Power Electronics Market Price, Trends, Growth, Analysis, Key Players, Outlook, Report, Forecast 2025-2032

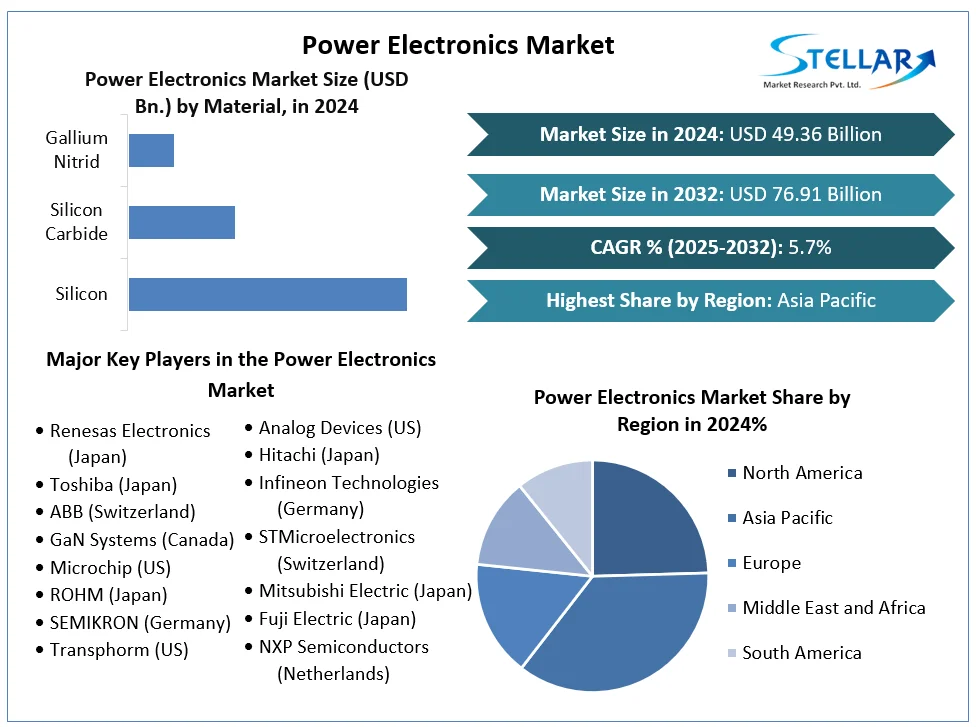

Power Electronics Market is forecast to expand from USD 49.36 billion in 2024 to USD 76.91 billion by 2032, exhibiting a 5.7% CAGR during 2025–2032 ([turn0search0]). Other projections estimate a market size of USD 60.10 billion by 2032 at 5.78% CAGR and USD 52.38 billion by 2033 at ~5% CAGR ([turn0search1][turn0search6][turn0search2]). The wide range reflects evolving demand across electric vehicles, renewable energy, and industrial automation.

Request Free sample Report:https://www.stellarmr.com/report/req_sample/Power-Electronics-Market/430

Market Estimation, Growth Drivers & Opportunities

Power electronics encompasses power discrete devices, modules, and power ICs utilizing silicon, SiC, GaN, and other materials for efficient conversion, conditioning, and control of electrical energy ([turn0search0][turn0search6][turn0search2]).

Key growth drivers include:

-

Rapid EV adoption, which relies heavily on SiC and GaN-based inverters, onboard chargers, and power modules.

-

Expansion of renewable energy systems (solar, wind) and ESS deployments that require high-efficiency power converters.

-

Data-center electrification, smart grid modernization, and utility infrastructure upgrades generating global demand for advanced power electronics ([turn0search1][turn0news18][turn0news22]).

-

Shift from legacy silicon to wide‑bandgap semiconductors, enabling higher switching efficiency, thermal resilience, and compactness ([turn0search7][turn0search9]).

Opportunities lie in scaling SiC/GaN device production, integrating intelligent power modules for EV traction systems, embedding power ICs in data‑center UPS systems, and deploying modules within industrial automation and grid edge installations.

U.S. Market: Latest Trends & Investment

The U.S. power electronics market reached approximately USD 8.13 billion in 2024 and is forecast to grow to USD 14.64 billion by 2033, implying a 6.75% CAGR ([turn0search10]).

Recent trends:

-

CHIPS Act-driven investments have spurred U.S.-based SiC/GaN chip factories, with major expansions by Texas Instruments, Bosch, and others in silicon carbide infrastructure ([turn0search29]).

-

Data center and AI infrastructure firms—like American Superconductor—are ramping power systems to support surging electricity use by AI-driven operations ([turn0news16]).

-

Utilities and OEMs are procuring advanced converter modules for EV charging stations, renewable integration, and grid stabilization, aligning with broader sustainability mandates.

Market Segmentation: Segment with Largest Share

By Device Type:

-

Power discrete devices (MOSFETs, IGBTs, diodes) held the largest 2024 share (~46–48%), favored for cost-efficiency in automotive and industrial applications ([turn0search7][turn0search5]).

-

The power module segment is growing fastest (~8.6% CAGR) thanks to adoption in EV inverters and renewable energy installations.

By Material:

-

Silicon dominated 2023–24 (~89%+ share) due to legacy infrastructure and reliability.

-

However, silicon carbide is advancing at double-digit CAGR (~15–16%) and GaN is emerging for medium-voltage, high-efficiency designs ([turn0search1][turn0search7][turn0search9]).

By End‑Use Industry:

-

Consumer electronics led in 2023 holding ~28–29% of revenue.

-

The automotive segment—especially EV traction and charging systems—is the fastest-growing application (~13% CAGR) ([turn0search7][turn0search9][turn0search2]).

Competitive Analysis: Top 5 Companies

The industry is led by established semiconductor and automation leaders:

ON Semiconductor Corporation – Offers wide portfolio in automotive and industrial power management, ramping production of SiC and GaN discrete devices for EV and renewable applications ([turn0search4]).

ABB Ltd. – Integrates power electronics in grid automation and electrification systems; demand from data-center infrastructure boosts its equipment sales ([turn0search4][turn0news19]).

Infineon Technologies AG – Key innovator in wide-bandgap MOSFETs, integrated power ICs, and modules; heavily adopted across EV OEMs and renewable inverter markets ([turn0search4][turn0search1]).

Texas Instruments Inc. – Strong in analog and power ICs; investing in U.S. chipmaking capabilities and supplying high-efficiency controllers for automotive and industrial projects ([turn0search4][turn0search29]).

ROHM Co. Ltd. – Japanese provider of discrete semiconductors and modules, historically strong in automotive and consumer electronics; expanding into SiC and GaN applications ([turn0search4]).

Other influential players include STMicroelectronics, Renesas, Vishay, Toshiba, Mitsubishi Electric, Nexperia, Semikron, and Monolithic Power Systems (MPS)—the latter recently boosted investor interest thanks to ~39% sales growth and a top-tier stock rating ([turn0search2][turn0search25][turn0search26][turn0news24]).

Regional Analysis: USA, UK, Germany, France, Japan, China

-

United States: Held ~North America’s biggest market share (~6–7 USD bn in 2024), led growth via EV expansion, CHIPS Act-funded manufacturing, and ramping SiC/GaN capabilities ([turn0search10][turn0search29][turn0news16]).

-

Europe (UK, Germany, France): Regulatory push for grid decarbonization and industrial automation fuels demand. Companies like ABB, Infineon, STMicroelectronics, and Semikron (now Semikron Danfoss) are major regional contributors—Semikron holds ~30% share of global diode/thyristor modules ([turn0search25][turn0search4]).

-

Japan: Home to Mitsubishi Electric, ROHM, Toshia; strong domestic demand for power modules in EVs, industrial drives, and electronics manufacturing.

-

China (APAC): Largest regional share (~48–55% in 2024). China dominates in volume production and material scaling; regional policy supports localization of ESS, EV electronics, and renewable infrastructure ([turn0search2][turn0search5][turn0search7]).

Asia-Pacific leads in revenue share (~48.7% in 2024) and is among fastest growing, while Europe is forecast to exhibit high growth in the 2025–2032 period ([turn0search2][turn0search6][turn0search7]).

Conclusion

The Power Electronics Market is on steady upward trajectory—from USD 49.36 billion in 2024 toward USD 76.9 billion by 2032, growing at ~5.7% CAGR ([turn0search0][turn0search1][turn0search2]). Growth is buoyed by EV electrification, renewable energy expansion, data-center optimization, and industrial digitization powered by SiC and GaN innovation.

Major opportunities include:

-

Scaling production of SiC and GaN power modules to meet EV and renewable demand.

-

Deploying intelligent power ICs and PMICs in automotive traction systems, charging infrastructure, and consumer devices.

-

Integrating power electronics solutions into AI-driven data centers, UPS units, and industrial automation to manage rising energy demands (e.g. GE Vernova and ABB data center growth) ([turn0news19][turn0news15][turn0news21]).

-

Leveraging government subsidy programs like the CHIPS Act to establish domestic wide-bandgap manufacturing capacity.

-

Expanding in Asia-Pacific, Europe, and North America, guided by regional electrification and efficiency initiatives.

About us

Phase 3,Navale IT Zone, S.No. 51/2A/2,

Office No. 202, 2nd floor,

Near, Navale Brg,Narhe,

Pune, Maharashtra 411041

+91 9607365656

sales@stellarmr.com

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness