Fractionated Fatty Acid Market: Strategies for Manufacturers and Suppliers

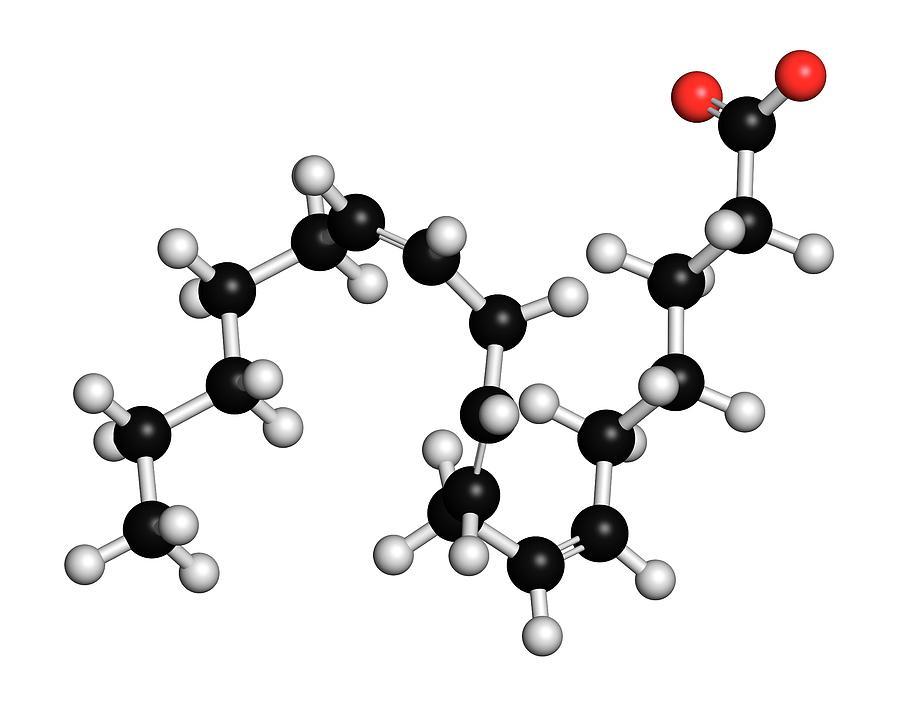

The fractionated fatty acid market is expanding as industries increasingly seek sustainable and high-performance raw materials for applications in lubricants, coatings, personal care, and specialty chemicals. These fatty acids, derived from natural sources such as vegetable oils and animal fats, undergo a refining process to separate specific components with desirable chemical properties. As demand grows, manufacturers and suppliers must adopt strategic approaches to remain competitive, enhance supply chain efficiency, and meet evolving industry needs.

Market Insights

The fractionated fatty acid industry is influenced by various factors, including sustainability trends, regulatory requirements, technological advancements, and shifting consumer preferences. These elements shape the competitive landscape and drive innovation across the supply chain.

Rising Demand for Sustainable Ingredients

The global shift toward bio-based products is a significant factor driving the growth of the fractionated fatty acid market. Industries such as cosmetics, personal care, and food processing are replacing synthetic chemicals with natural alternatives due to increasing environmental awareness and regulatory support. As a result, manufacturers and suppliers are focusing on expanding their product portfolios to cater to this demand.

Technological Innovations in Fractionation

Advancements in processing technologies, such as enzymatic hydrolysis and molecular distillation, are improving the efficiency and purity of fractionated fatty acids. These innovations enable manufacturers to offer tailored products with enhanced stability, functionality, and application-specific properties. Companies investing in research and development can differentiate their offerings and gain a competitive advantage.

Regional Market Growth and Supply Chain Optimization

Emerging economies in Asia-Pacific, Latin America, and Africa are witnessing increased demand for fractionated fatty acids due to industrial expansion and rising consumer awareness of bio-based products. Establishing production facilities in these regions allows manufacturers to reduce transportation costs and improve supply chain efficiency. Strategic partnerships with local suppliers and distributors further strengthen market presence and accessibility.

Regulatory and Compliance Considerations

Governments worldwide are implementing policies that promote the use of renewable and biodegradable materials. Regulations governing the cosmetics, food, and industrial sectors require manufacturers to meet strict quality and environmental standards. Compliance with these regulations ensures market access and enhances brand reputation. Companies that proactively align with sustainability goals are more likely to gain customer trust and secure long-term growth.

Strategies for Manufacturers and Suppliers

To succeed in the evolving fractionated fatty acid market, businesses must implement strategies that enhance production efficiency, expand market reach, and ensure product innovation.

Diversification of Product Portfolio

Offering a broad range of fractionated fatty acids tailored to different applications enhances market competitiveness. Manufacturers should develop customized formulations for industries such as personal care, lubricants, and coatings to address specific performance requirements. Investing in value-added products, such as functionalized fatty acids with improved oxidative stability, can attract new customers and expand revenue streams.

Investment in Sustainable Sourcing and Processing

Sourcing high-quality raw materials from sustainable and certified suppliers ensures product consistency and regulatory compliance. Implementing eco-friendly processing technologies reduces waste, minimizes carbon footprints, and enhances operational efficiency. Companies that adopt sustainable manufacturing practices are well-positioned to meet growing consumer and regulatory expectations.

Strengthening Supply Chain Resilience

Fluctuations in raw material availability and transportation challenges can impact production and delivery timelines. Establishing strategic partnerships with multiple suppliers and investing in logistics infrastructure improves supply chain resilience. Utilizing digital technologies for real-time monitoring and inventory management enhances operational agility and reduces disruptions.

Market Expansion Through Strategic Partnerships

Collaborations with research institutions, technology providers, and industry stakeholders drive innovation and market expansion. Joint ventures and licensing agreements allow companies to leverage advanced processing techniques and expand their geographic reach. Establishing distribution networks in emerging markets strengthens brand presence and increases accessibility for end-users.

Adapting to Changing Consumer Preferences

Educating consumers and businesses about the benefits of bio-based products enhances market adoption. Transparent labeling, certifications, and marketing campaigns highlighting sustainability and performance benefits build consumer confidence. Companies that align their branding and messaging with environmental and ethical considerations can differentiate themselves from competitors.

Future Outlook

The fractionated fatty acid market is poised for continued growth as demand for bio-based products increases across various industries. Manufacturers and suppliers that prioritize sustainability, invest in research and development, and optimize supply chain operations will be better positioned to succeed in this evolving landscape. By adopting strategic approaches that align with market trends and consumer preferences, businesses can drive long-term profitability and contribute to the advancement of eco-friendly industrial solutions.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness