Marine Wind Turbine Market Opportunities, Sales Revenue, Leading Players and Forecast 2029

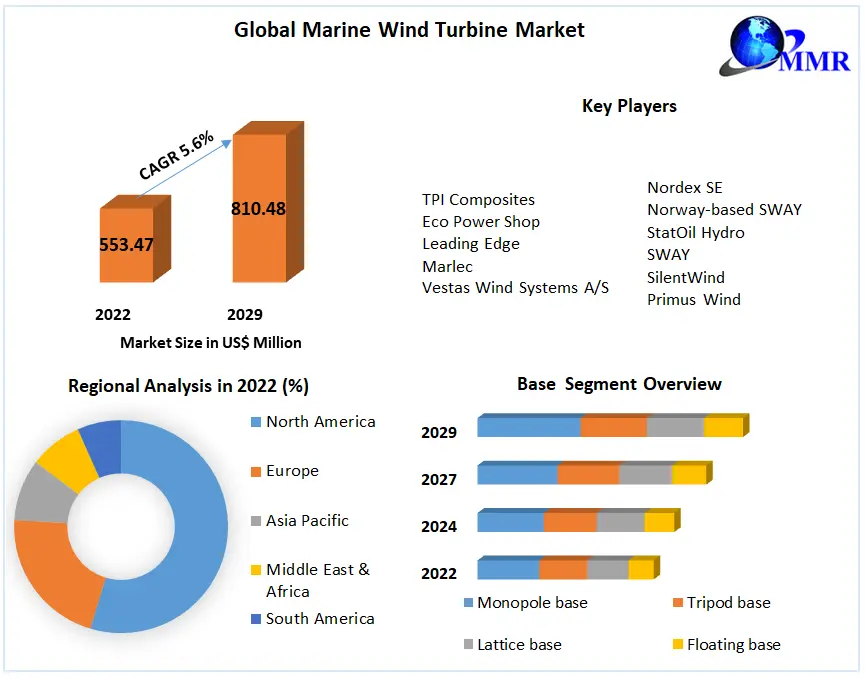

Marine Wind Turbine Market size is expected to reach nearly US$ 810.48 Mn. by 2029 with the CAGR of 5.6% during the forecast period.

Market Size

- 2023 Estimated Value: USD 16.5 billion

- 2032 Forecast: USD 45.6 billion

- CAGR (2024–2032): ~11.6%

- Alternate estimates suggest the market could reach about USD 160 billion by 2032, implying an annual growth of ~12.4%, depending on definitions of scope and inclusion of broader offshore wind assets.

Overview

Marine wind turbines—deployed offshore or on floating platforms—convert consistent maritime wind energy into electricity. These systems support fixed-bottom and floating foundations and are increasingly favored in deep-water or coastal applications. Advantages include broader site options, higher wind speeds, larger turbines, and integration into coastal and island energy infrastructure.

To Know More About This Report Request A Free Sample Copy https://www.maximizemarketresearch.com/request-sample/82261/

1. Market Estimation & Definition

Key segments assessed:

- By Design Type: Floating platforms vs. fixed-bottom marine turbines

- By Capacity Range: Under 1 MW, 1–3 MW, 3–5 MW, over 5 MW

- By Components: Turbine units, rotor blades, towers, nacelles, foundation systems

- By Application Sector: Commercial, industrial, residential electrification needs

- By Region: Asia‑Pacific, Europe, North America, Latin America, Middle East & Africa

2. Market Growth Drivers & Opportunity

- Renewable Energy Commitments: Governments worldwide are targeting generous offshore wind capacity targets—such as 60 GW by 2030 in the EU and 30 GW in the U.S.—propelling deployment.

- Technological Progress in Floating Platforms: Floating turbine systems enable deep-water deployments, expanding addressable areas—especially in Japan, Norway, and the U.S. West Coast.

- Efficiency and Turbine Scaling: Modern turbines exceed 14 MW capacity, increasing output per installation and reducing per‑MW costs.

- Cost Improvements and Investor Confidence: Falling generation prices (~USD 78/MWh) and financing support through incentive programs reduce project risk.

- Emerging Market Entry: Asia-Pacific (especially China) is rapidly expanding offshore capacity, opening global market prospects.

3. Segmentation Analysis

- By Design Type:

- Fixed-bottom turbines dominate installed base today, especially in shallow coastal waters.

- Floating turbines are the fastest-growing segment, opening up deep-water wind zones and offering greater flexibility.

- By Capacity Class:

- Mid-range turbines (3–5 MW) lead in current volume, while above 5 MW systems (including 14 MW and larger) are expanding fastest.

- By Component Segment:

- Rotor blades and turbine nacelles represent the lion’s share of cost and revenue.

- Foundation technologies—especially floating platforms—are gaining investment and innovation focus.

- By Application End‑Use:

- Commercial and utility-scale energy dominate, with consumer/residential generation segmenting small-scale applications or island microgrids.

4. Major Manufacturers

Leading global firms in marine/offshore wind turbine development include:

- Siemens Gamesa Renewable Energy

- Vestas Wind Systems

- General Electric Renewable Energy

- Ming Yang Smart Energy

- Shanghai Electric

- Envision

- MHI Vestas Offshore Wind

- Nordex SE

These companies drive industry innovation in turbine size scaling, floating platform engineering, and operations & maintenance systems in offshore settings.

Get More Info: https://www.maximizemarketresearch.com/request-sample/82261/

5. Regional Analysis

- Europe: Represents the largest regional market (~50% share in 2023), led by UK, Germany, Denmark, Netherlands; heavy investment in North Sea floating and fixed installations.

- Asia‑Pacific: Secondary in size (~30%) but fastest-growing—China alone added the majority of global new capacity in 2023, expanding from 5 GW in 2018 to over 37 GW by 2023. Japan, Taiwan, and South Korea are also scaling floating projects.

- North America: ~15% market share, with growth driven by U.S. commitments to 30 GW offshore by 2030 and development of commercial floating farms off the Rhode Island/Massachusetts coast.

- Latin America & MEA: Emerging regions with multi-GW opportunities in coastal wind and tropical island energy access projects.

6. Country-Level Analysis (USA & Germany & China)

- United States: Currently modest in offshore development, but policy momentum, port infrastructure build-out, and planned large projects are expected to lift U.S. share to ~15–18% of global market by 2032.

- Germany (Europe): A core market with mature offshore framework, substantial installed capacity, project pipeline, and investment in floating tech for North Sea expansion.

- China (Asia‑Pacific): Rapid leader in global growth—accounting for over 50% of global offshore installations in recent years, with floating pilot projects and large-scale pipeline expanding rapidly.

7. COVID‑19 Impact Analysis

Pandemic-related disruptions from 2020–2021 temporarily delayed offshore construction and supply chain mobilization. However, stimulus-led rebounds in infrastructure spending—particularly in Europe and China—helped restore momentum by late 2021. Renewed focus on energy security and green stimulus packages accelerated marine wind turbine deployments in 2022 onward.

8. Competitive (Commutator) Analysis

Market Structure:

Moderately consolidated—dominated by large turbine OEMs with emerging specialized firms focusing on floating foundation technologies and deep-water installation vessels.

Sector Trends:

- Rapid growth in floating wind infrastructure

- Larger turbine units (>14 MW) driving scale efficiency

- Digital technologies like predictive maintenance, digital twins, remote monitoring reducing O&M costs

- Vessel and port infrastructure expansion—servicing logistics for offshore commissioning

Challenges:

- High capital costs and long lead times for approval and installation

- Supply chain bottlenecks (turbine capacity, cables, installation vessels)

- Environmental permitting and marine ecosystem concerns

- Long deployment timelines limit speed in emerging economies

Opportunities:

- Technological race to unlock deep-water potential through floating wind

- Strategic partnerships between governments and OEMs

- Retrofitting oil/gas platforms and investment in large turbine blade factories

- Emerging offshore programs in India, Southeast Asia, Latin America

9. Key Questions Answered

|

Question |

Answer |

|

Global marine wind turbine market size in 2023? |

USD 16.5 billion |

|

Forecast size by 2032? |

USD 45.6 billion |

|

Projected CAGR (2024–2032)? |

~11.6% |

|

Leading region by share in 2023? |

Europe (~50%) |

|

Fastest-growing region? |

Asia‑Pacific (esp. China, >15% CAGR) |

|

Dominant turbine design? |

Fixed-bottom currently; floating fastest-growing |

|

Largest capacity turbine segment? |

3–5 MW today; >5 MW expanding rapidly |

|

Top global companies? |

Siemens Gamesa, Vestas, GE, Ming Yang, Envision, etc. |

|

Key country markets? |

China, USA, Germany |

|

Emerging growth opportunities? |

Floating wind, large turbines, deep-water deployment |

10. Press Release Conclusion

The global marine wind turbine market is at an inflection point, poised to nearly triple over the next decade from USD 16.5 billion in 2023 to over USD 45 billion by 2032, backed by strong renewable energy mandates, surge in floating turbine adoption, and accelerating deep-water zone development. Europe currently leads in technological deployment and installed base, while Asia-Pacific—dominated by China—marks the fastest growth and innovation. The U.S. and other emerging offshore markets have high potential, especially with policy support and infrastructure investment. Market winners will be turbine OEMs offering high-capacity machines, floating solutions, and smart operations support—while navigating supply, permitting, and marine sustainability challenges. As energy systems transition toward low-carbon models, marine wind turbines are set to play a critical role in renewable power generation worldwide.

About Maximize Market Research:

Maximize Market Research is a global market research and consulting company specializing in data-driven insights and strategic analysis. With a team of experienced analysts and industry experts, the company provides comprehensive reports across various sectors, aiding businesses in making informed decisions and achieving sustainable growth.

Contact Us

Maximize Market Research Pvt. Ltd.

2nd Floor, Navale IT Park, Phase 3

Pune-Bangalore Highway, Narhe

Pune, Maharashtra 411041, India

📞 +91 96073 65656

✉️ sales@maximizemarketresearch.com

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness