Carbon Offset and Carbon Credit Trading Service Market Analysis by Size, Share, Growth, Trends, Opportunities and Forecast (2024-2032)

Carbon offset and services relating to carbon credit trading have received increased attention as the international community wakes up to the issue of climate change. There are social demands to reduce emissions from governments, businesses, and persons, thus interest in proper carbon markets is growing. Carbon offsetting enables industries and firms to balance out their emission of carbon through funding projects that will lead to the emissions of lesser carbon or the absorption of GHG. On the other hand, carbon credits serve as a market instrument where stakeholders can buy and sell permission to emit a specified volume of CO2. This article gives an insight into present developments, issues, and prospects of carbon offset and carbon credit trading services.

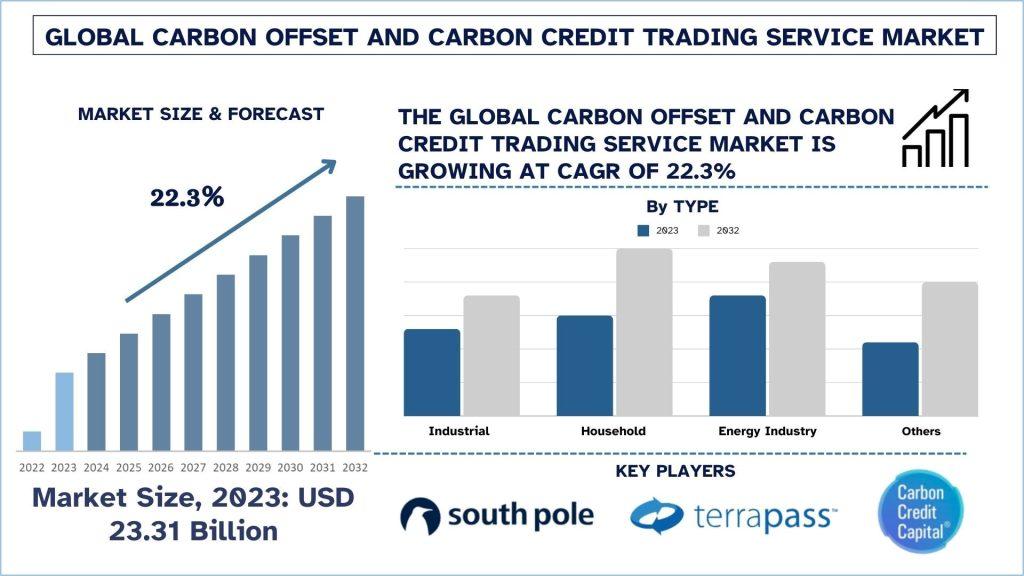

According to the UnivDatos Market Insights Analysis, the rise of government regulations and carbon pricing, growing investor and consumer pressure, increasing corporate social responsibility and sustainability goals, and rising environmental awareness drive the carbon offset and carbon credit trading service market. As per their “Carbon Offset and Carbon Credit Trading Service Market” report, the global market was valued at USD 23.31 Billion in 2023, growing at a CAGR of about 22.3% during the forecast period from 2024 - 2032 to reach USD billion by 2032.

For a detailed analysis of the Carbon Offset and Carbon Credit Trading Service Market browse through - https://univdatos.com/report/carbon-offset-and-carbon-credit-trading-service-market/

The Emergence of Carbon Credits

The demand for carbon credits has been rapidly increasing in the recent past due to the increased need for corporations to work towards their sustainable development goals. This rise is mainly due to the increasing voices from shareholders, government bodies, and customers, who are increasingly demanding less emissions. Nation states across the globe have set their climate goals in line with the Paris Accords, putting pressure on firms in the pursuit of carbon-neutral or net zero. Carbon credit trading services have therefore emerged as a key element of organizational climate initiatives where the greatest contributions to emissions are made by sectors such as energy, manufacturing, and transport.

The market for crediting carbon, that is the ability of companies and people to purchase the right to emit for others, has grown. Carbon credits are also realizing their worth with the price per ton of CO2 equivalent enhancing steadily as the demand gradient the supply gradient. This increase of fees may continue to rise in the future especially when more actors announce their net-zero targets and more stringent laws are implemented.

Market Players and Industry Activities

Carbon offset and credit trading are also best being driven by many Multinational companies around the globe. Several large corporations such as Microsoft, Amazon, and Shell have especially taken their bets on carbon offset initiatives. Microsoft Corporation aims to go a step further and be carbon-negative by 2030. Amazon has also come up with its 2 Billion US Dollars Climate Pledge Fund to support sustainable technologies and Shell intends to neutralize its customers’ emissions besides investing in forest conservation and reforestation projects.

Other players, including financial institutions, are also coming into the sector, given the future potential of the carbon credits market. Some of the examples include Goldman Sachs which has invested in carbon offset schemes, and trading platforms. Also, more fintech startups within this market provide carbon credit trading services that are convenient for SMEs as well as individuals. They use blockchain to avoid fraud and check the carbon credit transactions, thus strengthening the market’s credibility.

Technological Advancements in Carbon Trading

Digital platforms and blockchain are some of the most crucial emerging trends regarding the future of carbon offset and credit trading. Blockchain, in particular, provides an effective mechanism for registering the parties’ carbon credit transactions in a distributed ledger and, therefore, eliminating such significant threats as fraud and double-counting. Other firms like KlimaDAO and Toucan are employing blockchain as an essential tool to tokenize carbon credits so that more parties can invest in these credits.

Similarly, digital marketplaces of carbon credits are emerging into the mainstream markets. Some of these facilities are integrated and efficient to show buyers and sellers of carbon credits such as Xpansiv and Verra’s VCS registry. These platforms not only have the benefit of streamlining the carbon market but also allow small companies to participate in carbon offsetting. This democratization of the carbon market is expected to further inflate the growth of the sector.

Legal Changes and Government Assistance

Policy measures also have an essential influence on the carbon offset and credit trading environment. Carbon prices such as cap-and-trade systems and carbon taxes have been implemented in many countries to encourage companies to lessen their emissions. The largest and most developed emissions trading scheme is the EU ETS being in the European Union which has formed the basis for other countries.

In the United States of America, the Biden administration has demonstrated a good attitude towards combating climate change by planning to bring in more and more investment into new projects in clean energy and carbon offset projects. The U. S. Securities and Exchange Commission (SEC) is also looking into rules that would compel companies that release their financial reports to state the emissions of carbon, which will fuel more demand for carbon offset and credit trading services.

In Asia, China started its national carbon trading system in 2021 which has become the biggest in the world by the amount of emission allowed. It is believed this system will grow in the future and create a market for carbon credits in the region as well as inspire other developing nations.

For More Detailed Analysis in PDF Format, Visit - https://univdatos.com/get-a-free-sample-form-php/?product_id=35111

Conclusion

Consequently, the carbon offset and the carbon credit trading services industry stands at a crossroads. Thus, the market will continue to grow with increasing demand from corporations, governments, and consumers. However, some issues must be solved to provide long-term success in the market, including weak standardization and the threat of greenwashing. About future development of carbon offset and credit trading, technological progress, changes in the regulatory environment, and international cooperation will remain the key drivers as the carbon market becomes one of the probably the most important instruments in the fight against climate change and realization of net-zero emissions.

The way forward is going to depend on public and private partnerships as well as strong funding put into sustainable development schemes. As the market grows more and more saturated, carbon trading could prove to be one of the most efficient means of controlling global emissions and transitioning to a cleaner economy.

Related Trending Reports of UnivDatos Market Insights:

Concentrated Solar Power Market: Current Analysis and Forecast (2023-2030)

PTFE Fabric Market: Current Analysis and Forecast (2023-2030)

Cooling Fabrics Market: Current Analysis and Forecast (2024-2032)

Halal Tourism Market: Current Analysis and Forecast (2024-2032)

High Visibility Clothing Market: Current Analysis and Forecast (2024-2032)

Contact Us:

UnivDatos Market Insights

Email - contact@univdatos.com

Website - https://univdatos.com/

LinkedIn- https://www.linkedin.com/company/univ-datos-market-insight/mycompany/

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness