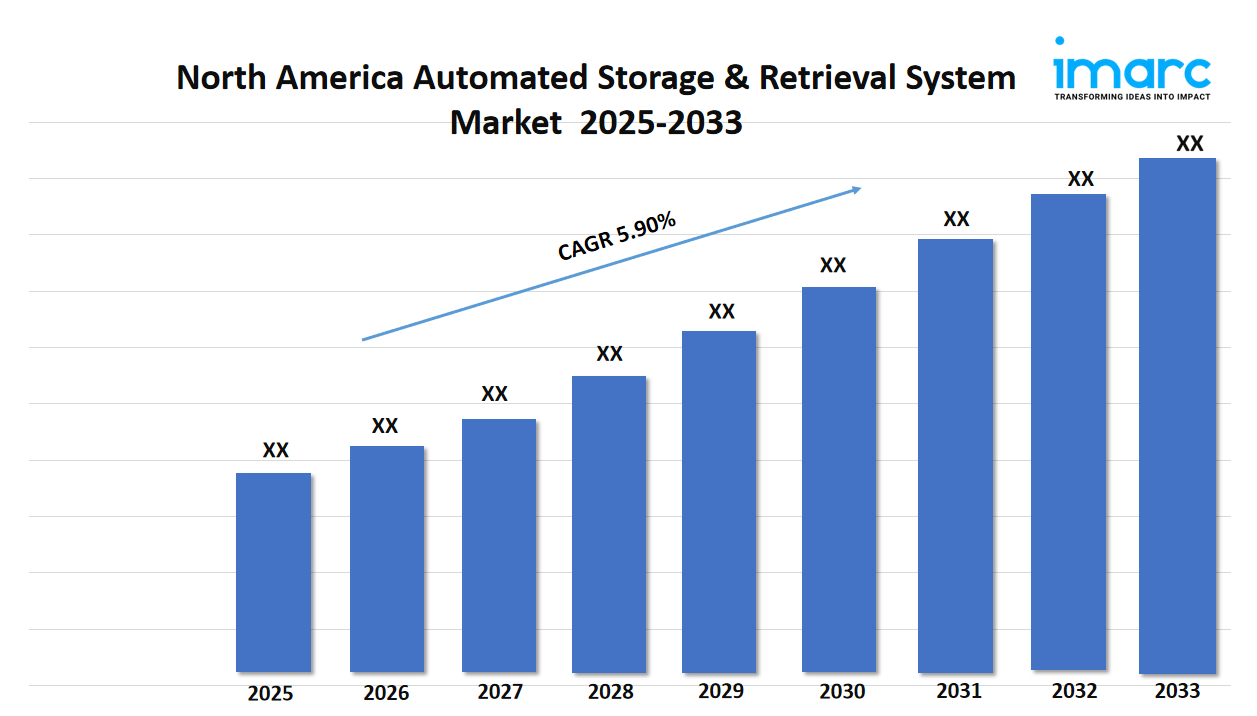

North America Automated Storage & Retrieval System Market Size, Growth, and Trends Forecast 2025-2033

North America Automated Storage & Retrieval System Market Overview

Market Size in 2024: USD 5.90 Billion

Market Size in 2033: USD 9.86 Billion

Market Growth Rate 2025-2033: 5.90%

According to IMARC Group's latest research publication, "North America Automated Storage & Retrieval System Market Size, Share, Trends and Forecast by Type, Load, Application, End User, and Country, 2025-2033", The North America automated storage & retrieval system market size reached USD 5.90 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 9.86 Billion by 2033, exhibiting a growth rate (CAGR) of 5.90% during 2025-2033.

Growth Factors in the North America Automated Storage & Retrieval System Market

-

Surge in Electric Vehicle Adoption:

The international battery recycling market is flourishing because of the tremendous increase in electric vehicles (EVs). As EVs are now on every road, the demand for lithium-ion batteries has increased and thus the need to recycle these end-of-life batteries. For example, the International Energy Agency reported that there were over 2.3 million electric car sales in 2022, which created a lot of battery production and recycling. Governments are also joining in on the movement with U.S.'s Responsible Battery Recycling Act to drive safe disposal and recycling, among other things. Private companies like Redwood Materials are also joining in with automakers (e.g., Toyota) to recycle EV batteries while recovering materials like lithium and cobalt. The increase in recycling helps encourage sustainability by creating additional alternatives for mining and in some cases accelerates development of the mining industries.

-

Stringent Environmental Regulations:

Governments across the globe are making significant efforts to control the amount of battery waste by instituting strict legislation, and thereby pushing the recycling industry as a whole faster. For example, the EU Battery Directive establishes minimum recycling thresholds for a variety of batteries and provides a framework for developing and institutionalizing recycling improvements, with the overarching goal of establishing legislation that forces companies to allocate resources to developing better recycling technology. In the United States, the EPA recently updated its requirements for safely transporting lithium-ion batteries and also reinforced guidelines for mitigating fire risks in ship and shore-based facilities, incentivizing remediation efforts and eventually compliance, as compared to casual adherence. Regulations are in place to make sure hazardous materials are managed properly (e.g., cobalt and lead), including any intermediate impacts on the environment during manufacturing, recycling, and disposing of discarded batteries. In the U.S., for instance, over 95% of lead-acid batteries are recycled, driven by the robustness of existing logistics. These regulations often have a cascading impact - forcing companies (like Umicore and Call2Recycle) to expand, which makes recycling part of the battery lifecycle, and contributes to the growth of the market for recycling, etc.!

-

Technological Advancements in Recycling:

With innovations in recycling technology making battery recycling more efficient and cost effective, there is much opportunity for growth. With companies now developing and employing hydrometallurgy to recover more than 95% of important battery raw materials like lithium and nickel with lower environmental impact, battery manufacturers are going to become more economically viable for battery recyling. Example, Aqua Metals have developed, commercialized, and automated hydro metallurgical process for recycling lead-acid batteries with no air emissions. AI and robotics technology is changing the conservation of battery raw materials by automating sorting of material and disassembly of batteries systems by lowering costs. Glencore in partnership with Li-Cycle expanded their battery recycling using patented technology to recover critical minerals and make battery recycling part of a Circular Economy. We know from the incremental improve in recycling without using much technology improvements the recovery of battery raw materials will only be more profitable for the recycling companies and will also attract heavy investment, such us Retriev Technologies, as technology leapfrogs the current technology in battery recycling. As technologies continue to improve battery recycling can address the growing problem of battery recyling waste; many for electrical batteries powered by renewable energies, and consumer electronics.

Download a sample PDF of this report: https://www.imarcgroup.com/north-america-automated-storage-retrieval-system-market/requestsample

Key Trends in the North America Automated Storage & Retrieval System Market

Integration of AI and Robotics

AI and robotics are significantly impacting the ASRS market in North America by increasing efficiencies and accuracy. New technologies using AI are increasing efficiencies around inventory management and demand forecasting and have considerably reduced the risk of errors. In ASRS's operated by Amazon that process millions of orders daily have, for example, when utilizing AI, cut the time it requires to fulfill orders by up to 50% compared to ASRS's without the use of AI. It is also important to look at robotics, like those in Ocado's warehouses, which speed the picking of items, sorting, and some systems dispute items at 1,000 per hour. This is essential in e-commerce, as time is the most significant factor. Furthermore, many companies like Dematic are placing a considerable amount of resources into testing AI to integrate it into ASRS. Some studies show using classes of AI variables resulted in a reduction of 30% in costs. More companies are starting to see the value and the potential of integrating these technologies into their scope of operations; to the point of changing the mindset of warehouses being stagnant and therefore forever stale to being operational 'smart' hubs, particularly for organizations in fast-paced industries like retail, logistics, and others.

Focus on Sustainability and Energy Efficiency

Sustainability is increasingly valued in the North America ASRS market as companies are striving to implement energy-efficient systems in order to reduce costs and impact the environmental. The latest ASRS units feature energy-efficient components such as regenerative braking or low-energy motors, with power reductions as high as 20 percent. Swisslog designs their ASRS systems with energy-saving features that have assisted companies like Walmart reduce their carbon footprint. Depending on the scale of a companies green initiatives, certifications like LEED are driving companies to spend money on environmentally-conscious ASRS. In the United States, tax incentives for the implementation of sustainable technology has accelerated companies' intention to adopt sustainable practices, as many companies report an average annual savings of $100,000 in energy costs and other initiatives beyond technological investments. Consumers are demanding greener practices as well, which drives competition in the ASRS sector; therefore, investing in energy-efficient ASRS may provide a competitive advantage for the logistics and manufacturing industries that strive towards a balance between producing profit while facing increased green initiatives.

Expansion in Cold Storage Applications

The North America ASRS market is gaining momentum, particularly in cold storage applications and technology. This is largely due to demand in the food, beverage, and pharmaceutical industries. Automated storage and retrieval systems are now designed for an operational temperature below 0°C, allowing the systems to handle perishables in a safe and accurate manner. For instance, Lineage Logistics is deploying ASRS to manage inventory for frozen food products stored in a temperature maintained far below freezing, (below -20°C), while processing over 10,000 pallets per day. The labor savings realized can be as high as 40% and inventory accuracy is historically improved. Companies, such as SSI Schaefer are building cold-chain ASRS, and install bases are growing 15% per year across the U.S. and Canada. This also adds to a perfect storm for the rapidly expanding e-commerce grocery segment, as delivery of products maintained at safe environmental temperatures accurate and fast is required, and investments in ASRS perfect for the challenges of temperature-sensitive products in grocery e-commerce are growing.

We explore the factors driving the growth of the market, including technological advancements, consumer behaviors, and regulatory changes, along with emerging north america automated storage & retrieval system market trends.

North America Automated Storage & Retrieval System Industry Segmentation:

The report has segmented the market into the following categories:

Analysis by Technology:

- Air Atomization

- Others

Analysis by Raw Material:

- Aluminium Ingots

- Aluminium Scrap

Analysis by End Use:

- Industrial

- Automotive

- Chemical

- Construction

- Explosives

- Defense and Aerospace

- Others

Country Analysis:

- United States

- Canada

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Future Outlook

The North America ASRS market is poised for robust growth, driven by the continued expansion of e-commerce, advancements in automation technologies, and the need for efficient supply chain solutions. As consumer demand for faster delivery and seamless shopping experiences intensifies, companies will increasingly invest in ASRS to enhance warehouse productivity and accuracy. The integration of AI, robotics, and IoT will further improve system capabilities, enabling real-time inventory management and predictive analytics. For instance, innovations like Honeywell’s AI-powered ASRS, capable of managing thousands of SKUs, highlight the market’s potential for scalability. Despite challenges like high initial costs, the long-term benefits of reduced labor dependency and optimized space will drive widespread adoption, positioning North America as a leader in warehouse automation by 2033.

Research Methodology:

The report employs a comprehensive research methodology, combining primary and secondary data sources to validate findings. It includes market assessments, surveys, expert opinions, and data triangulation techniques to ensure accuracy and reliability.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness