Energy Storage Systems—Utility-Scale Momentum and Asia-Pacific Leadership

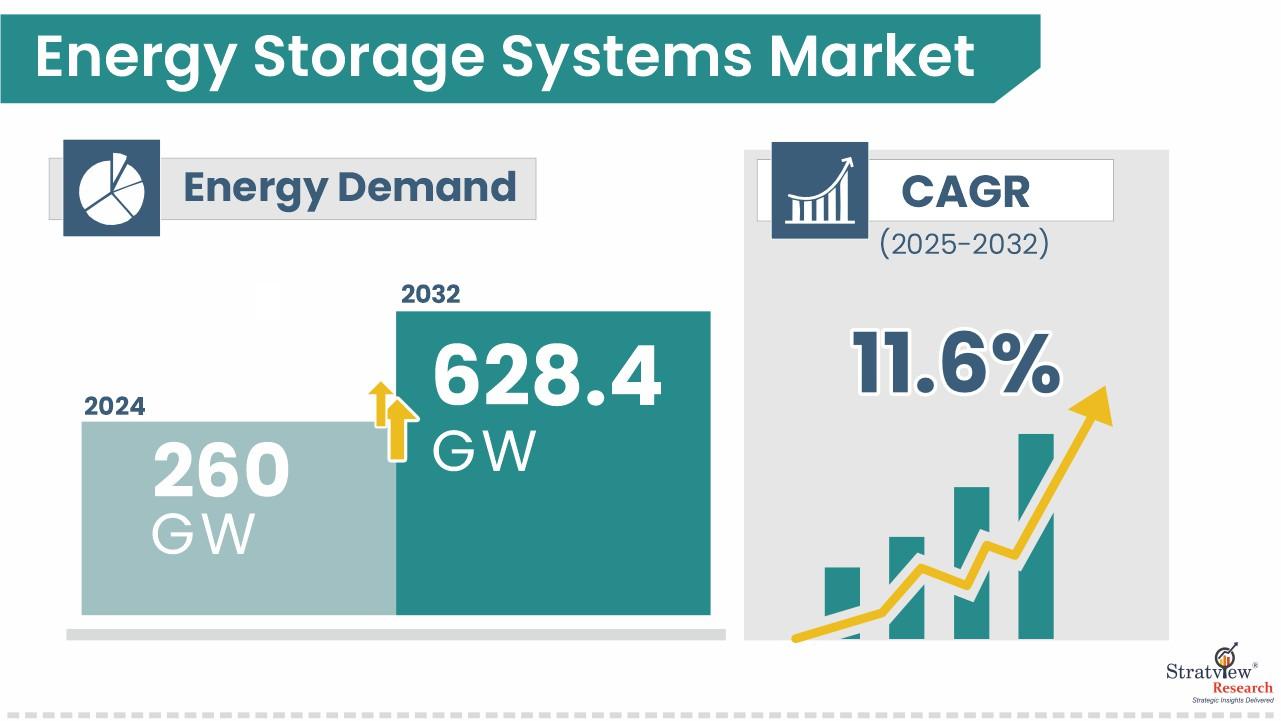

Energy storage systems (ESS) convert electricity into storable forms—electrochemical, mechanical, or thermal—and return it to the grid or load when needed. They stabilize frequency, shift energy from low-price to high-price periods, and firm variable renewables. Stratview Research estimates global energy storage systems market demand at 260 GW in 2024 and projects 628.4 GW by 2032, an 11.6% CAGR over 2025–2032.

Request the sample report here:

https://stratviewresearch.com/Request-Sample/1751/energy-storage-systems-market.html#form

Drivers

Decarbonization policies and renewable build-outs are the primary engine. As wind and solar scale, systems that can shift surplus generation and provide firm capacity become indispensable. Stratview highlights that governments’ investments in sustainable energy and the need for continuous electricity supply are key demand catalysts supporting ESS adoption.

Technology readiness is the second driver. Among storage options, lithium-ion batteries lead electrochemical solutions due to high energy density, strong round-trip efficiency, and declining costs—attributes that underpin rapid deployment for both utility-scale and distributed projects.

A third structural tailwind is the breadth of ESS services. Stratview’s segmentation shows “electric energy time-shift” (buy low, dispatch high) as the largest application, reflecting a global pivot to market-based arbitrage and peak-shaving to lower system costs. Other important use cases include electric supply capacity, black start, renewable capacity firming, and frequency regulation, together creating multi-revenue “stacking” opportunities.

The technology mix remains diverse. Stratview identifies four families: pumped hydro; electrochemical (lithium-ion, sodium-sulfur, lead-acid, flow, others); electro-mechanical (flywheel, compressed air); and thermal (water, molten salts, phase-change materials). Of these, pumped hydro is projected to remain the largest segment during the forecast period, buoyed by long lifetimes, grid-scale efficiency, and low storage cost per kWh for multi-hour to long-duration needs.

Regionally, Asia-Pacific leads and is expected to stay the largest (and fastest-growing) market, supported by rapid industrialization, urbanization, and heavy investment in renewable capacity across China, Japan, India, South Korea, and ASEAN economies. North America and Europe also offer substantial growth as policy frameworks mature and interconnection queues prioritize storage.

Challenges

First, economics and bankability: while costs have fallen, long-duration projects and hybrid assets still hinge on clear market signals and long-term offtake or capacity payments. Second, siting and permitting—particularly for large pumped hydro reservoirs or utility-scale battery parks—can extend timelines. Third, supply-chain resilience and safety: ensuring high-quality cells, robust thermal management, and compliance with evolving standards is essential for project uptime and insurability. Fourth, market design complexities: stacking revenues across capacity, ancillary services, and arbitrage requires sophisticated dispatch optimization and transparent rules to minimize merchant risk.

Conclusion

ESS are moving from niche to necessary infrastructure. Stratview’s outlook—260 GW in 2024 scaling to 628.4 GW by 2032 (11.6% CAGR)—signals durable demand tied to renewables integration and grid flexibility. Expect pumped hydro to remain the backbone of long-duration capacity, while lithium-ion dominates fast-response and 2–8-hour applications. Asia-Pacific will set the deployment pace, with North America and Europe accelerating under supportive policy regimes. Success for developers and suppliers will hinge on safety and reliability, revenue-stacking competence, and the ability to tailor technology—electrochemical, mechanical, or thermal—to specific grid services and local market rules.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Spiele

- Gardening

- Health

- Startseite

- Literature

- Music

- Networking

- Andere

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness