U.S. Pet Insurance Market Size, Share & Report 2033

IMARC Group has recently released a new research study titled “U.S. Pet Insurance Market Size, Share, Trends and Forecast by Policy, Animal, Provider, and Region, 2025-2033,” which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

U.S. Pet Insurance Market Overview

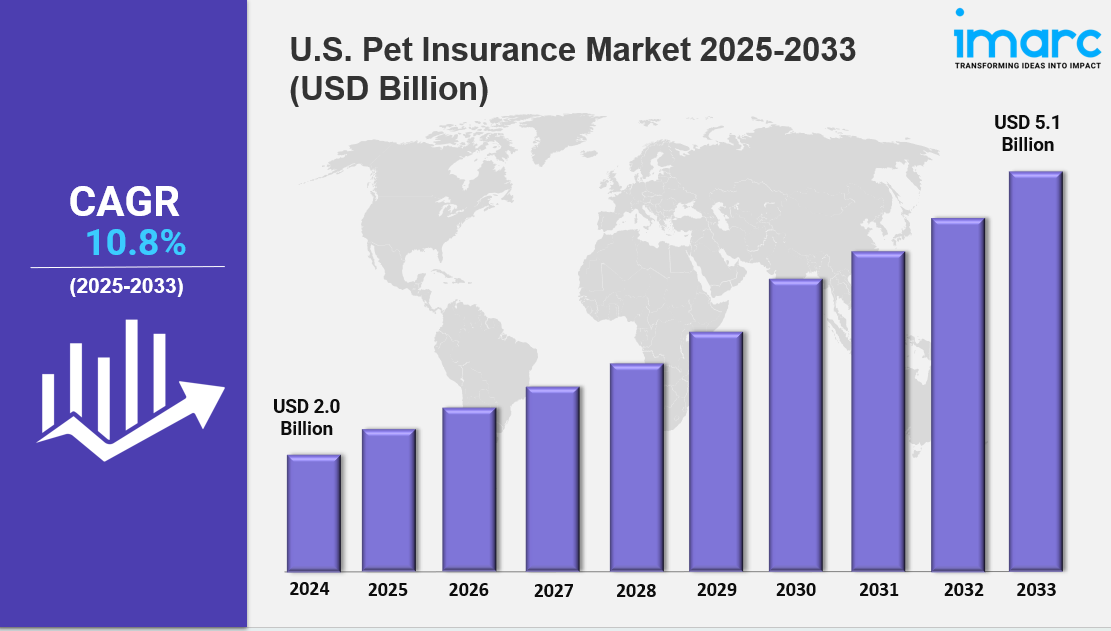

The U.S. pet insurance market size was valued at USD 2.0 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 5.1 Billion by 2033, exhibiting a CAGR of 10.8% from 2025-2033.

Market Size and Growth

Base Year: 2024

Forecast Years: 2025-2033

Historical Years: 2019-2024

Market Size in 2024: USD 2.0 Billion

Market Forecast in 2033: USD 5.1 Billion

Market Growth Rate 2025-2033: 10.8%

Request for a sample copy of the report: https://www.imarcgroup.com/united-states-pet-insurance-market/requestsample

Key Market Highlights:

✔️ Strong market growth driven by rising pet ownership and increasing veterinary care costs

✔️ Growing awareness of pet health and wellness boosting insurance adoption

✔️ Expanding offerings with customizable, multi-pet, and wellness coverage plans from insurers

U.S. Pet Insurance Market Trends

The U.S. pet insurance market is growing quickly as more pet owners choose comprehensive policies that go far beyond emergency care. Instead of relying on basic accident-only coverage, many are now selecting plans that cover long-term conditions such as diabetes, arthritis, and cancer. Providers are also adding benefits like rehabilitation, behavioral therapy, and even alternative treatments, which is helping to expand the market and meet a wider range of needs.

Premiums reflect this broader coverage, averaging about $780 per year for dogs and $384 for cats. Add-ons like genetic testing have also become popular, with nearly one-third of policyholders opting for these features from insurers such as Nationwide and Trupanion. These shifts are shaping the latest trends outlined in the U.S. pet insurance market report.

Employer-Sponsored Plans Driving Growth

Employer-sponsored insurance has emerged as one of the strongest growth drivers. By 2024, nearly two-thirds of Fortune 500 companies offered pet insurance as part of their employee benefits. Participation rates at major employers such as Amazon and Starbucks reached close to 90%, showing just how much demand exists among workers. With veterinary expenses rising nearly 20% in a single year, insurers like Lemonade have introduced flexible pricing models tied to local veterinary costs—helping them remain competitive and aligned with the evolving U.S. pet insurance market forecast.

Technology Reshaping the Market

Technology is transforming how pet insurance is delivered. Activity trackers from companies like Healthy Paws and FitBark are now being used by insurers to reward owners of active pets with premium discounts. Integration of veterinary health records by providers such as Petplan has made it easier to personalize coverage.

Mobile apps have streamlined claims processing, with more than 70% of claims now submitted digitally, cutting reimbursement times significantly. Blockchain pilots are also being tested to improve transparency and reduce administrative expenses, further shaping long-term U.S. pet insurance market growth.

Privacy concerns around genetic testing have prompted insurers to adopt stronger security measures. Companies like Embark Veterinary introduced advanced encryption tools, while over 30 states implemented standardized policy formats to improve clarity and consumer confidence.

Market Expansion and Competitive Landscape

The U.S. pet insurance market size is expected to surpass $24 billion by 2028. Retailers are also joining the space—Walmart partnered with Spot to make insurance available at vet clinics and adoption centers. Gen Z pet owners, who now represent more than half of new enrollments, are pushing demand for low-cost, digital-first plans such as Pets Best’s $9.99 accident-only coverage.

Adoption is expanding in rural areas too, helped by programs like the Farm Bureau’s bundled farm and pet insurance, which boosted coverage in underserved regions by 60%. At the same time, mergers and acquisitions are reshaping competition. For instance, Allstate’s $2.7 billion acquisition of Fetch created the largest digital pet insurance platform in the country.

U.S. Pet Insurance Market Future Outlook

The U.S. pet insurance market forecast points to steady growth in the years ahead, driven by rising veterinary costs, greater accessibility, and continuous innovation. From climate-related policy options to app-based pricing and expanded employer-sponsored programs, the industry is adapting to the needs of modern pet owners. These developments are expected to fuel strong U.S. pet insurance market growth through 2025 and beyond.

Ask Analyst & Browse Full Report with TOC & List of Figures: https://www.imarcgroup.com/request?type=report&id=20400&flag=C

U.S. Pet Insurance Market Segmentation:

The market report segments the market based on product type, distribution channel, and region:

Analysis by Policy:

-

Illnesses and Accidents

-

Chronic Conditions

-

Others

Analysis by Animal:

-

Dog

-

Cat

-

Others

Analysis by Provider:

-

Public

-

Private

Regional Analysis:

-

Northeast

-

Midwest

-

South

-

West

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

Key Highlights of the Report

1. Market Performance (2019-2024)

2. Market Outlook (2025-2033)

3. COVID-19 Impact on the Market

4. Porter’s Five Forces Analysis

5. Strategic Recommendations

6. Historical, Current and Future Market Trends

7. Market Drivers and Success Factors

8. SWOT Analysis

9. Structure of the Market

10. Value Chain Analysis

11. Comprehensive Mapping of the Competitive Landscape

About Us:

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC’s information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company’s expertise.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91-120-433-0800

United States: +1 201971-6302

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness