India Frozen Food Market: A Deep Dive into Analysis and Forecast to {2029}

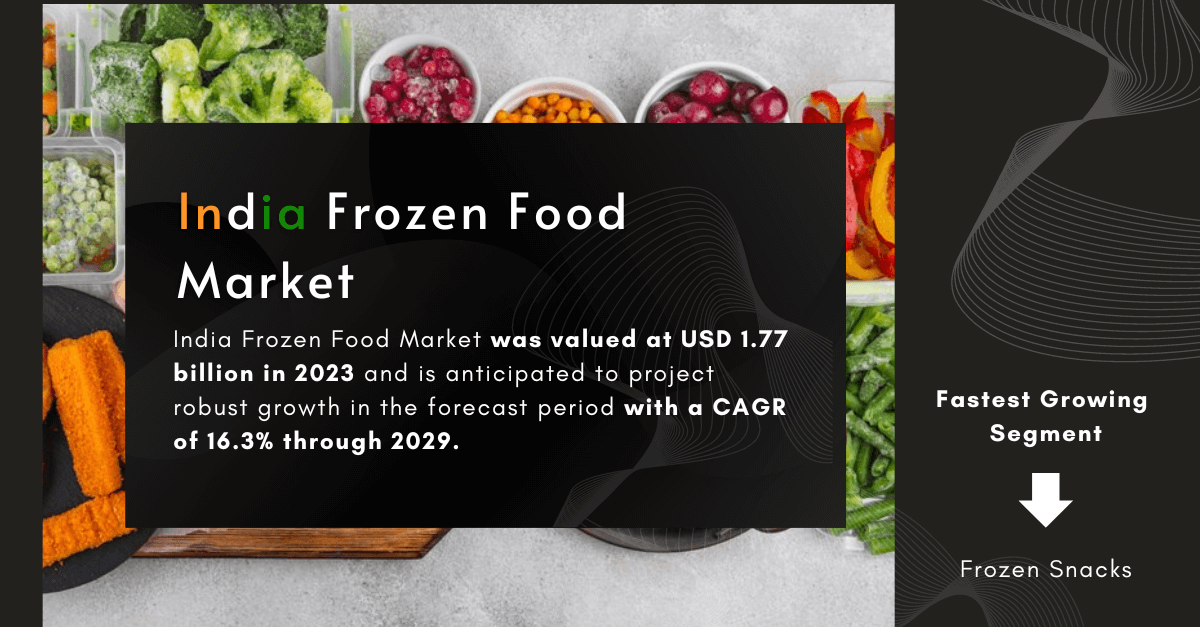

According to the TechSci Research report, "India Frozen Food Market - Industry Size, Share, Trends, Competition Forecast & Opportunities, 2029", the Indian frozen food market stood at USD 1.77 billion in 2023 and is projected to grow with a Compound Annual Growth Rate (CAGR) of 16.3% during the forecast period from 2025 to 2029.

The rapid growth and transformation of this market can be attributed to changing consumer preferences, urbanization, and increasing disposable incomes. Once a niche industry, frozen foods have become an essential part of the Indian food landscape, offering convenience and diversity to cater to the varied tastes and lifestyles of India’s population.

Historical Overview of Frozen Food in India

While the concept of freezing food as a preservation method is not new in India, the modern frozen food industry began to take shape in the mid-20th century with the introduction of commercial freezing technology.

Historically, communities in colder regions, such as the Himalayan states, preserved food in natural ice caves during winter. Over the years, this practice evolved into a sophisticated industry driven by technological advancements and changing lifestyles.

Browse over XX market data Figures spread through 83 Pages and an in-depth TOC on "India Frozen Food Market” @ https://www.techsciresearch.com/report/india-frozen-food-market/8257.html

India Frozen Food Market Size and Growth

The frozen food market in India was valued at approximately USD 1.3 billion in 2020. Since then, the industry has witnessed rapid expansion, with increasing demand from urban populations for ready-to-eat and easy-to-prepare food products.

This growth is expected to continue, driven by factors such as urbanization, increased consumer awareness of convenience foods, and a growing desire for diverse culinary experiences.

Drivers of Growth in the India Frozen Food Market

1. Urbanization and Changing Lifestyles

India's rapid urbanization has played a pivotal role in boosting the demand for frozen food products. As more people migrate to urban areas, their lifestyles change, often becoming busier and more time-constrained. Consequently, the demand for quick and easy meal solutions, such as frozen foods, has surged.

2. Rising Disposable Incomes

Increased disposable incomes have enabled Indian consumers to afford a more diverse range of food products. This, in turn, has boosted demand for high-quality frozen foods that provide both convenience and a variety of flavors.

3. Convenience of Frozen Foods

Frozen foods offer unparalleled convenience for busy consumers, as they allow for quick meal preparation without sacrificing quality or taste. Ready-to-cook frozen meals have gained popularity, allowing consumers to enjoy restaurant-quality dishes in the comfort of their homes without the need for extensive cooking skills or time-consuming preparation.

Health-Conscious Consumers: A Growing Segment

Health-conscious consumers are becoming a significant segment in the Indian frozen food market. Recognizing this, manufacturers have introduced healthier options, including:

- Frozen fruits and vegetables without added preservatives.

- Low-fat and low-sodium frozen meals.

- Gluten-free products.

These products cater to consumers looking for convenient yet healthful food choices, aligning with a growing trend toward mindful eating.

Cold Chain Infrastructure: The Backbone of Frozen Food Market

1. Challenges of Cold Chain in India

India's diverse climate and temperature variations throughout the year present a major challenge to maintaining the quality of frozen products. Without a robust cold chain infrastructure, frozen food products are at risk of spoilage, resulting in significant losses for companies.

2. Investments in Cold Storage Facilities

To ensure the quality and safety of frozen food products, investments in cold storage facilities and an efficient distribution network are essential. Companies are increasingly focusing on expanding their cold storage capacity and improving logistics to ensure that frozen products reach consumers in optimal condition.

Consumer Perceptions and Food Safety

Consumer perceptions of frozen food in India have historically been mixed, with concerns related to food safety and quality. However, with stringent quality control measures and greater transparency in labeling and ingredients, companies are working to build trust with consumers. Educating consumers about the benefits of frozen foods, including their nutritional value and safety, is crucial for the industry's sustained growth.

Regulatory Landscape: Ensuring Safety and Quality

The frozen food industry in India is subject to various regulations and quality standards to ensure the safety and quality of products. These regulations include:

- Labeling requirements.

- Hygiene standards.

- Adherence to cold chain protocols.

Compliance with these regulations is essential for companies to avoid issues related to product recalls and consumer health concerns. Companies that can navigate the regulatory landscape effectively will be well-positioned to succeed in the market.

Distribution Channels: Expanding Access

Frozen food products in India are distributed through a variety of channels, including:

- Supermarkets and hypermarkets.

- Convenience stores.

- Specialty frozen food outlets.

- Online platforms.

The rise of e-commerce has expanded the reach of frozen food brands, allowing consumers to shop for their favorite frozen products online. This shift toward online shopping is expected to continue, providing new opportunities for growth.

Seasonal Demand for Frozen Foods

While frozen foods are popular year-round, their demand experiences seasonal fluctuations. For example, during the monsoon season, when fresh produce is scarce, frozen fruits and vegetables serve as essential ingredients in many households. Similarly, in regions where fresh food is not readily available, frozen products are a convenient and reliable option.

Export Opportunities for Indian Frozen Food Brands

Indian frozen food brands are increasingly exploring opportunities for exporting their products to international markets, particularly in regions with a significant Indian diaspora. This trend provides a valuable avenue for growth and global recognition, allowing Indian companies to leverage the country's agricultural resources and culinary diversity.

India Frozen Food Market Segmentation: Product Types and Regional Insights

The India frozen food market is segmented into product types, categories, sales channels, and regions.

1. Product Types

- Frozen Snacks: A significant share of the frozen food market in India is occupied by frozen snacks such as samosas, spring rolls, pakoras, and French fries. These snacks are favored for their convenience and quick preparation, making them a popular choice for consumers with busy lifestyles.

- Frozen Fruits and Vegetables: These products are essential during seasons when fresh produce is not readily available. They offer a convenient way for consumers to enjoy fruits and vegetables without the hassle of preparation.

- Frozen Meat, Poultry, and Seafood: These products cater to consumers seeking high-quality protein options that can be quickly prepared for meals.

- Others: Other frozen food products include frozen ready meals, dairy products, and bakery items.

2. Regional Insights

- North Region: The North region holds a significant share of the Indian frozen food market. Major metropolitan areas such as Delhi and cities in Uttar Pradesh and Haryana contribute to the high demand for convenient, ready-to-eat food options.

- West, South, and East Regions: These regions are also experiencing growth in demand for frozen foods, driven by urbanization and changing consumer preferences.

Download Free Sample Report @ https://www.techsciresearch.com/sample-report.aspx?cid=8257

Customers can also request 10% free customization on this report.

Key Players in the India Frozen Food Market

Several major companies are operating in the Indian frozen food market, contributing to its growth and development. These include:

- McCain India Pvt Limited: Known for its range of frozen snacks and potato products, McCain India is a leading player in the market.

- Venky’s (India) Limited: Specializing in frozen poultry products, Venky's is a well-established brand in the frozen food industry.

- Mother Dairy Fruit and Vegetable: A key player in the frozen fruits and vegetables segment, Mother Dairy offers a wide range of products catering to health-conscious consumers.

- Godrej Tyson Foods Limited: This company is known for its frozen chicken and meat products, catering to the protein needs of Indian consumers.

- Al Kabeer Group: Offering a range of frozen snacks and ready meals, Al Kabeer is a popular brand in the Indian frozen food market.

- Innovative Foods Limited (Sumeru): Sumeru is known for its premium frozen food offerings, including ready-to-cook meals and snacks.

- ITC Limited: ITC has expanded its frozen food product line, offering a range of frozen snacks and ready meals.

- Arya Foods Amba: Arya Foods Amba specializes in frozen fruits and vegetables, focusing on health-conscious consumers.

- Conagra Brands: Known for its international frozen food brands, Conagra has a growing presence in India.

- Apex Frozen Foods Ltd: Specializing in frozen seafood, Apex Frozen Foods is a key player in the frozen food market.

India Frozen Food Market Future Trends and Opportunities

1. Innovations in Frozen Food Products

As the frozen food market in India continues to grow, companies are investing in product innovation to meet changing consumer preferences. These innovations include healthier options, ethnic and regional flavors, and premium frozen food products.

2. Sustainability and Eco-Friendly Packaging

With growing awareness of environmental issues, there is increasing demand for eco-friendly packaging in the frozen food industry. Companies that adopt sustainable practices in their packaging and distribution processes are likely to gain a competitive edge in the market.

3. Increased Penetration in Rural Areas

While urban areas have been the primary drivers of demand for frozen foods, there is significant potential for growth in rural areas as well. With improvements in cold chain infrastructure and greater awareness of frozen foods, rural consumers are expected to contribute to the market's expansion in the coming years.

Conclusion

The India frozen food market is poised for significant growth in the coming years, driven by changing lifestyles, increasing disposable incomes, and rising demand for convenience foods.

As companies continue to innovate and expand their product offerings, the frozen food industry will play an increasingly important role in shaping India's food landscape. With the right investments in infrastructure, regulatory compliance, and consumer education, the frozen food market is set to thrive, offering a diverse range of products to meet the evolving needs of Indian consumers.

You may also read:

India Feminine Hygienic Product Market Projected Growth: 13.85% CAGR from 2024 to {2029}

India Flavors Market Growth: Implications of the 8.8% CAGR for {2029}

India Folding Furniture Market Overview: Size, Growth & Share (Projected Growth: X% Increase)

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness