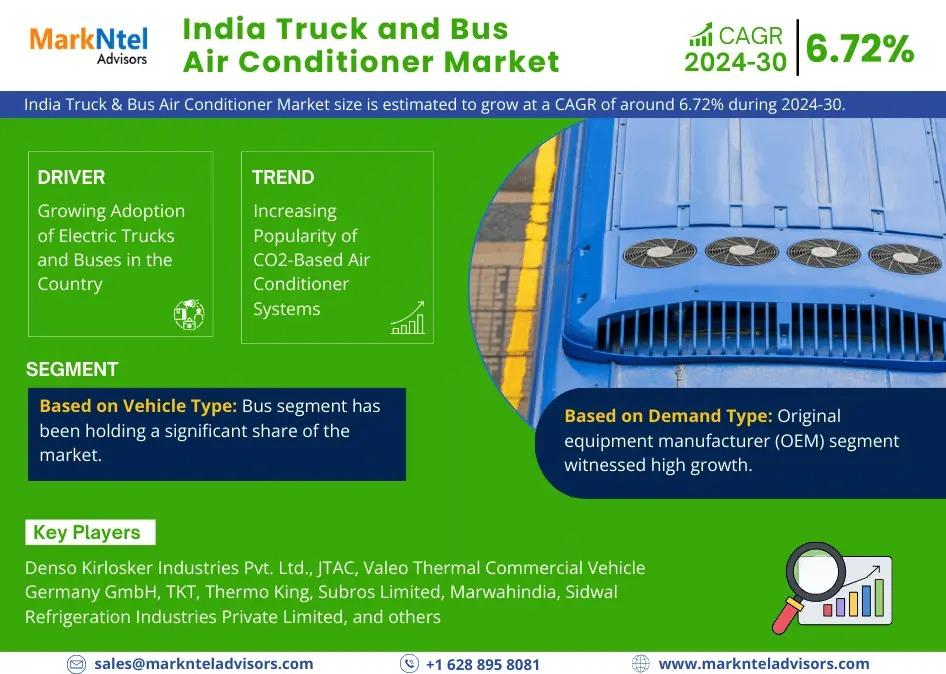

The India Truck & Bus Air Conditioner Market is projected to grow at a CAGR of about 6.72% during the forecast period of 2024–30, cites MarkNtel Advisors in the recent research report. The growth of the market is being driven by advancing road infrastructure, positive trade trends, regulatory actions, more private schools, etc. The rapid road expansion, including state and national highways, boosts the truck & bus air conditioning industry. Government investments improve connectivity, benefiting outstation buses and freight trucks with expanded routes. This spurs growth in truck and bus air conditioning due to traveler comfort, operator advantage, and rising temperature needs. This evolving landscape has driven the size and volume of the India Truck & Bus Air Conditioner Market, highlighting changing preferences, operator benefits, and the essential need for cooling.

Furthermore, the private education sector in India has witnessed substantial expansion in the last few years, driven by an increasing need for high-quality education, enhanced infrastructure, and the growth of affordable private schools. According to the National Independent School Alliance (NISA), in 2023, there are over 400,000 private, affordable schools serving students in India. With India's population on the rise, the demand for quality education is anticipated to continue growing in the future. Private schools prioritize the safety and well-being of students during transportation, with air-conditioned buses ensuring a comfortable and controlled environment, particularly in areas with extreme weather conditions. Thus, an increased requirement for bus air conditioners is anticipated in the forecast period, further states the research report, “India Truck & Bus Air Conditioner Market Analysis, 2024.”

Download Sample PDF Copy of this Report: - https://www.marknteladvisors.com/query/request-sample/india-truck-bus-air-conditioner-market.html

India Truck & Bus Air Conditioner Market Segmentation Analysis

By Vehicle Type

- Bus

- Large Buses (Above 10 Meter)

- Medium Buses (7.1 to 10 Meter)

- Small Buses (Below 7 Meter)

- Truck

- Heavy Duty Trucks (Above 7 Tons)

- Light & Medium Duty Trucks (Up to 7 Tons)

By Product Type

- Roof Mounted Split AC

- Back Wall AC

By Demand Type:

- OEM

- Replacement

By Capacity

- Up to 10 Kw

- 1-25 Kw

- 1-40 Kw

- Above 40 Kw

By Region

- North

- West

- East

- South

Bus Segment to Hold Major Market Share

Based on the vehicle type, the market is further bifurcated into bus, and truck. The bus segment is projected to hold a major share of the India Truck & Bus Air Conditioner Market in the coming years. The surge in online booking platforms such as Zing Bus and Red Bus, coupled with the ongoing trends of migration and urbanization, has fuelled a notable uptick in the popularity of outstation bus services in India. This heightened adoption of outstation bus services reflects a soaring demand for transportation options that are not only efficient but also comfortable and easily accessible. In response to this demand, operators are increasingly favoring air-conditioned buses, acknowledging that passengers prioritize the comfort and convenience offered by such services. This has significantly contributed to the recent growth of the market as operators strive to meet the evolving preferences of travelers.

Moreover, the One Nation, One Permit government initiative is anticipated to boost the share of this segment by streamlining and expediting permit processing for bus operators, fostering easier interstate travel, and more. Additionally, state governments like Delhi, Karnataka, West Bengal, Uttar Pradesh, Tamil Nadu, etc., are progressively undertaking measures to expand and upgrade their public transport bus fleets in the coming years. Consequently, these factors are poised to positively propel the demand for bus air conditioners in the forecast period.

OEM Dominating the India Truck & Bus Air Conditioner Market

In the historical period, the Original Equipment Manufacturer (OEM) segment experienced significant growth attributed to the heightened adoption of premium buses & trucks and the rise of the tourism industry. The nation has experienced a rise in the acquisition of premium and high-end trucks in recent years, propelled by increased activities in mining, road construction, and e-commerce. For instance, in 2022, Daimler India Commercial Vehicles sold around 29,470 commercial vehicles, recording about a 25% increase in sales compared to the previous year. This upswing in sales has generated a heightened need for air conditioners for trucks and buses from original equipment manufacturers (OEMs) aiming to equip their premium commercial vehicles.

Moreover, the expanding tourism industry in India is expected to drive the demand for air-conditioned buses and luxury coaches. According to the Tourism Ministry statement for 2023, the number of foreign tourists who arrived in India in early 2023 is around 166 percent higher than the figures for the corresponding period in 2022. With the continuous growth of tourism, tour operators and travel companies are expected to prioritize fleets equipped with air conditioning to offer an enhanced travel experience to customers. This trend is anticipated to augment the share of the OEM segment in the market in the coming years.

Explore the Full Report with Charts, Table of Contents, and List of Figures – https://www.marknteladvisors.com/research-library/india-truck-bus-air-conditioner-market.html

Competitive Landscape

With strategic initiatives such as mergers, collaborations, and acquisitions, the leading market companies, including Denso Kirlosker Industries Pvt. Ltd., JTAC, Valeo Thermal Commercial Vehicle Germany GmbH, TKT, Thermo King, Subros Limited, Marwahindia, Sidwal Refrigeration Industries Private Limited, Songz, Ebespacher Gruppe GmbH & Co. KG, and others, are looking forward to strengthening their market position.

Key Questions Answered in the Research Report

- What are the industry’s overall statistics or estimates (Overview, Size- By Value, Forecast Numbers, Segmentation, Shares)?

- What are the trends influencing the current scenario of the market?

- What key factors would propel and impede the industry in the country?

- How has the industry been evolving in terms of geography & product adoption?

- How has the competition been shaping across the country?

- How have buying behavior, customer inclination, and expectations from product manufacturers been evolving during 2019–30?

- Who are the key competitors, and what strategic partnerships or ventures are they coming up with to stay afloat during the projected time frame?

Who We Are:

Our team entails professional analysts and researchers who intelligently utilize research techniques to procure detail-driven, unbiased, and reliable data encompassing the industry. We aim to nurture a result-oriented team to offer strategically-moving insights to our clients.

Our fact-based reports allow the user to design their motives, funds, and strategies, with a higher focus on mitigating confusion and bringing forward a clear insight into the industry. It further allows the clients to identify the lucrative opportunities awaiting.

Insights offered by MarkNtel Advisors comprise in-depth information on regional & country-based trends emerging in the industry. The team studies & compiles the prospects, ensuring consistency in reports.

Our services are beyond offering research reports to the clients and further expand into addressing queries while incorporating with them for advice, development, & execution of strategies for exception growth.

Other Trending Reports:

- https://knowledgehub2.quora.com/India-Vacuum-Cleaners-Market-size-was-valued-at-USD-42-million-in-2023-is-estimated-to-reach-Grow-2-18-CAGR-by-2029

- https://knowledgehub2.quora.com/Europe-Basmati-Rice-Market-Trends-Demand-Top-Players-and-Future-Predictions-by-2030

- https://knowledgehub2.quora.com/Plasma-Fractionation-Market-Size-Share-Price-Trends-Analysis-Key-Players-Report-Forecast-2024-2030-1

- https://knowledgehub2.quora.com/Plasma-Fractionation-Market-Size-Share-Price-Trends-Analysis-Key-Players-Report-Forecast-2024-2030-1

For Media Inquiries, Please Contact:

Call: +1 628 895 8081 | +91 120 4278433

Email: sales@marknteladvisors.com

Sales Office: 564 Prospect St, B9, New Haven, Connecticut, USA-06511

Corporate Office: Office No.109, H-159, Sector 63, Noida, Uttar Pradesh-201301, India