Carbon Credit Market Research, Developments, Expansion, Statistics, Industry Outlook, Size, Growth Factors and Forecast 2030

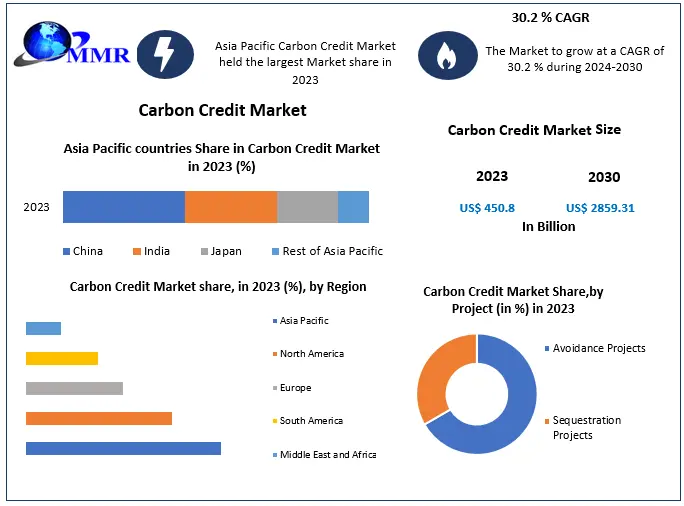

The size of the carbon credit market was estimated to be worth USD 450.8 billion in 2023. From 2024 to 2030, the market's total revenue is predicted to increase by 30.2%, to reach approximately USD 2859.31 billion.

Carbon Credit Market Overview

Maximize Market Research is a Business Consultancy Firm that has published a detailed analysis of the “Carbon Credit Market”. The report includes key business insights, demand analysis, pricing analysis, and competitive landscape. The report provides the current state of the Carbon Credit Market by thorough analysis, and projections are made up to 2030.

Discover detailed insights by accessing the sample through the provided link @https://www.maximizemarketresearch.com/request-sample/198127/

Carbon Credit Market Scope and Methodology:

This report analyzes the Carbon Credit Market across different regions and detailed segmentation, providing a definition, description, and forecast. It encompasses various important market factors along with comprehensive qualitative and quantitative investigations. This includes reviewing the competitive landscape, competitor profiles, industry analysis, economic implications, important viewpoints, market trends, and market assessment.

The report delves into past data, focusing on different Carbon Credit Market scenarios and conducting a comprehensive evaluation of the factors influencing the market, including drivers, constraints, opportunities, challenges, and future trends. The report thoroughly examines market potential, market dynamics, growth opportunities, segmented markets, geographic scenarios, competition analysis, and predictions with the right methodology and assumptions. The study also involves evaluating the value chain, conducting PESTLE analysis, examining the impact, and conducting PORTER’s analysis.

Carbon Credit Market Regional Insights

The study thoroughly examines the markets in the Middle East, Africa, South America, Asia Pacific, Europe, and North America. Understanding the intricate dynamics of the global Carbon Credit Market is an essential component of the regional analysis provided in the report. The report contains details about the import and export of goods, market size, and growth rate for all countries. Furthermore, the report has also presented an overview of the latest advancements in the international Carbon Credit Market across different countries and regions.

Click here to request access to a sample for detailed information : @https://www.maximizemarketresearch.com/request-sample/198127/

Carbon Credit Market Segmentation

by Project

Avoidance Projects

Sequestration Projects

by Type

Compliance Market

VoluntaryMarket

by Application

Energy and Power

Aviation

Transportation

Industrial

Others

According to application, the carbon credit market's highest share is anticipated to belong to the energy & electricity segment in 2023. The Paris Agreement's emphasis on lowering greenhouse gas emissions has spurred a rise in renewable energy projects worldwide. The industrial sector is shifting from high-emission fossil fuel-based technologies to low-emission technologies that integrate sustainable energy into their operational procedures as a result of the global shift towards sustainable energy sources like solar, wind, and hydropower. The primary source of greenhouse gas emissions is the production of energy and power. These elements are anticipated to fuel the growth of the carbon credit market's energy and power segment.

Access a sample report for comprehensive details through the link : @https://www.maximizemarketresearch.com/request-sample/198127/

Carbon Credit Market Key Players

1. BP Target Neutral

2. JPMorgan Chase & Co.

3. Gold Standard

4. Carbon Clear

5. South Pole Group

6. 3Degrees

7. Shell

8. EcoAct

9. CBL Markets

10. Carbon Credit Capital

11. ClimateCare

12. VCS (Verified Carbon Standard)

13. Sindicatum Sustainable Resources

14. Mercury Capital Advisors

15. Nori

16. Carbon Trust

17. Veridium Labs

18. Natural Capital Partners

19. EDF Trading

Discover more by downloading the sample document through this link : @https://www.maximizemarketresearch.com/market-report/carbon-credit-market/198127/

Key questions answered in the Carbon Credit Market are:

- What is Virtual Power Plant ?

- What is the growth rate of the Carbon Credit Market ?

- What was the Carbon Credit Market size in 2023?

- What are the upcoming opportunities and trends for the Carbon Credit Market ?

- What are the different segments of the Carbon Credit Market ?

- What are the recent industry trends that can be implemented to generate additional revenue streams for the Carbon Credit Market ?

- What segments are covered in the Carbon Credit Market ?

- Which are the factors expected to drive the Carbon Credit Market growth?

- What growth strategies are the players considering to increase their presence in Virtual Power Plant ?

- Who are the leading companies and what are their portfolios in Carbon Credit Market ?

- Who are the key players in the Carbon Credit Market?

- What is the CAGR at which the Carbon Credit Market will grow during the forecast period?

Browse our trending reports to explore related insights and analyses.

♦ Laboratory Freezers Market https://www.maximizemarketresearch.com/market-report/global-laboratory-freezers-market/26491/

♦ Boiler Market https://www.maximizemarketresearch.com/market-report/boiler-market/11574/

Key Offerings

- Past Size and Competitive Landscape

• Past Pricing and price curve by region

• Size, Share, Size Forecast by different segment

• Dynamics Growth Drivers, Restraints, Opportunities, and Key Trends by Region

• Segmentation A detailed analysis by segment with their sub-segments and Region

• Competitive Landscape Profiles of selected key players by region from a strategic perspective

Contact Maximize Market Research: sales@maximizemarketresearch.com

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness