Section 321 Entry, Section 321 Customs Explained: Key Guidelines and Compliance Tips

Section 321 entry is a U.S. Customs provision allowing shipments valued at $800 or less to enter the country duty-free and with reduced paperwork. This rule simplifies the import process by eliminating the need for formal customs entry and payment of duties and taxes on low-value shipments. It benefits businesses and individuals by speeding up clearance and lowering costs.The provision is designed to streamline trade for small shipments, often including e-commerce packages, making customs less of a hurdle. While Section 321 offers clear advantages, importers must understand when and how to use it properly to maximize its benefits under customs regulations.

Understanding Section 321 Entry

Section 321 entry allows shipments valued at $800 or less to enter the U.S. without formal customs duties or taxes. It streamlines the import process, reducing paperwork and speeding clearance. The following details clarify how this provision works and who qualifies.

Definition of Section 321

Section 321 is a U.S. customs regulation under the Tariff Act of 1930. It permits duty-free and tax-free entry of goods valued at $800 or less. The provision is designed to facilitate low-value imports, especially from eCommerce, by exempting them from formal customs entry procedures.This entry type falls under the “de minimis threshold,” meaning shipments under this value avoid complex customs requirements. Section 321 applies to both commercial goods and personal shipments. It benefits importers by lowering costs and processing time.

Eligibility Criteria for Section 321

To qualify, shipments must not exceed $800 in value, including shipping and insurance. This limit applies per shipment, not cumulatively per day or consignee.Eligible goods cannot be restricted or require special permits, such as firearms, alcohol, or products subject to partner government agency controls.Both importers and customs brokers may file for Section 321 clearance. However, some testing phases require filings only by the importer of record or authorized customs brokers. The goods must enter the U.S. through a participating port of entry.

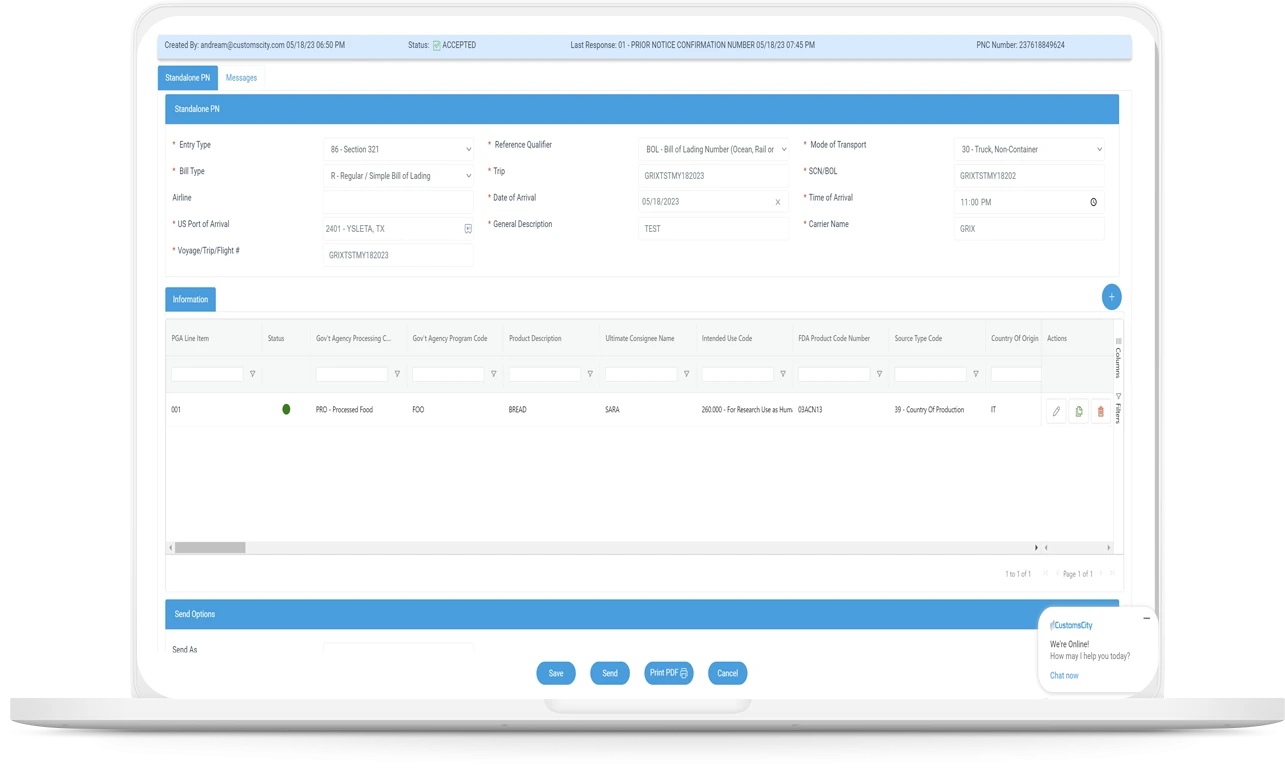

Entry Process and Documentation

Section 321 shipments are declared via an informal entry, often using manifest data or entry type 86 for formal processing with partner agency data. Entry type 86 is an electronic submission system designed to expedite clearance for qualifying low-value shipments.Documentation requirements are minimal, typically involving a commercial invoice and necessary shipment data. Customs brokers or importers submit these electronically through the Automated Broker Interface (ABI).The process eliminates the need for formal entry documents like customs bonds or detailed cargo lists, reducing administrative burden.

Benefits of Section 321 Entry

The primary benefit is duty- and tax-free entry for qualifying shipments, which lowers import costs significantly. It also speeds customs clearance, reducing wait times at ports of entry.This provision supports small businesses and eCommerce platforms by facilitating faster and simpler deliveries. It reduces paperwork and eliminates the need for formal customs entries, lowering compliance costs.Overall, Section 321 enhances trade efficiency for low-value goods while ensuring regulatory compliance within set thresholds.

Section 321 Customs Compliance and Best Practices

Section 321 offers duty- and tax-free entry for low-value shipments, but strict compliance with customs regulations is essential. Proper shipment declaration, accurate documentation, and detailed recordkeeping help avoid delays, penalties, or denied entry.

Customs Regulations for Section 321

Section 321 allows shipments valued up to $800 to enter the U.S. duty-free without a formal customs entry. The shipment must be imported by one person on one day and meet specific eligibility criteria.Carriers or customs brokers must submit all required information before the shipment arrives. The U.S. Customs and Border Protection (CBP) requires complete and accurate details to ensure safety, security, and compliance with import rules.Multiple claims for Section 321 on the same shipments are prohibited. Also, shipments requiring Partner Government Agency (PGA) oversight typically cannot use Section 321 unless under special provisions.

Common Mistakes and How to Avoid Them

One frequent mistake is failing to provide complete documentation or accurate shipment details to carriers or brokers. This can cause shipments to be held or rejected at the border.Shippers sometimes exceed the $800 value limit or consolidate multiple shipments improperly to claim Section 321 benefits. This practice risks penalties and shipment denial.Another common error is duplicating Section 321 claims for a single shipment. Ensuring clear communication with carriers and verifying shipment data can prevent such issues.

Recordkeeping and Audit Requirements

Businesses must keep thorough records for all Section 321 shipments for at least five years. These include invoices, shipping documents, and communications with carriers or customs brokers.CBP may request documentation during audits to verify compliance with Section 321 rules and value limits. Proper recordkeeping supports transparent and efficient audit responses.Failure to maintain accurate records can lead to fines, increased inspections, or loss of Section 321 privileges. Consistent documentation aids smooth customs processing and mitigates risks during review.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jogos

- Gardening

- Health

- Início

- Literature

- Music

- Networking

- Outro

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness