Gas Turbine Market Overview: Key Developments, Industry Scope, and Future Prospects

The gas turbine market plays a critical role in global energy infrastructure, offering efficient, flexible, and cleaner power generation solutions. As economies strive to meet growing energy needs while reducing carbon emissions, gas turbines continue to be central to power generation, industrial processes, and mechanical applications.

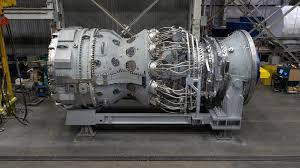

Understanding Gas Turbines and Their Applications

Gas turbines are combustion engines that convert natural gas or liquid fuels into mechanical energy, which is then used to drive generators for electricity or provide mechanical drive for industrial processes. These machines are widely used in:

-

Electric power generation (utility and distributed)

-

Oil & gas and petrochemical industries

-

Aerospace propulsion (jet engines)

-

Marine propulsion

Modern gas turbines are valued for their high efficiency, rapid start-up time, low emissions, and operational flexibility, making them an integral part of both centralized and decentralized energy systems.

Market Size and Growth Dynamics

The global gas turbine market has shown steady growth in recent years, primarily fueled by:

-

Increasing electricity demand worldwide

-

A shift from coal-fired to gas-fired power plants

-

Growing investments in industrial automation and infrastructure

-

Technological innovations enhancing turbine performance

Countries are investing in gas-fired capacity as a cleaner alternative to coal while also integrating gas turbines with renewable energy systems. These trends position gas turbines as reliable bridge technologies in the transition to low-carbon energy systems.

Key Market Drivers

1. Energy Transition and Emissions Control:

With global efforts to reduce greenhouse gas emissions, gas turbines are gaining traction as transitional solutions. They emit significantly less CO₂ than coal and oil-based plants and offer fuel flexibility — including the ability to operate on hydrogen or synthetic fuels.

2. Advancements in Turbine Technology:

Turbine manufacturers are continually innovating, introducing high-efficiency models with digital controls, improved aerodynamics, advanced materials, and enhanced cooling systems. These improvements boost performance while reducing operational costs.

3. Grid Stability and Backup Power:

Gas turbines provide essential backup for intermittent renewable energy sources like solar and wind. Their ability to ramp up quickly makes them ideal for grid stabilization and peak load management.

4. Industrial Sector Expansion:

Industries such as refining, chemicals, steel, and cement heavily rely on gas turbines for mechanical drive and on-site power generation. Growing industrialization in emerging economies is expanding this market segment.

Market Segmentation Snapshot

By Technology:

-

Open Cycle Gas Turbines (OCGT): Fast-response systems used primarily for peaking power.

-

Combined Cycle Gas Turbines (CCGT): Integrate steam cycles for higher efficiency, widely used for base-load power.

By Capacity:

-

<40 MW: For small-scale industrial and remote applications

-

40–120 MW: Mid-scale facilities and distributed generation

-

>120 MW: Utility-scale plants and heavy-duty applications

By End User:

-

Utilities

-

Industrial

-

Oil & Gas

-

Aerospace and Defense

Regional Market Insights

Asia-Pacific:

A leading region driven by power demand, urbanization, and infrastructure growth. Countries like India, China, and Southeast Asian nations are increasing investments in gas-fired plants to diversify energy sources and improve grid reliability.

Middle East & Africa:

Strong growth is driven by abundant gas resources and infrastructure modernization. Regional governments are diversifying energy portfolios and replacing aging oil-fired plants with gas turbines.

North America:

The U.S. leads in innovation and deployment, fueled by shale gas abundance and coal plant retirements. Combined-cycle installations dominate due to their higher efficiency.

Europe:

Despite aggressive renewable adoption, gas turbines remain important for backup power and cogeneration (CHP). The focus here is on hydrogen-capable systems to support decarbonization.

Latin America:

An emerging market where increasing electricity access and gas infrastructure improvements are creating new opportunities for gas turbine deployment.

Competitive Landscape

Leading players in the gas turbine industry include:

-

General Electric (GE)

-

Siemens Energy

-

Mitsubishi Power

-

Ansaldo Energia

-

Rolls-Royce

These companies focus on R&D, hydrogen integration, digital upgrades, and service offerings to remain competitive. Long-term service agreements and retrofitting solutions also contribute significantly to their revenues.

Future Outlook

The future of the gas turbine market is aligned with global energy transformation. Key trends include:

-

Hydrogen-ready and carbon-neutral turbines

-

Integration with renewable and battery storage systems

-

Digital twin technology for real-time performance optimization

-

Growth in distributed and decentralized energy models

While competition from renewables is strong, gas turbines offer unique strengths in flexibility, reliability, and efficiency — keeping them relevant for decades to come.

Conclusion

The gas turbine market stands at the crossroads of efficiency and sustainability. As the world shifts toward a cleaner and more resilient energy mix, gas turbines will continue to play a foundational role — not just in electricity generation, but also in supporting industrial productivity and global energy security. With supportive policy, continued innovation, and expanding global demand, the market holds strong long-term potential.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness