Blower Market Price, Trends, Growth, Analysis, Key Players, Outlook, Report, Forecast 2025-2032

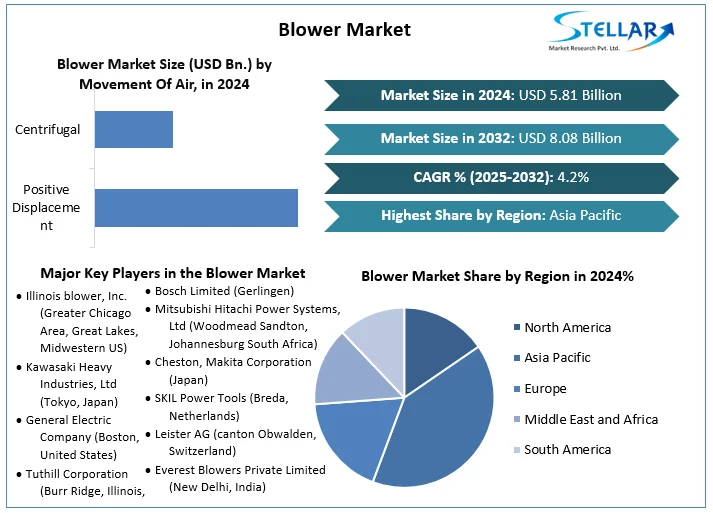

Blower Market is projected to climb from approximately USD 5.81 billion in 2024 to around USD 8.08 billion by 2032, reflecting a compound annual growth rate (CAGR) of about 4.2% during 2025–2032

Request Free Sample report:https://www.stellarmr.com/report/req_sample/Blower-Market/852

Market Estimation, Growth Drivers & Opportunities

In 2024, the blower market stood at roughly USD 5.81 billion, with consistent growth expected through 2032 at a CAGR of 4.2% Key drivers include:

-

Industrial growth and infrastructure expansion, especially in sectors like wastewater treatment, chemicals, and food & beverage processing that require efficient air-moving systems.

-

Energy‑efficiency mandates and environmental regulations promoting adoption of variable-speed and oil-free blower technologies

-

Technological advancements such as integrated real‑time performance controls, magnetic bearings, composite impellers, and IoT-enabled blower monitoring

-

High-speed turbo and centrifugal blowers gaining traction due to their lower maintenance needs and superior energy efficiency, particularly in water treatment and material handling

Opportunities lie in expansion into municipal utilities, hydrogen electrolysis plants, and eco-sensitive industrial sectors where certified low-emission, high-efficiency blowers have growing demand

U.S. Market: Latest Trends & Investment (2024–2025)

The United States dominates North American demand, with revenues near USD 750 million in 2023 and projected to surpass USD 1.42 billion by 2032 U.S. demand is buoyed by:

-

Federal and state environmental regulations mandating energy-efficient, low-emission equipment in industrial applications.

-

Infrastructure projects like wastewater treatment upgrades and new hydrogen manufacturing hubs funded by recent legislation, creating rising demand for oil-free, variable-speed blowers

-

Accelerated investment in smart blower solutions configured for predictive maintenance and lower operational costs, often paired with AMI and smart grid adoption

Leading companies like Atlas Copco (energy-efficient rotary screw blowers launched March 2024) and Ingersoll Rand (a significant acquisition in October 2024 to boost its industrial blower portfolio) are driving growth in the U.S. and globally

Market Segmentation: Leading Segment Only

Among blower types, centrifugal blowers dominate the overall market—capturing approximately 56% of industrial installations in 2024 due to their versatility in HVAC, manufacturing, and process ventilation (U.S. Dept. of Energy).

Product segmentation highlights high‑speed turbo blowers as the fastest-growing segment, driven primarily by efficiency gains and growing use in wastewater treatment and pneumatic conveying systems

End‑user analysis reveals industrial applications—especially water & wastewater treatment, chemicals, and food processing—as the largest consuming sectors of blowers globally

Competitive Analysis: Top 5 Global Players

Based on global presence and strategic initiatives, the leading companies include:

-

Atlas Copco AB (Sweden)

Global leader, introduced energy-efficient rotary screw blowers in March 2024 with integrated controls, targeting sustainability-oriented industrial users -

Ingersoll Rand (U.S.)

Expanded volume and technology footprint through an October 2024 acquisition of a high-performance industrial blower manufacturer; continues product innovation and aftermarket services -

Aerzener Maschinenfabrik GmbH (Germany)

A top supplier of positive-displacement and centrifugal blowers; known for high-efficiency models and advanced engineering. -

Everest Blowers Private Limited (India)

A strong regional manufacturer investing in tailored blower solutions for chemicals and utility industries across Asia, and expanding to export markets -

Tuthill Corporation / Gardner Denver (U.S.)

Tuthill’s blower technologies and Gardner Denver’s global service reach combine to offer low-pressure blowers and packaged systems; Gardner Denver’s late-2024 partnership expanded municipal water-treatment product offerings .

These companies are enhancing offerings via product innovations (e.g. magnetic bearings, digital controls), M&A strategies, and expansion into aftermarket service and renewable-energy blower applications.

Regional Analysis: USA, UK, Germany, France, Japan, China

-

USA: Leads North America with strong penetration in industrial, municipal, and pharmaceutical sectors. Regulatory focus on energy efficiency and smart infrastructure is fueling demand

-

UK: Blower adoption driven by utilities and industrial upgrades; green chemistry policies and municipal water infrastructure projects raise demand levels.

-

Germany: Europe’s largest blower market (~36.5% of Europe in 2023), supported by its robust industrial and automotive infrastructure and emphasis on low-emission air systems

-

France: Investment in clean industrial technologies and water treatment upgrades supports continued use of efficient blower systems.

-

Japan: Demand from chemical, semiconductor, and power-generation industries underpins steady blower usage; manufacturers like Mitsubishi Hitachi are innovating in reliability and precision applications

-

China: Dominates Asia Pacific with ~40.4% share in 2023; rapid industrialization, urbanization, and infrastructural investment contribute to strong blower demand, especially in chemicals, water treatment, and manufacturing

Conclusion & Strategic Outlook

The global blower market is projected to grow from USD 5.81 billion in 2024 to about USD 8.08 billion by 2032 at 4.2% CAGR \ Key drivers include expansion of industrial infrastructure, increasing regulatory emphasis on energy efficiency, and technological modernizations such as smart controls and oil-free technologies.

About us

Phase 3,Navale IT Zone, S.No. 51/2A/2,

Office No. 202, 2nd floor,

Near, Navale Brg,Narhe,

Pune, Maharashtra 411041

+91 9607365656

sales@stellarmr.com

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness