Busbar Market Share, Industry Growth, Business Strategy, Trends and Regional Outlook 2029

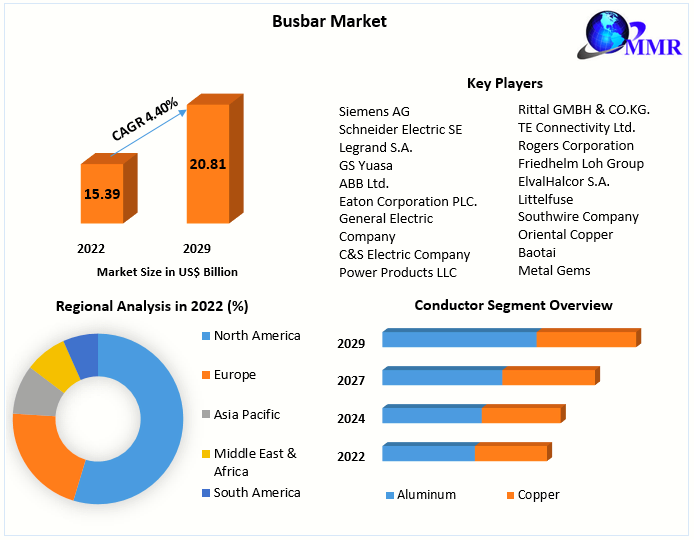

The Busbar Market size was valued at US$ 15.39 Bn. in 2022 and the total revenue is expected to grow at 4.40 % through 2023 to 2029, reaching nearly US$ 20.81 Bn

Market Size

- 2024 Market Estimate: USD 19.5 billion

- 2033 Forecast Range: USD 25.4 billion to USD 28.0 billion

- Expected CAGR (2025–2033): Approximately 4.1%–5.8%

- Overview

Busbars are conductive cables (usualmente de copper or aluminum) diseñados para distribuir eficazmente la electricidad en switchgear, panels, substations, centros de datos, and estructuras industriales. They brindan menor pérdida de energía, versatilidad de instalación modular, y un tamaño reducido en comparación con los antiguos sistemas de cableado. Principales beneficios incluyen una mayor capacidad actual, menor tiempo de inactividad, y respaldo para una infrastructure que pueda ser escalable.

To Know More About This Report Request A Free Sample Copy https://www.maximizemarketresearch.com/request-sample/31459/

1. Market Estimation & Definition

The busbar market is structured by:

- Material (Conductor): Copper, Aluminium

- Power Rating: Low (<125 A), Medium (125–800 A), High (>800 A)

- End‑Users: Utilities, Industrial, Commercial, Residential

- Installation Type: In‑Building, Outdoor, Mobile

- System Type: Traditional vs. Smart / Modular busbars

- Geography: North America, Europe, Asia‑Pacific, Latin America, Middle East & Africa

- 2. Market Growth Drivers & Opportunity

Key drivers fueling growth include:

- Growing Electrification & Urbanization: Infrastructure build-out in emerging markets increases requirement for efficient power distribution

- Adoption of Smart Grids and Data Centers: Demand surge in modular, scalable busbar systems supporting real-time monitoring and predictive maintenance.

- Energy-Efficiency & Load Handling: Busbars present lower resistance and higher reliability compared to cable systems, aiding efficiency goals.

- Renewable Energy Integration: Busbar usage increases in solar farms, wind plants, and microgrid projects to manage diverse power flows.

- Urban safety and infrastructure resilience: Busbars require less maintenance and improve fire safety over cable-heavy setups.

- Demand for Smart, Modular Systems: Flexible, plug-and-play busbars gain traction in commercial buildings and electrical infrastructure.

3. Segmentation Analysis

- By Material:

- Copper led the 2024 market share (~67%) due to superior conductivity. Aluminum segment is growing fastest on lower cost and reduced weight—especially in EVs and light installations.

- By Power Rating:

- Low‑power (<125 A) segment holds ~25% due to utility and commercial adoption. Medium-power (125–800 A) leads by volume share (~47%). High-power (>800 A) serves industrial and energy sectors with steady growth.

- By End‑User / Installation Type:

- Industrial / In‑building installations dominate; industrial segment ~64% share in 2024.

- Commercial accounts for ~38% of usage, driven by automation and high-rise development.

- Residential and Utilities utilize busbars in control centers and substations.

- By System Type:

- Traditional busbars form the base;

- Smart, modular systems are fastest-growing, enabling IoT monitoring and flexible expansion.

4. Major Manufacturers

Prominent global vendors in this market include:

- Siemens AG

- ABB Group

- Schneider Electric

- Eaton Corporation

- General Electric

- Legrand

- Mersen

- Rittal

- CHINT Group

- Southwire

- Rittal

- Emerson (PowerBar division of Vertiv)

- Wöhner (Germany)

These players lead with integrated product portfolios, global manufacturing, and smart busbar innovations.

Get More Info: https://www.maximizemarketresearch.com/request-sample/31459/

5. Regional Analysis

- Asia‑Pacific: Largest region in 2024 (~45–50% share), led by China and India’s electrification investments and smart city rollout.

- North America: Strong growth expected (fastest CAGR), with demand from utilities, data centers, and commercial infrastructure.

- Europe: Hybrid of mature usage and innovation push in Germany, UK, France; sustainability and modular trends strong.

- Latin America & MEA: Emerging use cases in energy, industrial, and telecom sectors with modest but rising penetration.

6. Country-Level Analysis (USA & Germany)

- United States:

- One of the world’s largest individual markets.

- Rapid adoption in data centers and utility-scale installations, coupled with smart grid modernization.

- Growth bolstered by infrastructure spending and renewable energy connections.

- Germany:

- Leading European manufacturing hub and EV infrastructure nation.

- Strong push on laminated and smart busbars in industrial automation and building electrification.

- Regulatory energy-efficiency mandates stimulate advanced busbar adoption.

7. COVID‑19 Impact Analysis

While industrial and building projects slowed during 2020–21, demand rebounded strongly by late 2021–2022 as infrastructure investment resumed. Growth in data center buildouts and renewable energy installations sharply increased post-pandemic, supporting busbar deployment recovery and expansion.

8. Competitive Analysis

- Structure: Moderately consolidated with global OEM leaders; regional producers emerging in high-growth markets.

- Strategic Trends:

- Development of smart modular busbar systems equipped with IoT sensors and remote monitoring.

- Focus on sustainable and recyclable materials, driven by ESG standards.

- Partnerships between busbar producers and smart-building or EV infrastructure firms to create integrated solutions.

- Challenges:

- Rising raw material costs (especially copper, aluminum volatility).

- Installation complexity and high upfront investment.

- Maintenance challenges in harsh or outdoor environments.

- Opportunities:

- Retrofit and modular kits in smart building upgrades.

- Solar, data center, and EV charging station infrastructure.

- Light-weight aluminum usage in EV and aerospace verticals.

- 9. Key Questions Answered

|

Question |

Answer |

|

Market size in 2024? |

USD 19.5 billion |

|

Forecast for 2033? |

USD 25.4–28.0 billion |

|

CAGR (2025–2033)? |

~4.1%–5.8% |

|

Leading conductor type? |

Copper (~67% share) |

|

Fastest‑growing conductor? |

Aluminium |

|

Leading power rating segment? |

Medium power (125–800 A) |

|

Largest end-user sector? |

Industrial / In‑building (~64%) |

|

Dominant region? |

Asia‑Pacific (~45–50% share) |

|

Fastest-growing region? |

North America |

|

Key global manufacturers? |

Siemens, ABB, Schneider, Eaton, GE, Vertiv, etc. |

10. Press Release Conclusion

The global busbar market is set for strong, steady growth—driven by escalating electrification, smart-grid infrastructure, and data center expansion. With Asia-Pacific dominating volume demand and North America spearheading innovation adoption, companies offering smart, modular, and sustainable busbar systems are best positioned for competitive advantage. Despite challenges tied to material pricing and installation complexity, ongoing urban electrification and energy efficiency mandates present opportunities for expansion. As industries shift to renewable, digital, and resilient power distribution frameworks, busbars will remain foundational components of future energy networks

About Maximize Market Research:

Maximize Market Research is a global market research and consulting company specializing in data-driven insights and strategic analysis. With a team of experienced analysts and industry experts, the company provides comprehensive reports across various sectors, aiding businesses in making informed decisions and achieving sustainable growth.

Contact Us

Maximize Market Research Pvt. Ltd.

2nd Floor, Navale IT Park, Phase 3

Pune-Bangalore Highway, Narhe

Pune, Maharashtra 411041, India

📞 +91 96073 65656

✉️ sales@maximizemarketresearch.com

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness