Enteral Feeding Formulas Market Segments by Region, Growth, Sales and Revenues of Manufacturers Forecast till 2029

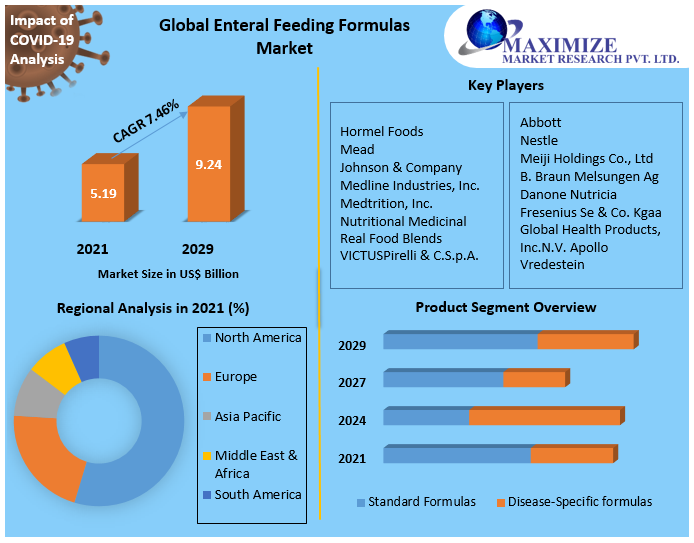

Enteral Feeding Formulas Market size was valued at US$ 5.19 Bn in 2021 and is expected to reach US$ 9.24 Bn by 2029 to exhibit a CAGR of 7.46% during a forecast period.

Market Size

- 2023 Estimated Value: USD 7.50 billion

- Forecast for 2033: USD 12.93 billion

- Aggregate CAGR (2023–2033): ~5.6%

Overview

Enteral feeding formulas son especialidades nutricionales administradas a través de caminos gastrointestinales (usualmente tuberías de alimentación) para pacientes que no pueden ingerir alimentos de manera oral. Utilizadas extensamente en hospitales, cuidados prolongados y en residencias, estas formulas abarcan tanto los compuestos poliméricos convencionales como los específicos para enfermedades como oncology, neurología, renal y diabetes.

To Know More About This Report Request A Free Sample Copy https://www.maximizemarketresearch.com/request-sample/24151/

1. Market Estimation & Definition

Key market segmentation encompasses:

- Product Type: Standard formulas (~56.8%) and disease‑specific formulations

- Feed Flow Type: Intermittent feeding (~89%) versus continuous feeding

- Patient Stage: Adult patients (~90.4%) and pediatric use

- Indication: ‘Other’ (non‑specific) indications (~37%), oncology, gastrointestinal, neurological, diabetes, renal, etc.

- End‑Use: Home-care agencies (~60%) and hospitals/long‑term care

- Sales Channel: Institutional (dominant ~52%) and online (fastest-growing)

- Geography: North America, Europe, Asia‑Pacific, Latin America, Middle East & Africa

- 2. Market Growth Drivers & Opportunity

- Chronic and critical disease burden: High incidence of cancer, neurological disorders, diabetes, and GI impairment requires enteral nutrition.

- Ageing population: Older patients commonly require nutritional support through feeding tubes.

- Shift to home care: Growing preference for home‑based nutrition—reduces hospital stays and infection risk.

- Specialized formulations: Demand rises for disease‑specific and peptide‑based formulas for tailored nutritional management.

- Cost and clinical benefits: Enteral feeding is more cost-effective, preserves gut integrity, and carries lower infection risk than parenteral nutrition.

3. Segmentation Analysis

- Product Type:

- Standard formulas represent ~56–57% share—cost-effective and broadly used.

- Disease‑specific formulas are the fastest-growing segment, catering to oncology, diabetes, renal and other therapeutic needs.

- Flow Type:

- Intermittent feeding (~89%) is standard; continuous feeding sees incremental adoption in ICUs and long-term care.

- Stage (Patient Age):

- Adults (~90% share) dominate; however, pediatric formulations are growing faster in relative terms.

- Indication:

- Other/multiple indications (~37%) lead, followed by oncology, neurological, and gastrointestinal.

- End-Use / Channel:

- Home‑care agencies (~60%) lead usage; institutions (~52%) dominate revenue; online sales growing fastest.

4. Major Manufacturers

Key players shaping the market include:

- Abbott Laboratories

- Danone S.A.

- Fresenius Kabi AG

- Nestlé Health Science

- Victus Inc.

- Primus Pharmaceuticals

- Meiji Holdings

- Mead Johnson

These companies lead innovation in disease‑specific formulations and global oncology nutrition solutions.

5. Regional Analysis

- North America: Leading region (~30% share in 2023), supported by strong healthcare systems, aging demographics, and chronic disease prevalence.

- Europe: Second-largest region with sustained demand in cancer care and institutional nutrition.

- Asia-Pacific: Fastest-growing region (~6–7% CAGR), led by India, China, Japan, and Southeast Asia.

- Latin America and Middle East & Africa: Smaller markets but exhibiting gradual growth in home-care and hospital adoption.

6. Country-Level Analysis (USA, Germany, China)

- United States: Largest single country market (~USD 2.8 billion in 2023); innovation in tailored formulas (e.g., lactose‑free, gluten‑free) supports consistent uptake.

- Germany: Leading European hub for advanced disease-specific nutrition in clinical settings.

- China: Major Asia-Pacific growth driver—due to rising malnutrition rates, expanding home-care infrastructure, and increasing healthcare access.

Get More Info: https://www.maximizemarketresearch.com/request-sample/24151/

7. COVID‑19 Impact Analysis

The pandemic caused supply chain disruptions and reduced elective hospital nutrition services in 2020–2021. However, demand surged in ICUs, emergency care, and home-based feeding services. Online prescription and delivery infrastructure accelerated, bolstering long-term adoption.

8. Competitive (Commutator) Analysis

Market Structure: Moderately consolidated—led by global nutrition brands, with regional producers addressing local needs.

Trends:

- Surge in disease-specific and peptide-based formulas tailored for oncology, diabetes, GI and preterm patient populations.

- Growth in online/digital distribution and home-care channels.

- Increased institutional services bundle nutrition with home-support packages.

Challenges:

- Variable reimbursement policies across geographies.

- Patient compliance and formula tolerance concerns.

- Price sensitivity in lower-income markets.

Opportunities:

- Expansion into under-served pediatric and elderly demographics.

- Partnerships with telehealth platforms and distributors for direct-to-consumer delivery.

- Co-development of formulas addressing emerging preterm or malnutrition patient needs.

9. Key Questions Answered

|

Question |

Answer |

|

Market size in 2023? |

USD 7.50 billion |

|

Forecast for 2033? |

USD 12.93 billion |

|

CAGR (2023–2033)? |

~5.6% |

|

Leading product type? |

Standard formulas (~56–57%) |

|

Fastest-growing product segment? |

Disease-specific formulations |

|

Dominant flow type? |

Intermittent feeding (~89%) |

|

Most common patient stage? |

Adults (~90%) |

|

Leading indication? |

Other/multiple (~37%) |

|

Largest end-use environment? |

Home care agencies (~60%) |

|

Fastest-growing sales channel? |

Online retail/platforms |

|

Top region? |

North America (~30%) |

|

Fastest-growing region? |

Asia-Pacific (~6–7% CAGR) |

|

Key country markets? |

USA, Germany, China |

|

Leading global providers? |

Abbott, Danone, Fresenius, Nestlé, Victus, Primus, etc. |

10. Press Release Conclusion

The Global Enteral Feeding Formulas Market is positioned for sustainable long-term expansion, expected to grow from USD 7.50 billion in 2023 to USD 12.93 billion by 2033 (~5.6% CAGR). Growth is driven by rising chronic disease prevalence, aging populations, home-care adoption, and innovation in disease-specific nutrition. North America leads in market share and innovation, while Asia-Pacific presents the highest growth potential. Market leaders investing in tailored formulations, digital distribution channels, and institutional-home service integration are poised to set the pace in this sensitively regulated and clinically critical segment of healthcare.

About Maximize Market Research:

Maximize Market Research is a global market research and consulting company specializing in data-driven insights and strategic analysis. With a team of experienced analysts and industry experts, the company provides comprehensive reports across various sectors, aiding businesses in making informed decisions and achieving sustainable growth.

Contact Us

Maximize Market Research Pvt. Ltd.

2nd Floor, Navale IT Park, Phase 3

Pune-Bangalore Highway, Narhe

Pune, Maharashtra 411041, India

📞 +91 96073 65656

✉️ sales@maximizemarketresearch.com

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness