Autotransformer Market Top Players, Current Trends, Future Demands and Forecast to 2026

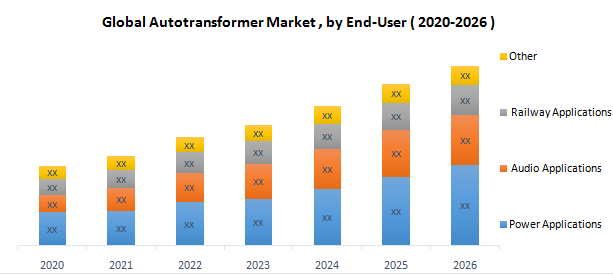

Autotransformer Market was valued US$ XX Mn. in 2020 and is expected to reach US$ XX Mn. by 2026.

1. Market Size

The global autotransformer market was valued at USD 9.3 billion in 2023 and is projected to expand at a compound annual growth rate (CAGR) of approximately 7.6%, reaching an estimated USD 11 billion by 2030. The growing need for efficient power transmission systems and compact electrical equipment continues to support strong market momentum.

2. Overview

An autotransformer is a kind of transformer that has variable voltage taps and a single winding that serves as both the main and secondary side. Autotransformers are more compact, use less material, and are more efficient than traditional two-winding transformers. These qualities make them ideal for a wide range of uses, including railway electrification, industrial machinery, power distribution, voltage management, and renewable energy systems.

To Know More About This Report Request A Free Sample Copy https://www.maximizemarketresearch.com/request-sample/85312/

3. Market Estimation & Definition

The market includes a wide range of autotransformers, from dry-type models used in indoor or sensitive environments to oil-immersed models designed for outdoor, high-load scenarios. These products are further categorized by phase type (single-phase and three-phase), voltage capacity, and end-use application. As the energy sector transitions toward smarter grids and decentralized power generation, the demand for reliable, space-saving voltage regulation technologies like autotransformers is rapidly growing.

4. Market Growth Drivers & Opportunities

1. Grid Modernization & Electrification

Global energy infrastructures are being modernized to support growing urbanization, electrification, and renewable integration. Autotransformers help maintain voltage stability and reduce transmission losses, which is critical for the success of smart grids.

2. Increased Efficiency Requirements

Autotransformers are more energy- and cost-efficient than traditional transformers due to their single-winding design. This makes them an attractive choice for utilities and manufacturers aiming to optimize operational performance.

3. Integration with Renewable Energy

The rapid deployment of wind, solar, and hydroelectric projects is fueling demand for voltage regulators and distribution transformers that can adapt to fluctuating loads and intermittent power sources. Autotransformers are ideal for balancing loads and connecting renewable sources to the main grid.

4. Rise in Compact Infrastructure Demand

Space-saving infrastructure is gaining priority across industrial, commercial, and residential sectors. The compact design and high VA rating of autotransformers make them perfect for OEMs and facility operators with space constraints.

5. Environmental Compliance and Dry-Type Growth

Dry-type autotransformers are becoming more popular due to their safety, low maintenance, and environmental advantages. They eliminate the need for oil, reducing the risk of leakage and fire, which makes them ideal for indoor and eco-sensitive applications.

5. Segmentation

By Type:

- Dry-Type Autotransformers

- Oil-Immersed Autotransformers

By Phase:

- Single-Phase

- Three-Phase

By Application:

- Power Transmission & Distribution

- Industrial Motors & Equipment

- Railway Systems

- Voltage Regulation

- Audio & Electronic Devices

Among these, three-phase autotransformers dominate the market due to their wide use in industrial and utility-scale applications.

6. Major Manufacturers

- ABB

- Siemens Energy

- General Electric

- Hitachi Energy

- Hyundai Electric

- Schneider Electric

- Toshiba

- Bharat Heavy Electricals Limited (BHEL)

These leading manufacturers are consistently investing in R&D to develop smarter, more efficient transformer designs with built-in diagnostics, IoT compatibility, and compliance with international safety and energy standards.

Get More Info: https://www.maximizemarketresearch.com/request-sample/85312/

7. Regional Analysis

Asia-Pacific

Asia-Pacific is the largest and fastest-growing regional market, supported by robust urban development, grid upgrades, and renewable energy projects. Countries like China and India are witnessing massive investments in transmission infrastructure and electrification programs.

North America

North America shows steady growth due to the modernization of aging electrical infrastructure and rising adoption of dry-type transformers in commercial and indoor applications. The shift toward sustainable energy is further increasing the demand for autotransformers.

Europe

European countries, particularly Germany, are leading the adoption of environmentally compliant and energy-efficient power systems. Autotransformers are being increasingly used in industrial automation and renewable grid integration.

Middle East & Africa

Growing investments in electric power transmission and new industrial zones are fueling moderate growth in this region. Government initiatives focused on improving rural electrification are also contributing to demand.

Latin America

Latin America is experiencing gradual market expansion, led by infrastructural development, particularly in Brazil and Mexico. Ongoing efforts to improve energy access and minimize power losses are boosting the use of voltage regulation devices.

8. Country-Level Analysis

United States

The U.S. market is expanding due to widespread grid digitization and renewable energy deployment. Rising usage of autotransformers in EV charging stations and smart grids is contributing to growth.

Germany

Germany leads in Europe, driven by its energy transition goals and demand for compact, high-efficiency transformers. The integration of solar and wind power requires dependable voltage regulation solutions like autotransformers.

China

As one of the largest consumers of electricity, China is investing heavily in transformer technology to support its rapid urban expansion and industrial output. The country is also a major manufacturer and exporter of autotransformers.

India

With initiatives like "Power for All" and rapid rural electrification, India presents a strong demand for cost-effective, scalable transformer technologies. Local production and government support are helping the market flourish.

Australia & Canada

These nations are leveraging their renewable resources and upgrading distribution networks, resulting in a rising need for energy-efficient, space-saving transformers.

9. COVID-19 Impact Analysis

The COVID-19 pandemic led to temporary delays in transformer production and utility projects due to supply chain disruptions and labor shortages. However, post-pandemic recovery efforts, particularly infrastructure stimulus programs, revitalized the market. The growing emphasis on automation, grid resilience, and renewable integration has accelerated the adoption of advanced autotransformer solutions.

10. Competitor Analysis (Commutator Analysis)

Market Structure:

The autotransformer market is moderately consolidated, with a few major global players dominating the landscape. Competition is based on technology, product efficiency, customization, and regional presence.

Key Competitive Strategies:

- Technological Innovation: Integration of smart monitoring systems, low-loss magnetic materials, and energy-efficient insulation techniques.

- Strategic Partnerships: Collaborations with utilities and OEMs to deliver turnkey solutions for grid and industrial projects.

- Product Customization: Offering application-specific models for sectors such as transportation, data centers, and renewable energy.

- Mergers & Acquisitions: Acquiring regional manufacturers and startups to strengthen market positioning.

Opportunities:

- Upgrading aging grid infrastructure in developed countries

- Growing electrification in emerging markets

- Demand for modular dry-type units in commercial settings

- Smart grid compatibility and remote diagnostics

Challenges:

- High initial investment costs

- Fluctuating raw material prices

- Competition from alternative power regulation technologies (e.g., solid-state transformers)

11. Key Questions Answered

What is the size of the global autotransformer market?

The market was valued at USD 9.3 billion in 2023 and is projected to reach approximately USD 11 billion by 2030.

Which factors are driving market growth?

Key growth drivers include grid modernization, renewable integration, compact infrastructure demand, and efficiency improvement.

Which regions are leading the market?

Asia-Pacific leads the global market, followed by North America and Europe.

What applications are propelling demand?

Major applications include power transmission, industrial equipment, railways, renewable energy systems, and smart grids.

Who are the top market players?

ABB, Siemens Energy, GE, Hitachi Energy, Schneider Electric, Hyundai Electric, Toshiba, and BHEL.

What impact did COVID-19 have on the market?

The pandemic caused short-term disruptions but led to renewed interest in resilient, energy-efficient infrastructure post-recovery.

12. Press Release Conclusion

The global autotransformer market is on a trajectory of sustained growth, fueled by the urgent need for efficient, space-saving power management solutions across sectors. As power networks become more complex and energy demand increases, autotransformers provide a cost-effective and reliable solution for voltage regulation, system stability, and compact design. With governments and utilities prioritizing smart grid development, renewable integration, and infrastructure resilience, autotransformers will remain at the forefront of power transformation technologies through 2030 and beyond

Contact Us

Maximize Market Research Pvt. Ltd.

2nd Floor, Navale IT Park, Phase 3

Pune-Bangalore Highway, Narhe

Pune, Maharashtra 411041, India

📞 +91 96073 65656

✉️ sales@maximizemarketresearch.com

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness