Algorithmic Trading Market Analysis by Size, Share, Growth, Trends and Forecast (2023-2030) | UnivDatos

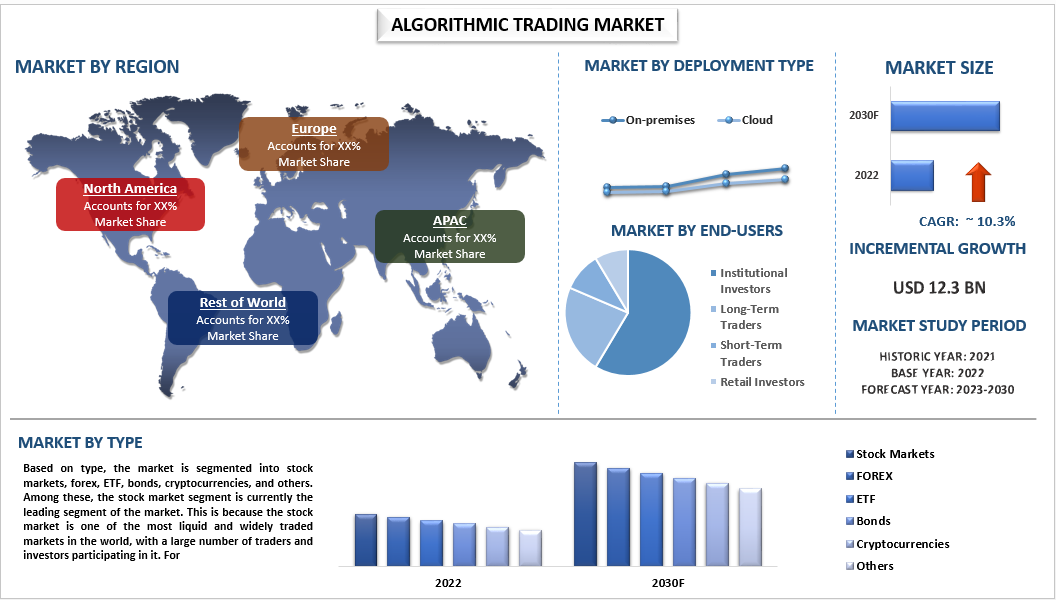

According to the Univdatos Market Insights, “Algorithmic Trading Market” report, the global market was valued at USD 12.3 Billion in 2022, growing at a CAGR of 10.3% during the forecast period from 2023 - 2030 to reach USD X billion by 2030. In the ever-evolving landscape of finance, the algorithmic trading market is experiencing a significant transformation. As technology continues to advance, algorithmic trading is poised for substantial growth, offering both traditional and emerging players a plethora of opportunities. Artificial intelligence (AI) and machine learning have revolutionized the way algorithms operate. These technologies analyse vast datasets and make informed trading decisions in real-time.

Access sample report (including graphs, charts, and figures): https://univdatos.com/get-a-free-sample-form-php/?product_id=48751

In North America, tech-savvy traders are harnessing AI to predict market movements, manage risks, and optimize trading strategies. Moreover, algorithmic trading, once primarily associated with equities, is expanding into various asset classes such as fixed income, forex, commodities, and cryptocurrencies. This diversification is creating new avenues for traders to explore and providing more opportunities for investors to diversify their portfolios.

Opportunities:

· Machine Learning and AI Integration: Algorithmic trading strategies leveraging machine learning and artificial intelligence are expected to dominate. These technologies can analyse vast datasets for predictive analytics, risk management, and sentiment analysis.

· Cryptocurrency Trading: The rapid expansion of the cryptocurrency market opens doors for algorithmic trading. Strategies that exploit price disparities across various cryptocurrency exchanges will gain prominence.

· Trading Automation: Complete automation of trading systems, coupled with intelligent order routing, will lead to more efficient execution of trading strategies.

Click here to view the Report Description & TOC https://univdatos.com/report/algorithmic-trading-market/

Investors And Key Players in The Algorithmic Trading Market:

Moreover, investors are the primary users of algorithmic trading strategies. Institutional investors, hedge funds, and proprietary trading firms deploy algorithmic systems to achieve various objectives, including optimizing trade execution, managing risk, and generating alpha (excess returns). By leveraging algorithms, investors can execute trades with precision and efficiency, often taking advantage of microsecond-level opportunities in the market. These investors contribute significantly to the liquidity and efficiency of financial markets. Also, companies specializing in algorithmic trading technology offer software solutions, trading platforms, and infrastructure to investors. These providers create the algorithms, back-testing tools, and execution systems necessary for algorithmic trading. Their role is pivotal in ensuring that investors have access to cutting-edge tools and strategies.

Conclusion

The algorithmic trading market is evolving at a rapid pace, and the future is filled with opportunities for innovation and growth. Market participants should remain agile and adapt to the latest technologies and trends to capitalize on these prospects.

Related Telecom & IT Market Research Report

MENA Wireless Routers Market: Current Analysis and Forecast (2024-2032)

Particle Size Analysis Market: Current Analysis and Forecast (2024-2032)

Waterway Transportation Software Solutions Market: Current Analysis and Forecast (2024-2032)

Asia Pacific WiGig Market: Current Analysis and Forecast (2024-2032)

Contact Us:

UnivDatos Market Insights

Contact Number - +19787330253

Email - contact@univdatos.com

Website - www.univdatos.com

LinkedIn- https://www.linkedin.com/company/univ-datos-market-insight/mycompany/

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness