About us

Phase 3,Navale IT Zone, S.No. 51/2A/2,

Office No. 202, 2nd floor,

Near, Navale Brg,Narhe,

Pune, Maharashtra 41041

+91 96073656561

sales@stellarmr.com

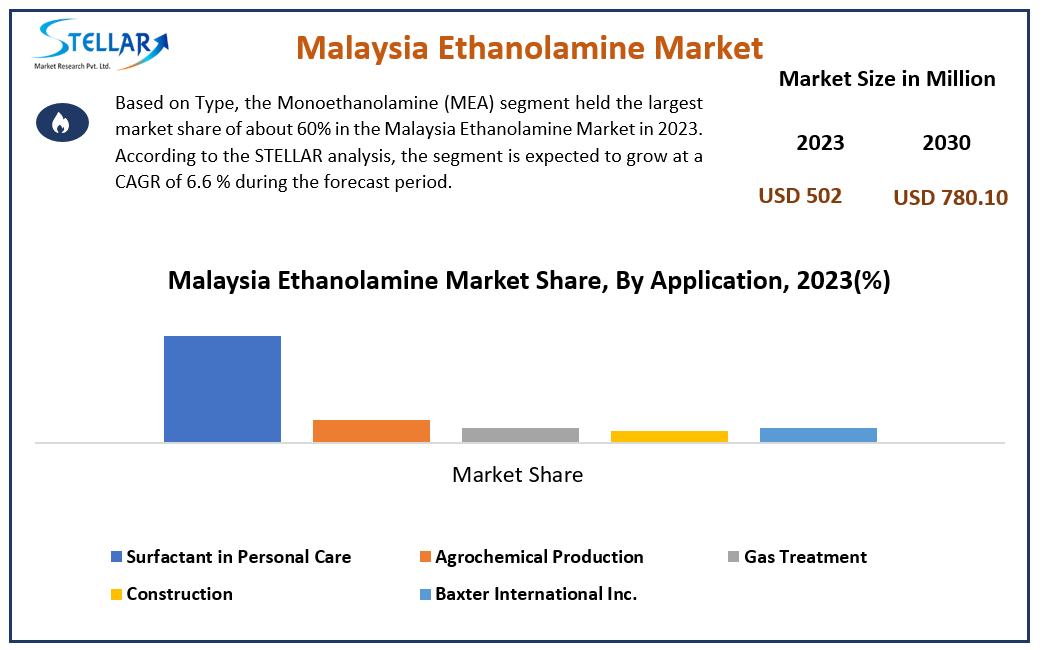

Malaysia Ethanolamine Market, valued at USD 56.5 million in 2023, is projected to grow at a CAGR of 7.24%, reaching USD 92.6 million by 2030. This significant growth is fueled by increasing applications across agrochemicals, personal care, detergents, gas treatment, and industrial chemicals, supported by Malaysia’s strategic industrial policy and growing manufacturing base.

Request Free Sample Report:https://www.stellarmr.com/report/req_sample/Malaysia-Ethanolamine-Market/1705

Ethanolamines—classified into monoethanolamine (MEA), diethanolamine (DEA), and triethanolamine (TEA)—are versatile chemical compounds used in numerous end-use industries. Malaysia's robust chemical and agriculture sectors are creating strong demand for these multifunctional amines.

Key Growth Drivers:

Agricultural Demand: As the country scales up its agricultural output, the use of ethanolamines as intermediates in the production of herbicides and fungicides is expanding, particularly in palm oil plantations.

Personal Care and Cosmetics: Rising consumer spending on skincare and grooming products is driving the demand for TEA, a pH balancer and emulsifier in creams, lotions, and shampoos.

Industrial and Chemical Processing: Ethanolamines are increasingly used in gas sweetening processes in refineries and petrochemical facilities, aligning with Malaysia's growing energy and oil & gas industry.

Detergents and Cleaning Products: Urbanization and heightened hygiene awareness are boosting the demand for ethanolamine-based cleaning agents in both residential and industrial markets.

Emerging Opportunities:

Green Chemistry and Bio-based Alternatives: Growing interest in sustainable production methods could lead to innovations in bio-based ethanolamines.

Export Potential: As a regional chemical manufacturing hub, Malaysia has opportunities to supply ethanolamines to neighboring ASEAN countries and the Middle East.

In 2024, the U.S. ethanolamine market witnessed innovation in carbon capture and gas treatment applications, where ethanolamines serve as efficient CO₂ absorption agents. Malaysia is moving in a similar direction, with local refineries beginning to explore carbon capture technologies. U.S. firms have also begun investing in plant-based ethanolamines to align with sustainable manufacturing—this trend is expected to influence Malaysia’s policy direction in the near future.

By Type:

Triethanolamine (TEA) holds the largest market share in Malaysia, widely used in cosmetic formulations and textile lubricants. Its multifunctional nature—acting as a surfactant, emulsifier, and pH balancer—makes it indispensable across industries.

By Application:

Agrochemicals dominate the Malaysian ethanolamine market. MEA and DEA are key raw materials in herbicides and are heavily utilized in palm oil farming and plantation management.

By End-Use Industry:

Personal Care & Cosmetics have gained significant market share due to rising consumer awareness, international brand penetration, and Malaysia’s booming skincare market.

1. Dow Chemical Company

As a global leader in ethanolamine production, Dow continues to supply the Malaysian market with consistent volumes. In 2024, Dow announced a major sustainability initiative to reduce emissions in ethanolamine manufacturing by over 30% by 2030, signaling its alignment with regional environmental targets.

2. BASF SE

BASF has an active presence in Southeast Asia, including a production partnership in Malaysia. The company recently expanded its product line with high-purity ethanolamines tailored for the cosmetics and pharmaceutical sectors.

3. Huntsman Corporation

Huntsman is a major supplier of DEA and TEA for Malaysia’s agrochemical and gas treatment markets. In 2024, the company entered a technical collaboration with a local gas processor in Pengerang to pilot advanced amine gas treatment systems.

4. INEOS Oxide

INEOS has shown growing interest in the Asia-Pacific region, and though it does not have direct facilities in Malaysia, it supplies high-volume ethanolamine solutions via regional trade routes. INEOS is investing in digital traceability of chemical raw materials to enhance compliance and logistics.

5. Mitsubishi Chemical Group

Mitsubishi has expanded ethanolamine production capabilities in Japan and exports to Malaysia via regional subsidiaries. The company recently introduced bio-ethanolamine blends derived from sustainable feedstock, targeting the cosmetics and detergent sectors.

These companies are playing a vital role in stabilizing supply chains, introducing innovations, and aligning production with evolving regulatory and consumer standards.

Malaysia’s strategic location, advanced port infrastructure, and thriving industrial parks make it a key player in the regional ethanolamine trade.

Industrial Zones and Logistics: Locations like Johor’s Pengerang Integrated Petroleum Complex (PIPC) and Penang’s Free Industrial Zone provide essential manufacturing and storage capacity for ethanolamines and related chemicals.

Government Incentives: Agencies such as the Malaysian Investment Development Authority (MIDA) are offering tax incentives and facilitation services for chemical manufacturers, particularly in export-focused ethanolamine production.

Environmental Regulations: Malaysia has implemented stricter environmental compliance frameworks over the last three years, pushing companies toward greener formulations and production efficiency in ethanolamine use.

Import-Export Dynamics: Malaysia imports raw ethanolamines primarily from the U.S., China, and Germany, but is increasing local value addition through formulation and blending industries.

The convergence of policy support, infrastructure, and international partnerships enables Malaysia to act as both a consumer and exporter in the ethanolamine value chain.

The Malaysia Ethanolamine Market is poised for steady and diversified growth, anchored in its demand across agrochemicals, personal care, and industrial processes. As global players invest in green chemistry and supply chain resilience, Malaysia’s role as a regional production and consumption hub is increasingly significant.

About us

Phase 3,Navale IT Zone, S.No. 51/2A/2,

Office No. 202, 2nd floor,

Near, Navale Brg,Narhe,

Pune, Maharashtra 41041

+91 96073656561

sales@stellarmr.com