demand for trade finance services. Financial institutions are adapting to this changing landscape by offering tailored solutions that cater to the specific needs of businesses engaged in international trade. As a result, the trade finance market is poised for growth, supported by the increasing volume of global trade and the need for efficient financing solutions.

Regulatory Changes and Compliance Requirements

Another dynamic impacting the trade finance market is the evolving regulatory landscape and heightened compliance requirements. Governments and regulatory bodies are implementing stricter regulations to enhance transparency and mitigate risks associated with trade financing, such as money laundering and fraud. By 2025, it is expected that compliance requirements will become even more stringent, compelling financial institutions to invest in robust compliance frameworks and technologies.

This shift will necessitate greater collaboration between banks, trade finance providers, and businesses to ensure adherence to regulations while facilitating smooth transactions. As companies expand their international operations, they will require trade finance solutions that not only meet their financing needs but also comply with the regulatory standards of multiple jurisdictions. This dynamic presents both challenges and opportunities for trade finance providers, as those that can navigate the regulatory landscape effectively will gain a competitive advantage in the market. Ultimately, the focus on compliance will shape the future of trade finance, driving innovation and the development of new solutions that prioritize regulatory adherence.

Trade Finance Market Report Segmentation:

Breakup by Finance Type:

· Structured Trade Finance

· Supply Chain Finance

· Traditional Trade Finance

Breakup by Offering:

· Letters of Credit

· Bill of Lading

· Export Factoring

· Insurance

· Others

Breakup by Service Provider:

· Banks

· Trade Finance Houses

Breakup by End-User:

· Small and Medium Sized Enterprises (SMEs)

· Large Enterprises

Breakup by Region:

· North America

· Asia-Pacific

· Europe

· Latin America

· Middle East and Africa

Competitive Landscape with Key Players:

The competitive landscape of the trade finance market size has been studied in the report with the detailed profiles of the key players operating in the market.

Some of These Key Players Include:

· Asian Development Bank

· Banco Santander SA

· Bank of America Corp.

· BNP Paribas SA

· Citigroup Inc.

· Crédit Agricole Group

· Euler Hermes

· Goldman Sachs Group Inc.

· HSBC Holdings Plc

· JPMorgan Chase & Co.

· Mitsubishi Ufj Financial Group Inc.

· Morgan Stanley

· Royal Bank of Scotland

· Standard Chartered Bank

· Wells Fargo & Co.

Ask Analyst for Customized Report:

https://www.imarcgroup.com/request?type=report&id=2031&flag=C

Key Highlights of the Report:

· Market Performance (2018-2023)

· Market Outlook (2024-2032)

· Market Trends

· Market Drivers and Success Factors

· Impact of COVID-19

· Value Chain Analysis

If you need specific information that is not currently within the scope of the report, we will provide it to you as a part of the customization.

About Us

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC’s information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company’s expertise.

Contact Us:

IMARC Group

134 N 4th St

Brooklyn, NY 11249, USA

Website: imarcgroup.com

Email: sales@imarcgroup.com

Americas: +1-631-791-1145 | Europe & Africa: +44-753-713-2163 | Asia: +91-120-433-0800

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jeux

- Gardening

- Health

- Domicile

- Literature

- Music

- Networking

- Autre

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness