Rare Earth Metals Market: Key Drivers and Growth Opportunities

Rare earth metals, a group of 17 chemical elements, have become indispensable to modern technology and industries. From smartphones and electric vehicles to renewable energy systems and advanced defense technologies, rare earth metals are essential components. As the demand for high-tech applications grows, so does the need for these critical materials, driving the expansion of the rare earth metals market. This article explores the key drivers and growth opportunities shaping the rare earth metals market.

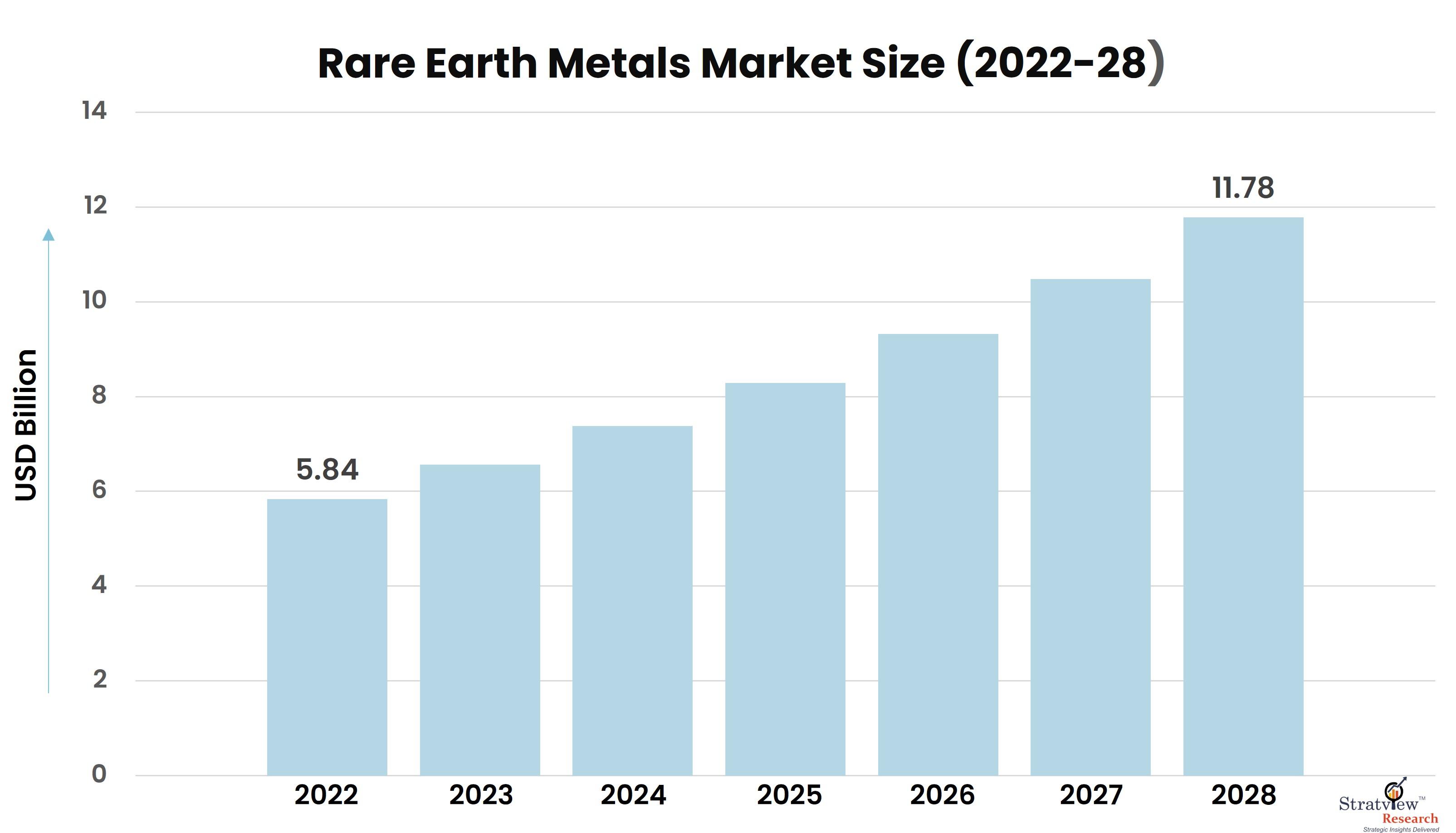

According to Stratview Research, the rare earth metals market was estimated at USD 5.84 billion in 2022 and is likely to grow at a CAGR of 12.42% during 2023-2028 to reach USD 11.78 billion in 2028.

Key Drivers of the Rare Earth Metals Market

One of the primary drivers of the rare earth metals market is the rapid adoption of green technologies, such as wind turbines, electric vehicles (EVs), and solar panels. Rare earth metals like neodymium, dysprosium, and praseodymium are crucial for manufacturing the powerful magnets used in electric motors and renewable energy equipment. As global efforts to combat climate change intensify, governments and corporations are investing heavily in sustainable technologies, leading to a surge in demand for rare earth metals.

The growth of the consumer electronics industry is another significant driver of the rare earth metals market. Smartphones, laptops, televisions, and other electronic devices rely on rare earth metals for components like displays, batteries, and speakers. With the ongoing digital transformation and the rise of smart devices, the consumption of rare earth metals is expected to continue its upward trajectory.

Additionally, the aerospace and defense sectors play a crucial role in driving demand for rare earth metals. These metals are essential in producing jet engines, missile guidance systems, and radar systems. As global defense spending increases, the demand for rare earth metals in military applications is expected to rise as well.

Growth Opportunities in the Rare Earth Metals Market

Several growth opportunities are emerging in the rare earth metals market. One of the most significant is the increasing focus on developing new sources of rare earth metals outside of China, which currently dominates the global supply chain. Efforts to diversify supply, particularly in regions like the United States, Australia, and Africa, are creating new opportunities for mining and production.

Another opportunity lies in recycling rare earth metals from electronic waste. With e-waste becoming a global environmental issue, there is growing interest in recovering rare earth metals from discarded electronics. Companies that can develop cost-effective recycling methods will benefit from both environmental and economic advantages.

Moreover, advancements in material science and engineering are driving innovation in the development of alternative materials that could reduce reliance on rare earth metals. However, until these alternatives become commercially viable, the demand for rare earth metals is likely to remain robust.

Conclusion

The rare earth metals market is positioned for significant growth, driven by the increasing demand for green technologies, consumer electronics, and defense applications. As supply chains diversify and recycling methods advance, new opportunities will arise, making this market a crucial area of focus for industries worldwide. With its role in powering the technologies of the future, the rare earth metals market is poised to become even more critical in the global economy.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness