Automotive Semiconductor Market Price, Trends, Growth, Analysis, Key Players, Outlook, Report, Forecast 2025-2032

Automotive Semiconductor Market Set to Reach USD 96.83 Billion by 2030 Amid Surge in EVs, ADAS Adoption, and Vehicle Electrification

Market Estimation, Growth Drivers & Opportunities

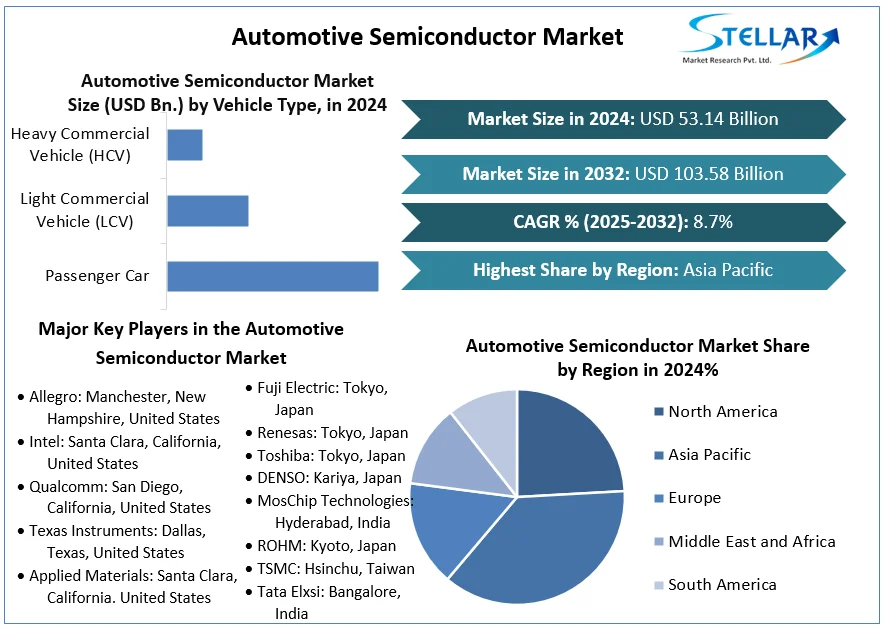

According to Stellar Market Research, the Automotive Semiconductor Market was valued at USD 49.29 billion in 2023 and is projected to grow at a CAGR of 10.2%, reaching USD 96.83 billion by 2030. This strong growth trajectory is attributed to several key drivers, most notably the accelerated adoption of electric vehicles (EVs), advanced driver assistance systems (ADAS), and vehicle connectivity technologies.

Request Free Sample Report:https://www.stellarmr.com/report/req_sample/Automotive-Semiconductor-Market/2283

Key Growth Drivers:

-

Electrification of Powertrains: EVs require significantly more semiconductor content than traditional ICE vehicles, especially for battery management systems, power inverters, and charging interfaces.

-

ADAS and Autonomous Driving: Demand for sensors, microcontrollers, and AI processors for functions like adaptive cruise control, lane-keeping assist, and automated emergency braking is rising sharply.

-

Vehicle Connectivity & Telematics: The integration of 5G, V2X (Vehicle-to-Everything), and over-the-air (OTA) updates is boosting the need for high-performance, secure automotive semiconductors.

-

Increased Safety Regulations: Governments worldwide are mandating advanced safety features, which drive semiconductor content in both premium and mid-range vehicle segments.

Opportunities:

-

Integration of AI chips for autonomous driving.

-

Expansion of 800V architectures for fast-charging EV platforms.

-

Rising demand for cyber-secure automotive microcontrollers.

-

Growth of semiconductor foundries focused on automotive-grade production.

U.S. Market Trends and Investment in 2024

In 2024, the U.S. automotive semiconductor market witnessed a surge in domestic chip manufacturing projects spurred by the CHIPS and Science Act. Ford and General Motors deepened partnerships with GlobalFoundries and ON Semiconductor to secure local supply chains amid global shortages. Tesla continues to lead with in-house chip designs tailored for its Autopilot and FSD (Full Self Driving) platforms.

Furthermore, increased regulatory focus on EV acceleration and vehicle safety mandates has made the U.S. a fertile ground for semiconductor innovation. Major players are investing in AI-focused chips, automotive-grade silicon carbide (SiC), and EV power modules to support high-efficiency electric drivetrains.

Market Segmentation: Largest Market Share Holder

According to the segmentation outlined in the Stellar Market Research report, the Power Semiconductor segment holds the largest share of the global automotive semiconductor market. This dominance is driven by the growing demand for energy-efficient power management systems in EVs and hybrid vehicles.

Silicon carbide (SiC) and gallium nitride (GaN)-based power components are increasingly used in traction inverters, DC-DC converters, and on-board chargers, offering superior thermal performance and higher efficiency over traditional silicon.

Competitive Analysis: Top 5 Companies

-

NXP Semiconductors

A global leader in automotive MCUs and ADAS solutions, NXP has made recent advancements in vehicle network processors and secure gateway modules. In 2024, it launched new chipsets for zonal architectures and collaborated with leading OEMs for centralized computing platforms. -

Infineon Technologies AG

Infineon remains dominant in the power semiconductor space, particularly for EV inverters and SiC modules. In 2024, the company expanded its SiC fab in Austria and rolled out a new line of 650V CoolSiC™ modules tailored for next-gen EVs. -

Texas Instruments (TI)

TI continues to supply analog and embedded processors for ADAS and infotainment. It recently introduced zero-drift op-amps and automotive-qualified voltage regulators that enhance battery and powertrain efficiency in electric vehicles. -

Renesas Electronics Corporation

Renesas leads in automotive microcontrollers and SOCs. Its 2024 strategy includes AI integration for advanced cockpit and ADAS systems. Recent investments include the development of low-power AI accelerators for semi-autonomous vehicles. -

STMicroelectronics

ST’s strength lies in its wide portfolio of SiC devices and sensors. In 2024, it unveiled new ADAS chips and collaborated with Hyundai on power modules for its EV lineup. ST also expanded its power device fab capacity in Italy and France to meet rising demand.

Regional Analysis

-

USA: The U.S. market is rapidly evolving due to strong federal backing through the CHIPS Act, fostering domestic chip manufacturing. Companies like ON Semiconductor, Wolfspeed, and Intel are investing in specialized fabs for automotive-grade chips. With EV mandates and safety regulations, the U.S. holds a significant share of the global market.

-

UK: The UK is focusing on automotive software innovation and electrification. While domestic chip production is limited, partnerships with European and Asian foundries help sustain its supply. The UK’s goal to phase out new petrol and diesel cars by 2035 is stimulating demand.

-

Germany: As Europe’s automotive hub, Germany has aggressively supported EVs and autonomous tech. Companies like Bosch and Continental are expanding R&D in chip technologies. Government subsidies and EU-wide chip initiatives ensure Germany maintains its position as a market leader.

-

France: France is advancing efforts to promote local EV production and support semiconductor ecosystems through initiatives like IPCEI. STMicroelectronics, a France-headquartered company, is ramping up production of automotive-grade SiC devices and smart sensors.

-

Japan: Japan’s automakers, including Toyota and Nissan, are investing heavily in hybrid and EV technologies, increasing the demand for semiconductors. The Japanese government is funding domestic chip R&D, and Renesas is at the forefront of automotive chip innovation.

-

China: China remains a rapidly growing market, driven by its dominance in EV production. Domestic chipmakers like BYD Semiconductor and Horizon Robotics are scaling up. Despite geopolitical challenges, China continues to invest in semiconductor self-sufficiency to meet the growing needs of its EV sector.

Conclusion

The Automotive Semiconductor Market is experiencing transformative growth driven by electrification, autonomy, and connectivity. As vehicles evolve into smart, energy-efficient, and software-defined machines, the semiconductor content per vehicle is expected to soar. Power semiconductors, ADAS processors, and AI-centric chips will form the backbone of next-gen mobility.

About us

Phase 3,Navale IT Zone, S.No. 51/2A/2,

Office No. 202, 2nd floor,

Near, Navale Brg,Narhe,

Pune, Maharashtra 411041

+91 9607365656

sales@stellarmr.com

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness