10 Ways Outsourced Accounts Payable Can Transform Your Finance Department

In today's fast-paced business environment, finance departments are under growing pressure to do more with less. Managing the accounts payable (AP) function in-house can be time-consuming, error-prone, and costly. That’s why more companies are turning to outsourced accounts payable services as a strategic solution.

Outsourcing AP is not just about reducing workload—it can fundamentally transform how your finance department operates, turning it from a reactive function into a proactive, strategic partner to the business.

Here are 10 ways outsourced accounts payable can revolutionize your finance department:

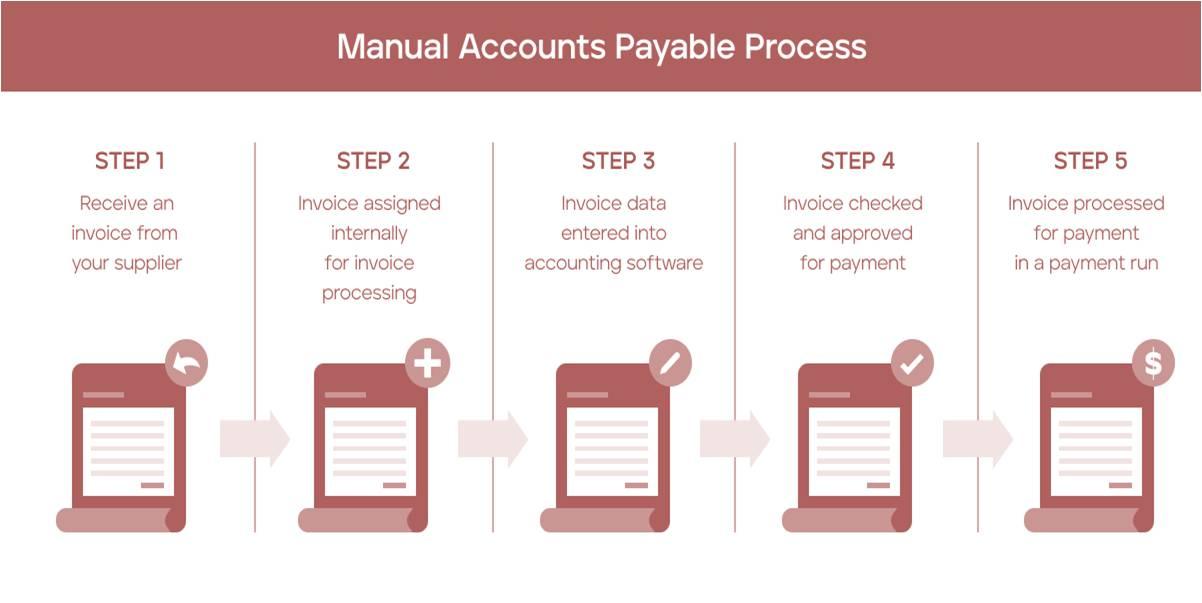

1. Streamlined Invoice Processing

One of the biggest benefits of outsourced accounts payable is the automation and streamlining of invoice processing. Manual data entry, paper invoices, and disorganized workflows are replaced with digital capture, AI-driven validation, and seamless approval chains.

This leads to:

-

Faster invoice turnaround times

-

Fewer errors

-

Greater consistency and visibility

With less time spent on low-value tasks, your finance team can focus on strategic activities.

2. Improved Accuracy and Fewer Errors

Human error is a major issue in traditional AP processes. Mistyped numbers, duplicate entries, or missed approvals can lead to costly mistakes.

Outsourced accounts payable providers use automation, AI, and validation checks to drastically reduce these issues. This ensures accurate data capture, consistent processing, and reduced risk of duplicate or fraudulent payments.

3. Better Cash Flow Management

When invoices are processed faster and more predictably, your finance department gains real-time visibility into payables. This allows for:

-

More accurate cash flow forecasting

-

Strategic scheduling of payments

-

Improved working capital management

Outsourced AP gives finance leaders the data they need to make smarter, faster financial decisions.

4. Cost Reduction

Maintaining an in-house AP team comes with overhead—staff salaries, software licenses, equipment, and training.

Outsourcing shifts many of these costs to a provider with scalable infrastructure. Plus, improved efficiency reduces invoice processing costs, often by up to 40-60%. Over time, outsourced accounts payable becomes a more cost-effective solution.

5. Enhanced Compliance and Audit Readiness

AP involves a lot of compliance requirements—from tax regulations and internal policies to external audits.

Outsourced AP providers are equipped with:

-

Automated audit trails

-

Documented workflows

-

Built-in policy enforcement

-

Secure data handling

This means your finance team is always prepared for audits, and compliance risks are greatly reduced.

6. Scalability as Your Business Grows

As your business expands, so does your invoice volume. Scaling an internal AP department to match growth can be expensive and inefficient.

With outsourced accounts payable, providers can easily scale services up or down based on your needs. Whether you process 1,000 or 100,000 invoices per month, the system adjusts without sacrificing quality or speed.

7. Stronger Vendor Relationships

Timely and accurate payments are critical to maintaining strong vendor partnerships. Outsourced AP ensures vendors:

-

Receive payments on time

-

Get clear communication about payment status

-

Have access to dedicated support when needed

This strengthens vendor trust and may even open the door to better terms, discounts, or faster deliveries.

8. Access to Advanced Technology

Many small to mid-sized businesses don’t have the budget to invest in top-tier AP automation tools on their own. When you partner with an outsourced accounts payable provider, you gain access to industry-leading technology without the capital investment.

These tools offer:

-

AI-based invoice capture

-

Dynamic approval workflows

-

Real-time dashboards

-

Fraud detection and exception alerts

This keeps your finance function competitive and modern.

9. Reduced Fraud Risk

AP fraud is a growing concern. From fake vendors to phishing scams and internal misuse, the risk is real—and expensive.

Outsourced AP providers implement multiple layers of fraud prevention, including:

-

Vendor verification protocols

-

Dual approvals and segregation of duties

-

Automated checks for duplicate or suspicious transactions

-

Audit logs and traceability

These safeguards help protect your business and maintain financial integrity.

10. Empowers Your Finance Team for Strategic Work

Perhaps the most transformative benefit of outsourced accounts payable is the freedom it gives your internal finance team. By offloading manual, repetitive tasks, your team can redirect their focus to:

-

Financial planning and analysis

-

Budget forecasting

-

Strategic vendor negotiations

-

Cost optimization initiatives

Rather than being buried in paperwork, your finance professionals become strategic contributors to business growth.

Final Thoughts

Adopting outsourced accounts payable is not just a matter of convenience—it’s a strategic move that can redefine the role of your finance department. From improving accuracy and cutting costs to enhancing compliance and enabling strategic decision-making, the benefits are substantial.

In a time when businesses are seeking leaner, more agile operations, outsourcing AP is a smart, forward-thinking choice. Whether you're a startup, growing mid-sized firm, or large enterprise, now is the time to explore how outsourced AP can drive transformation in your financial operations.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- الألعاب

- Gardening

- Health

- الرئيسية

- Literature

- Music

- Networking

- أخرى

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness