United States Powersports Market is Booming with a CAGR of 5.66% During 2025-2033

IMARC Group has recently released a new research study titled “United States Powersports Market Report by Vehicle Type (All-Terrain Vehicles (ATV), Side-By-Side Vehicles, Snowmobiles, Personal Watercraft, Heavyweight Motorcycle), Propulsion Type (Gasoline, Electric, Diesel), Application (On-Road, Off-Road), and Region 2025-2033,” which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

United States Powersports Market Overview

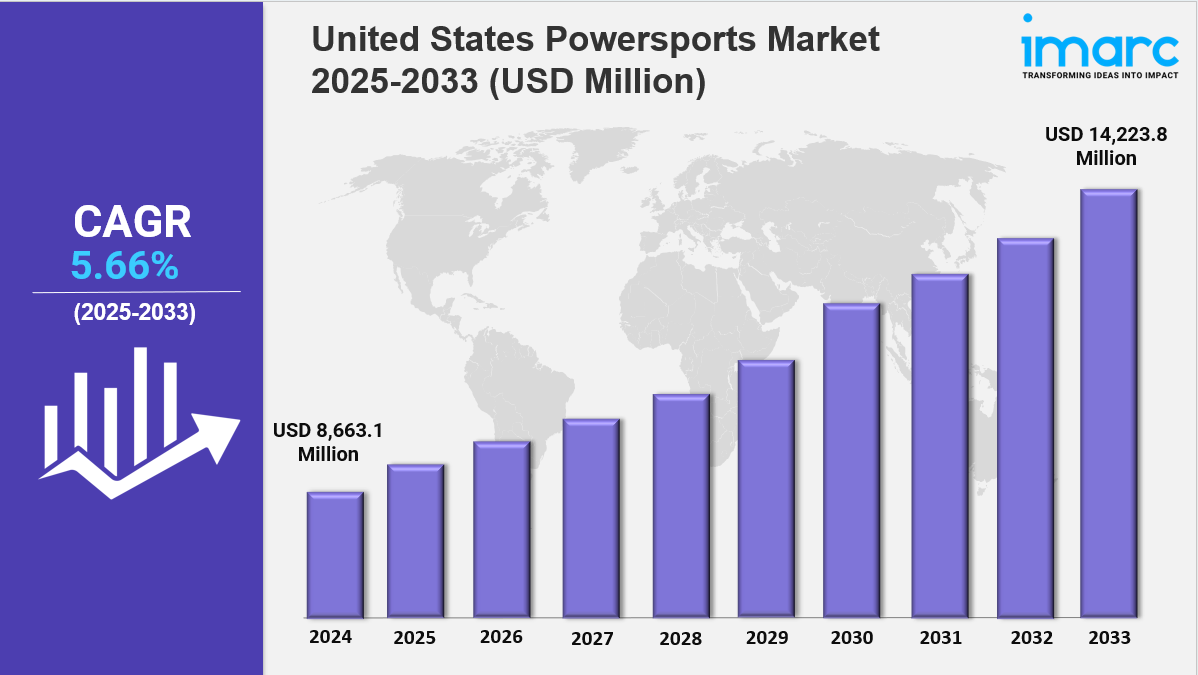

United States powersports market size reached USD 8,663.1 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 14,223.8 Million by 2033, exhibiting a growth rate (CAGR) of 5.66% during 2025-2033.

Market Size and Growth

Base Year: 2024

Forecast Years: 2025-2033

Historical Years: 2019-2024

Market Size in 2024: USD 8,663.1 Million

Market Forecast in 2033: USD 14,223.8 Million

Market Growth Rate 2025-2033: 5.66%

Request for a sample copy of the report: https://www.imarcgroup.com/united-states-powersports-market/requestsample

Key Market Highlights:

✔️ Strong consumer interest in outdoor recreational activities driving powersports demand

✔️ Technological advancements enhancing vehicle performance, safety, and user experience

✔️ Expanding financing options and dealership networks boosting market accessibility

United States Powersports Market Trends

The United States powersports market is undergoing a rapid transformation in 2024, driven by electrification, changing consumer demographics, and regulatory pressure. Growing concerns about emissions are pushing manufacturers to expand electric vehicle portfolios. Harley-Davidson’s LiveWire and Zero Motorcycles are leading with electric motorcycles, ATVs, and personal watercraft.

Battery performance has improved significantly, with models now reaching ranges of over 150 miles per charge. Infrastructure investment is also accelerating—Electrify America and OEM partnerships are easing “range anxiety” through widespread charging networks. These developments fueled a 48% year-over-year increase in electric powersports sales in 2024, with off-road segments such as electric dirt bikes gaining traction due to their low noise output in environmentally sensitive areas.

Challenges in Pricing and Supply

Despite strong momentum, the industry faces hurdles. Electric models remain 20–35% more expensive than traditional internal combustion options, while lithium supply chain volatility continues to pressure production costs. However, state-level incentives are shaping the United States powersports market share. Rebates in California, New York, and Oregon of up to $1,500 per unit are encouraging adoption, pushing electrification toward a projected $3.2 billion market niche by 2026.

Market Size and Post-Pandemic Adjustments

Following pandemic-era surges, the United States powersports market size has begun to stabilize. Unit sales peaked at 1.2 million in 2022 but declined 9% in 2024 as inflation weakened consumer purchasing power. Disposable income fell by 2.3%, leaving OEMs with higher inventory levels—85 days of supply in mid-2024 compared to 45 days in 2022.

In response, leading brands such as Polaris and BRP have scaled back production and introduced stronger dealer incentives. Segmentation trends reveal shifts in consumer preferences: entry-level models under $10,000 saw a 15% decline, while premium touring motorcycles priced above $20,000 rose by 7%, highlighting demand resilience among affluent buyers.

Geographic performance is uneven. Sun Belt states like Texas and Florida recorded a 4% sales increase, while the Midwest saw a 12% decline. Used-unit sales grew 18% year-over-year, absorbing demand from price-sensitive buyers, although dealership margins are pressured by higher financing costs.

Manufacturers are focusing on digital engagement to attract younger demographics. The average buyer age has dropped from 47 in 2018 to 41 in 2024, with Gen Z showing rising interest. Harley-Davidson’s “Learn to Ride” academies attracted 42,000 Gen Z participants, while Indian Motorcycle’s TikTok campaigns earned 18 million views. Many new models now feature GoPro mounts, app-controlled telemetry, and 5G connectivity to appeal to digital-native riders.

Expanding Diversity and Powersports Tourism

The United States powersports market growth is also influenced by cultural and demographic shifts. Hispanic consumers now account for 22% of new ATV sales, up from 15% in 2020, driving brands to launch Spanish-language sales and service initiatives. Rental platforms like Riders Share are tapping into “powersports tourism,” expanding peer-to-peer rentals in national park corridors to meet rising demand from both domestic and international travelers.

Technology continues to transform the industry. AI-powered retail tools now allow dealerships to configure custom builds within 14 days, while augmented reality service solutions are cutting repair times by up to 40%. Financing penetration has rebounded to 72% of new purchases, although access to subprime lending remains tight.

Regulatory changes are another factor shaping the outlook. Proposed NHTSA stability control mandates for UTVs may raise compliance costs, but manufacturers are adapting with design and safety innovations.

Outlook: Balancing Innovation and Affordability

The latest United States powersports market report highlights that the industry’s trajectory will depend on balancing high-tech innovation with affordability. With electrification accelerating, younger and more diverse buyers entering the market, and tourism fueling fresh opportunities, the United States powersports market growth outlook through 2025 and beyond remains strong, though closely tied to economic conditions and regulatory developments.

United States Powersports Market Segmentation:

The market report segments the market based on product type, distribution channel, and region:

Breakup by Vehicle Type:

-

All-Terrain Vehicles (ATV)

-

Side-By-Side Vehicles

-

Snowmobiles

-

Personal Watercraft

-

Heavyweight Motorcycle

Breakup by Propulsion Type:

-

Gasoline

-

Electric

-

Diesel

Breakup by Application:

-

On-Road

-

Off-Road

Breakup by Region:

-

Northeast

-

Midwest

-

South

-

West

Ask Analyst & Browse full report with TOC & List of Figures: https://www.imarcgroup.com/request?type=report&id=20210&flag=C

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

Key Highlights of the Report

1. Market Performance (2019-2024)

2. Market Outlook (2025-2033)

3. COVID-19 Impact on the Market

4. Porter’s Five Forces Analysis

5. Strategic Recommendations

6. Historical, Current and Future Market Trends

7. Market Drivers and Success Factors

8. SWOT Analysis

9. Structure of the Market

10. Value Chain Analysis

11. Comprehensive Mapping of the Competitive Landscape

About Us:

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC’s information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company’s expertise.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91-120-433-0800

United States: +1 201971-6302

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness