India LPG Market Size, Share, Growth, Trends and Analysis 2032

Key Highlights of the Report:

LPG Demand: Monthly LPG demand in the residential/commercial segment increased from 1.71 million metric tons (MMt) in September 2017 to 2.03 MMt in September 2019 and is expected to further increase to 2.38 MMt by the end of 2021.

Import dependency for LPG has increased from over 41 percent in 2010-11 to over 64 percent in 2022-23.

LPG consumption is projected to increase to 32 million tonnes by 2025 and further rise to 42.5 million tonnes by 2040.

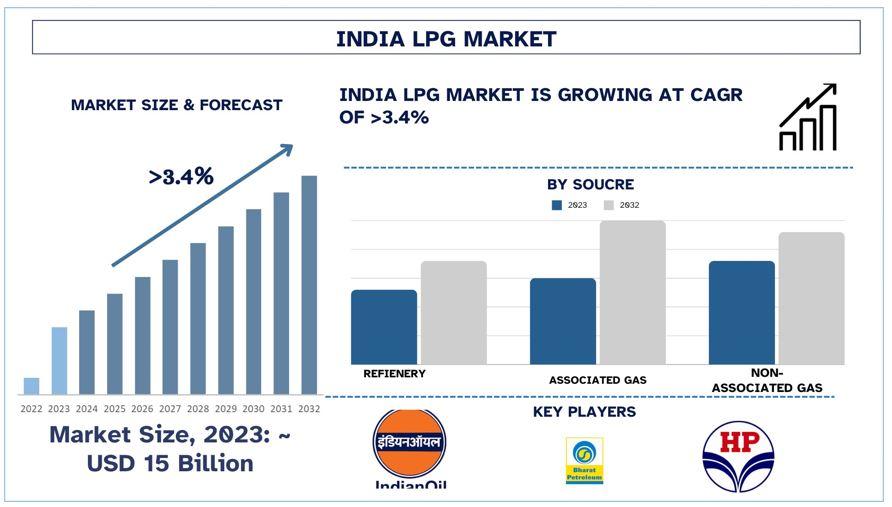

According to a new report by Univdatos Market Insights, the India LPG Market was valued at USD 15 Billion in 2023 and growing at a CAGR of 3.4%. Indian LPG market has in recent years witnessed tremendous growth and dynamic change. PMUY has been one of the most effective government schemes to boost the uptake of LPG in India. PMUY was launched in 2016, giving over 90 million new LPG connections to women belonging to BPL families to increase coverage of LPG in rural and secondary urban markets. The infrastructure facilities for the market also boast new bottling plants and pipelines such as the Paradip-Hyderabad pipeline to improve distribution.

LPG has become an essential element of India’s energy scenario and society’s fabric in a relatively short period. Environmentally, the transition from the traditional method of using biomass to using LPG has the advantage of decreasing indoor pollution, which is a plus for women and children who are affected most by pollution-related diseases. Economically, LPG has a positive impact where it affects investment in the sector and job opportunities through improvements in distribution this is especially felt in the rural areas where new stations for this sector are created. Also, the safety and convenience of using LPG relative to other flammable materials are an added advantage, which has improved the quality of life of many households.

Request Free Sample Pages with Graphs and Figures Here - https://univdatos.com/get-a-free-sample-form-php/?product_id=64585

Recent Developments of the Market

Import Development

Indian import dependence on foreign-sourced LPG has over five-fold rise in six years, from 49 percent to 64 percent in 2022-2023. This is due to a much higher demand for LPG by 32% contrary to a much smaller domestic production by 14%. Due to government interventions, access to residential LPG has increased in the country by more than double fashion in the last ten years, and currently, 314 million houses are using it.

For more information about this report visit- https://univdatos.com/report/india-lpg-market/

Conclusion

The demand for LPG in India has grown exponentially owing to government-sanctioned schemes such as the PMUY, which has provided subsidized connections for clean cooking fuel across both the rural and urban strata of the country. Nevertheless, this very pace of domestic consumption has also raised the country’s dependency on imports which as of now covers nearly fifty percent of the requirement.

To overcome this issue and the subsequent risks tied to fluctuations in global prices, India is working to diversify its procurement sources and negotiate long-term agreements with major suppliers. Also, a boost in domestic production through increasing refining scale and discoveries of new gas fields is needed. Pipelines and storage are other critical areas as far as the investors in such products are concerned as these help in maintaining a reliable supply. In combination with the development of the innovative technologies used in LPG and the strategic policies in India, the country is to establish a more sustainable domestic market for LPG that further contributes to the socio-economic development of India.

Related Reports-

India Data Center Market: Current Analysis and Forecast (2024-2032)

India Electronic Toll Collection Market: Current Analysis and Forecast (2024-2032)

Key Offerings of the Report

Market Size, Trends, & Forecast by Revenue | 2024−2032F.

Market Dynamics – Leading Trends, Growth Drivers, Restraints, and Investment Opportunities

Market Segmentation – A detailed analysis by source, application, and States

Competitive Landscape – Top Key Vendors and Other Prominent Vendors

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness