Automotive Coatings—Water-Based Momentum, E-Coat Upswing, APAC in Front

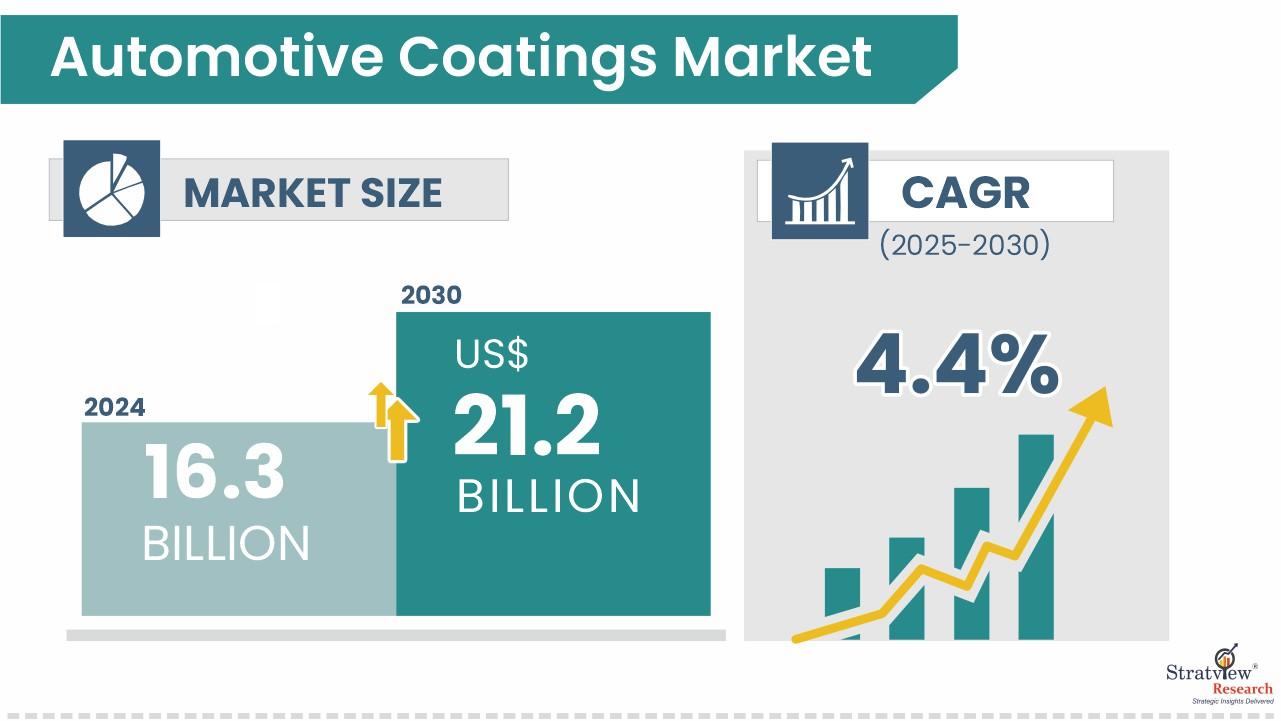

Automotive coatings safeguard metal and plastic substrates while delivering showroom gloss and long service life. Stratview Research estimates the automotive coatings market at USD 16.3 billion in 2024 and projects it to reach USD 23.09 billion by 2032, a 4.4% CAGR (2025–2032)—with 2025 expected at USD 17.08 billion. The report also notes a sizable cumulative sales opportunity through 2032.

Download the sample report here:

https://stratviewresearch.com/Request-Sample/4052/automotive-coatings-market.html#form

Drivers

The most basic engine is volume: as global vehicle output rises toward the decade’s end, coatings demand lifts across body, plastics, wheels, and underbody parts. Stratview explicitly links market expansion to increased passenger- and commercial-vehicle manufacturing and the protective/aesthetic roles coatings perform throughout the car.

Sustainability is the second accelerant. Tighter VOC policies are pushing OEMs and suppliers to reformulate; Stratview calls out regulatory pressure as a key market reality and highlights the shift toward low-VOC systems—spurring R&D and line conversions that expand water-borne adoption.

Third, electrification adds new use-cases. The report flags opportunities tied to EVs and autonomous platforms—ranging from battery/fire-resistant and anti-corrosion solutions to coatings for sensitive electronics—broadening value beyond exterior paint into functional layers that protect and thermally manage components.

Trends

Water-based technologies take the lead. Stratview identifies water-based as the dominant technology over the forecast and also the highest-CAGR segment—reflecting faster regulatory alignment and process maturity versus solvent-based, with powder gaining in select lines.

Layer mix shifts: E-coat grows fastest. Among coating types (e-coat, primer, basecoat, clearcoat), e-coat is projected to post the highest growth rate, powered by corrosion-protection needs, complex body-in-white designs, and EV architectures that heighten underbody durability requirements.

Resins: Acrylic today, PU rising. By resin family, acrylic dominates the market, while polyurethane is forecast to grow the fastest thanks to durability/appearance balance and compatibility with evolving water-borne and high-solids systems.

Vehicle class: passenger cars lead. Passenger cars remain the largest demand pocket, mirroring their share of global production and refinishing needs.

Region: Asia-Pacific sets the pace. Stratview cites APAC as both dominant and fastest-growing, underpinned by dense auto manufacturing, rising consumer spend, and expanding EV programs across China, Japan, Korea, and India.

Conclusion

With the market tracking to USD 23.09B by 2032, automotive coatings are transitioning from “paint” to engineered systems that deliver environmental compliance, durability, and EV-ready functionality. Expect water-based technologies to anchor growth; e-coat to outpace as bodies and battery enclosures demand tougher corrosion defense; acrylic to retain share while PU accelerates; and APAC to remain the industry’s gravitational center. Suppliers that pair chemistry innovation with line-ready implementation—and can qualify globally—will capture outsize value through 2032.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness