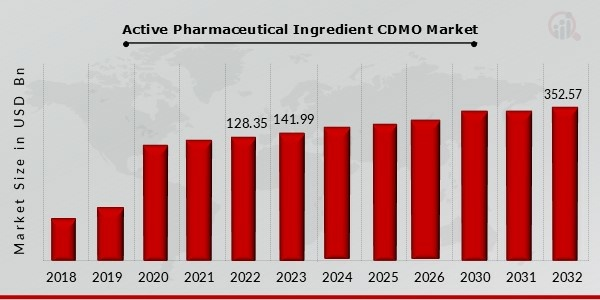

Global Active Pharmaceutical Ingredient (API) CDMO Market: Significant Growth and Future Projections from 2024 to 2032

The Active Pharmaceutical Ingredient (API) Contract Development and Manufacturing Organization (CDMO) market is undergoing substantial growth, with the market size projected to reach $13.68 billion in 2023. According to the latest analysis by Market Research Future (MRFR), the market is expected to grow from $14.18 billion in 2024 to $19.35 billion by 2032, with a compound annual growth rate (CAGR) of 3.97% during the forecast period (2024–2032).

The growing demand for pharmaceutical outsourcing, driven by technological advancements and shifting industry trends, is expected to propel the market forward. As pharmaceutical companies increasingly rely on external partners for manufacturing, the demand for API CDMOs will continue to rise, particularly for biologics and specialized therapies.

Market Overview & Scope

The global API CDMO market is witnessing a surge in demand due to several factors, including the increased reliance on outsourcing by pharmaceutical companies, the expanding production of biologics and generics, and the rising demand for specialized active pharmaceutical ingredients (APIs) used in advanced therapeutics. The market is also benefiting from the growing complexity of API production, especially with the rise in biologic drugs and complex generics.

Technological advancements are also playing a key role in reshaping the market landscape. The use of continuous manufacturing techniques and artificial intelligence (AI) for process optimization has significantly improved the efficiency, scalability, and cost-effectiveness of API production. Additionally, the increasing adoption of targeted therapies and personalized medicine is pushing for more specialized and innovative CDMO services to meet the demands of these complex treatments.

Segmentation Insights

The API CDMO market is segmented into key categories based on technology, therapeutic focus, and services offered. Here are some of the most significant segments driving growth:

-

Chemical Synthesis

- The Chemical Synthesis segment is one of the largest contributors to the market, representing nearly half of the market share. This segment is poised for continued growth due to innovations in chemical reagents, catalysts, and GMP-compliant manufacturing processes. Furthermore, the growing demand for complex and specialized APIs, along with advancements in automation and process analytics, are driving growth within this segment.

-

Biologics

- The Biologics segment is experiencing rapid expansion, expected to reach $120.1 billion by 2024. With chronic diseases such as cancer and autoimmune disorders on the rise, biologics, particularly monoclonal antibodies, are becoming essential for targeted therapies. The demand for technologies like mammalian cell culture and microbial fermentation is also increasing, as they enhance the cost-efficiency and scalability of biologics production.

-

Analytical Services

- The Analytical Services segment is projected to reach a market value of $26.5 billion by 2024. This sector is crucial to ensuring API quality, safety, and regulatory compliance. Services such as method development, impurity profiling, and stability testing are in high demand as the pharmaceutical industry continues to prioritize precision in drug development. Regulatory agencies globally are also enforcing stricter quality control, which further strengthens the need for robust analytical services.

-

Packaging and Formulation

- The Packaging and Formulation segment is set to experience significant growth, particularly driven by the rise of biologics and complex generics. This segment includes drug product development, lyophilization, and sterile filtration. These services are crucial for maintaining the stability and efficacy of biologics and injectable products, contributing to the overall market expansion.

-

Process Development Optimization

- Process Development Optimization is another key driver of market growth. With regulatory requirements becoming increasingly stringent, pharmaceutical companies are relying on CDMOs to assist with process validation, regulatory compliance, and quality control. These services are integral to ensuring that manufacturing processes meet the highest standards of safety and efficacy.

Regional Insights

The global API CDMO market is divided into five key regions, each contributing to the overall market growth:

-

North America

- North America remains the largest market for API CDMOs. With a robust pharmaceutical sector and the increasing demand for personalized medicine, the region is projected to retain its dominance in the coming years. Furthermore, the presence of several leading pharmaceutical companies, along with the adoption of innovative drug therapies, continues to fuel market expansion in this region.

-

Europe

- Europe holds the second-largest market share, driven by an increasing focus on biopharmaceuticals, clinical trials, and regulatory advancements. The region's emphasis on high-quality manufacturing processes and the growing popularity of biologics are expected to drive continued market growth. European markets are also experiencing a shift toward outsourcing API manufacturing to CDMOs to reduce costs.

-

Asia Pacific (APAC)

- APAC is the fastest-growing region in the API CDMO market, driven by the increasing prevalence of chronic diseases, rising healthcare expenditure, and an expanding pharmaceutical manufacturing base. Countries like China and India are becoming major hubs for pharmaceutical manufacturing and outsourcing services, which significantly contribute to the region’s rapid growth.

-

South America & Middle East and Africa (MEA)

- South America and MEA are expected to experience moderate but steady growth, driven by the increasing demand for cost-effective manufacturing solutions. These regions are seeing growth in contract manufacturing organizations and outsourcing opportunities, which helps fuel the expansion of the API CDMO market.

Key Drivers of Market Growth

Several factors are contributing to the growth of the API CDMO market:

-

Increasing Demand for Biologics

- The rising prevalence of chronic diseases and autoimmune disorders is driving the need for biologics. As biologic drugs become more complex to manufacture, CDMOs are playing a vital role in meeting these challenges. Technologies like cell line development, fermentation, and protein purification are crucial for producing these advanced therapies.

-

Technological Advancements

- Continuous manufacturing and AI-driven optimization are revolutionizing the way CDMOs manage production. These technologies allow for faster, more efficient manufacturing processes, ultimately reducing costs and increasing output capacity. Additionally, the use of automation and advanced data analytics helps optimize production timelines and improves overall product quality.

-

Growing Trend of Outsourcing

- The pharmaceutical industry's increasing reliance on outsourcing for manufacturing APIs is a critical driver of the market. Pharmaceutical companies are outsourcing their API production to CDMOs to focus on research and development, helping to streamline operations and reduce overhead costs. This trend is expected to continue, particularly as more complex drugs and biologics enter the market.

Key Players and Competitive Landscape

The competitive landscape of the API CDMO market is highly fragmented, with leading players focusing on expanding their capabilities and market reach. Key players include:

- Lonza

- Thermo Fisher Scientific

- WuXi AppTec

- Boehringer Ingelheim

- Catalent

- Patheon (part of Thermo Fisher)

- Jubilant HollisterStier

- Merck KGaA

- Siegfried Group

- Samsung Biologics

These companies are focusing on enhancing their technological capabilities, expanding their manufacturing capacity, and establishing strategic partnerships with pharmaceutical companies to strengthen their market positions.

Conclusion

The Active Pharmaceutical Ingredient (API) CDMO market is on track for significant growth, driven by the increasing demand for biologics, innovations in manufacturing technology, and the growing trend of outsourcing. As the pharmaceutical industry continues to focus on the development of more complex drugs and therapies, the role of API CDMOs will become increasingly critical. Key players in the market are investing in cutting-edge technologies and expanding their service offerings to meet the evolving needs of the pharmaceutical sector. With increasing demand for personalized medicine, biopharmaceuticals, and high-quality manufacturing, the API CDMO market is poised for continued growth and transformation through 2032 and beyond.