India Non-Life Insurance Market Research, Developments, Expansion, Statistics, Industry Outlook, Size, Growth Factors and Forecast 2030

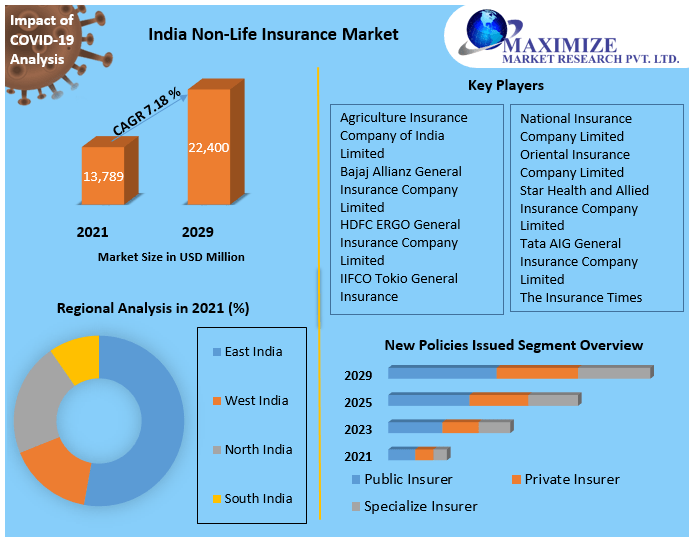

India Non-Life Insurance Market Growth or Demand Increase or Decrease for what contains ? Economic development, government initiatives promoting insurance coverage, and rising consumer awareness of insurance products are driving the robust expansion of the non-life insurance industry in India. The need for property, health, and auto insurance is increasing as a result of urbanization, the growing middle class, and increased risk awareness after the COVID-19 pandemic. Furthermore, the insurance industry's digital revolution and regulatory changes are increasing the affordability and accessibility of non-life insurance products. In spite of obstacles including rivalry and the requirement for increased financial knowledge, India's non-life insurance business is expected to grow. Explore additional details by clicking the link provided:https://www.maximizemarketresearch.com/request-sample/42091/ India Non-Life Insurance Market CAGR Estimation: India Non-Life Insurance Market was valued at US$ 13, 7889 Mn. in 2021 and is expected to grow at US$ 22,400 Mn. in 2029. India Non-Life Insurance Market size is expected to grow at a CAGR of 7.18 % through the forecast period. India Non-Life Insurance Market Segmentation: by Product • Motor insurance • Health insurance • Fire insurance • Marine insurance • Others Based on Product, The motor insurance held the largest market share in 2021. Significant rise in the demand of automobiles, and compulsion of motor insurance across the India. The report provides an in-depth segment analysis of the India non-life insurance market, thereby providing valuable insights at macro as well as micro levels. It covers against listed damage and destruction done to the car due to floods, earthquakes, typhoons etc. It also covers damage and destruction caused to the vehicle due to theft, burglary, strikes and riots. The cover offers protection for the owner/driver of the car and co-passengers while travelling. The cover is also valid for damage and destruction caused during mounting or dismounting from the car. This all factors lead to the growth of the India Non-Life Insurance Market. by New Policies Issued • Public insurer • Private insurer • Specialize insurer by Distribution Channel • Individual agents • Corporate agents - banks • Corporate agents - others • Brokers • Direct business • Others To access more comprehensive information, click here:https://www.maximizemarketresearch.com/request-sample/42091/ India Non-Life Insurance Market Overview: The Maximize Market Research report assists clients in gaining a comprehensive understanding of the competitive landscape, serving as a valuable resource for strategic planning purposes. The comprehensive India Non-Life Insurance market overview furnishes extensive information regarding market size, trade statistics, prominent participants, and a range of market indicators, encompassing aspects such as life cycle, prevailing trends, and more. India Non-Life Insurance Market Growth or Demand in which regions?? The India Non-Life Insurance market is experiencing significant growth across various regions. Urban areas, particularly in states like Maharashtra, Delhi, Karnataka, and Tamil Nadu, lead the market due to higher economic activity, greater insurance awareness, and higher disposable incomes. Rural regions are also seeing increased demand, driven by government initiatives and schemes aimed at boosting insurance penetration and financial inclusion. Additionally, the eastern and northeastern states are witnessing growth due to efforts to expand insurance coverage in underserved areas. Overall, both urban and rural regions are contributing to the robust expansion of the non-life insurance market in India. India Non-Life Insurance Market Scope & Methodology: The competitive landscape of the India Non-Life Insurance market encompasses aspects like technology adoption, financial strength, portfolio, mergers and acquisitions, joint ventures, and strategic alliances. A comprehensive report delves into the drivers, limitations, opportunities, and challenges inherent in the India Non-Life Insurance market. The report employed a bottom-up approach to ascertain India Non-Life Insurance market estimations and growth rates. To gain insights into India Non-Life Insurance market penetration, pricing dynamics, demand analysis, and competitive panorama, the report executed regional analysis at local, regional, and global levels. Essential details about the India Non-Life Insurance market, including stakeholders, investors, and new entrants, are presented to facilitate the development of marketing strategies and investment plans. Both primary and secondary data gathering techniques were employed for the India Non-Life Insurance Market. Primary approaches involved surveys, questionnaires, and interviews with industry leaders and business proprietors, while secondary data encompassed sources like press releases, annual and financial reports, white papers, etc. SWOT analysis was leveraged to pinpoint market vulnerabilities and weaknesses, while the PORTER framework was applied to gauge industry competitiveness within the India Non-Life Insurance Market. Click here for a more detailed explanation:https://www.maximizemarketresearch.com/request-sample/42091/ India Non-Life Insurance Market Key Players: • Agriculture Insurance Company of India Limited • Bajaj Allianz General Insurance Company Limited • HDFC ERGO General Insurance Company Limited • ICICI Lombard General Insurance Company Limited • IIFCO Tokio General Insurance • National Insurance Company Limited • Oriental Insurance Company Limited • Star Health and Allied Insurance Company Limited • Tata AIG General Insurance Company Limited • The New India Assurance Company Limited • The Insurance Times • ICICI Bank • Mahindra Insurance Brokers Limited • Royal Sundaram General Insurance Co. Limited • Universal Sompo General Insurance Co. Ltd. For an in-depth analysis, click the provided link:https://www.maximizemarketresearch.com/market-report/india-non-life-insurance-market/42091/ Key questions answered in the India Non-Life Insurance Market are: • What is India Non-Life Insurance ? • What is the growth rate of the India Non-Life Insurance Market? • Which are the factors expected to drive the India Non-Life Insurance market growth? • What are the different segments of the India Non-Life Insurance Market? • What are the factors restraining the growth of the India Non-Life Insurance Market? • What is the demand pattern of the India Non-Life Insurance Market? • What major challenges could the India Non-Life Insurance Market face in the future? Related Reports: Global Aerospace Fasteners Market https://www.maximizemarketresearch.com/market-report/global-aerospace-fasteners-market/96972/ Global Laser cleaning Market https://www.maximizemarketresearch.com/market-report/global-laser-cleaning-market/7073/ Key Offerings: • Past Market Size and Competitive Landscape • Past Pricing and price curve by region • Market Size, Share, Size & Forecast by different segment | • Market Dynamics – Growth Drivers, Restraints, Opportunities, and Key Trends by Region • Market Segmentation – A detailed analysis by segment with their sub-segments and Region • Competitive Landscape – Profiles of selected key players by region from a strategic perspective About Maximize Market Research: Maximize Market Research is a multifaceted market research and consulting company with professionals from several industries. Some of the industries we cover include medical devices, pharmaceutical manufacturers, science and engineering, electronic components, industrial equipment, technology and communication, cars and automobiles, chemical products and substances, general merchandise, beverages, personal care, and automated systems. To mention a few, we provide market-verified industry estimations, technical trend analysis, crucial market research, strategic advice, competition analysis, production and demand analysis, and client impact studies. Contact Maximize Market Research: 3rd Floor, Navale IT Park, Phase 2 Pune Banglore Highway, Narhe, Pune, Maharashtra 411041, IndiaC sales@maximizemarketresearch.com +91 96071 95908, +91 9607365656

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jeux

- Gardening

- Health

- Domicile

- Literature

- Music

- Networking

- Autre

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness