What Key Trends Are Influencing the Craft Segment in the Europe Beer Market?

Europe Beer Market Overview:

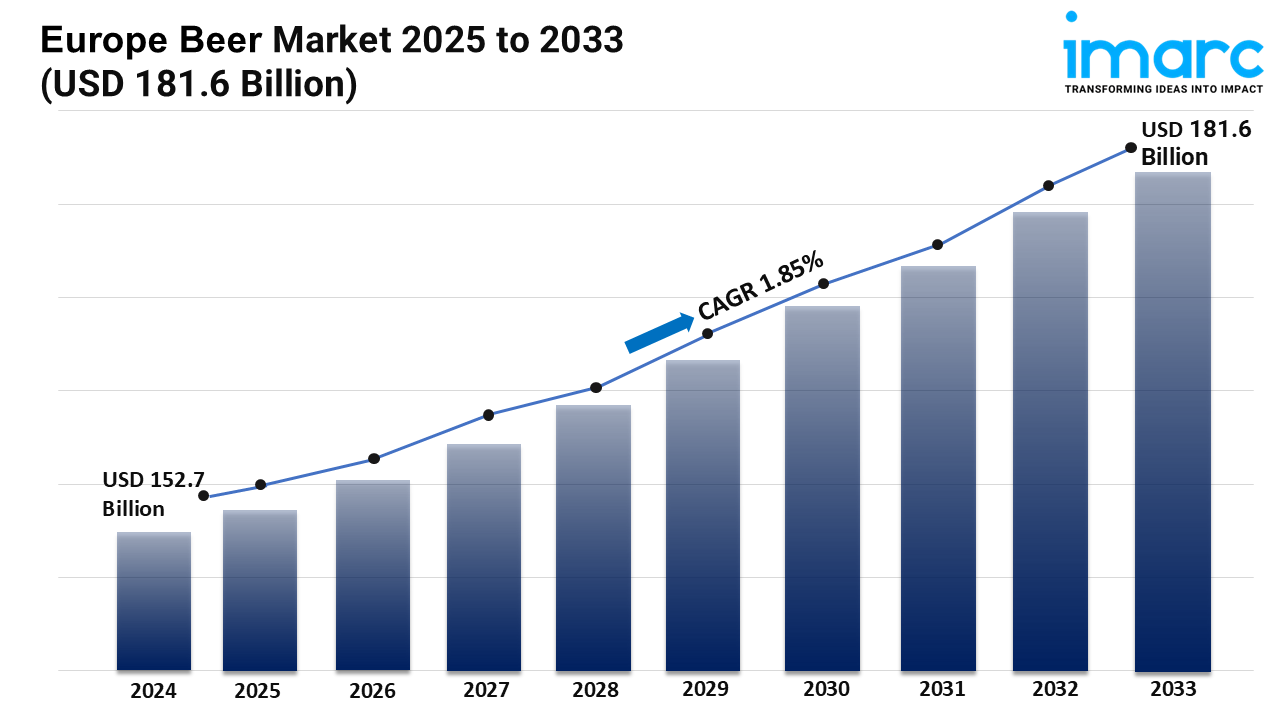

Market Size in 2024: USD 152.7 Billion

Market Forecast in 2033: USD 181.6 Billion

Market Growth Rate (2025-2033): 1.85%

The Europe beer market size was valued at USD 152.7 billion in 2024, and it is expected to reach USD 181.6 billion by 2033, exhibiting a CAGR of 1.85% from 2025-2033.

European Beer Industry Trends & Growth Drivers:

Zero-Alcohol Segment Outpaces Traditional Lager

Eurostat’s 2024 alcohol-consumption report notes a 12% year-on-year rise in <0.5% ABV beer sales across the EU, while overall beer volumes stayed flat. Heineken N.V. reported that its 0.0 brand grew 14% in Europe in 2023, now accounting for 7% of total Heineken volume.

Energy Crisis Spurs Brewers into Renewable Heat

Germany’s Federal Environment Agency (UBA) estimates breweries cut natural-gas use by 18% in 2023 versus 2021 through heat-pump retrofits. Carlsberg Group’s Kronenbourg plant in Obernai (France) switched to 100% biogas in February 2024, trimming CO₂ emissions by 8,000 t/year.

Craft Consolidation Accelerates Amid Input-Cost Inflation

UK Office for National Statistics (ONS) data show 62 independent brewery insolvencies in 2023, the highest since 2011. In response, Danish craft brewer Mikkeller acquired London’s Orbit Brewery in April 2024 to secure UK production capacity and hedge against currency swings.

Download a sample copy of the report: https://www.imarcgroup.com/europe-beer-market/requestsample

Europe Beer Market Segmentation:

Analysis by Product Type:

- Standard Lager

- Premium Lager

- Specialty Beer

- Others

Analysis by Packaging:

- Glass

- PET Bottle

- Metal Can

- Others

Analysis by Production:

- Macro-Brewery

- Micro-Brewery

- Others

Analysis by Alcohol Content:

- High

- Low

- Alcohol-Free

Analysis by Flavor:

- Flavored

- Unflavored

Analysis by Distribution Channel:

- Supermarkets and Hypermarkets

- On-Trades

- Specialty Stores

- Convenience Stores

- Others

Country Analysis:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

European Beer Companies:

- Asahi Group Holdings Ltd

- Carlsberg Group

- Oettinger Brewery

- Heineken NV

- Kirin Holdings Co. Ltd

- Bitburger Brewery

- Molson Coors Beverage Company

- Constellation Brands

- Anheuser Busch InBev

- Krombacher

- Pernod Ricard

Europe Beer Market News:

- 13 June 2024 – EU Parliament votes to extend lower excise rates for small brewers until 2030.

- 06 June 2024 – AB InBev launches €100 million barley-to-beer sustainability fund in France.

- 31 May 2024 – Heineken signs 10-year renewable-power PPA for all Spanish breweries.

Key highlights of the Report:

- Market Performance (2019-2024)

- Market Outlook (2025-2033)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness