Indonesia In Vitro Fertilization Service Market Price, Trends, Growth, Analysis, Key Players, Outlook, Report, Forecast 2024-2030

Indonesia In Vitro Fertilization (IVF) Service Market, valued at USD 95.86 million in 2023, is expected to grow at a CAGR of 6.5%, reaching approximately USD 148.92 million by 2030. Fueled by growing awareness of fertility treatment options, delayed parenthood trends, and improving healthcare infrastructure, the IVF services sector in Indonesia is undergoing a significant transformation.

Request Free Sample Report:https://www.stellarmr.com/report/req_sample/Indonesia-In-Vitro-Fertilization-Service-Market/1685

Market Estimation, Growth Drivers & Opportunities

IVF is one of the most sought-after assisted reproductive technologies (ART) worldwide and is rapidly gaining popularity in Indonesia. While cultural conservatism and affordability once limited widespread adoption, recent policy shifts, improved accessibility, and a rising number of fertility clinics have positively impacted the industry’s growth.

Key Growth Drivers:

-

Rising Infertility Rates: Increasing lifestyle disorders, stress, environmental pollutants, and delayed marriages have contributed to growing infertility rates among Indonesian couples, particularly in urban regions.

-

Technological Advancements in IVF: Modern techniques such as preimplantation genetic testing (PGT), frozen embryo transfer (FET), and intracytoplasmic sperm injection (ICSI) have improved IVF success rates and increased patient confidence.

-

Growing Medical Tourism: Indonesia is becoming a regional hub for fertility treatments due to cost-effectiveness and improving quality of care.

-

Public Awareness and Acceptance: Increased education about fertility issues and higher openness toward ART procedures are encouraging more couples to explore IVF options.

Opportunities:

-

Rural Market Penetration: IVF services are largely concentrated in major cities. Expanding outreach into Tier-2 and Tier-3 regions presents a lucrative opportunity for service providers.

-

Telemedicine and Remote Consultations: Post-pandemic digital healthcare growth allows clinics to reach patients across the archipelago, enhancing service accessibility.

-

Private-Public Partnerships: Collaborative programs aimed at reproductive health education and subsidized treatments can accelerate market penetration.

U.S. Market Trends & 2024 Investment Highlights (Comparative Insight)

In 2024, the U.S. witnessed a surge in egg freezing and IVF demand, with many tech companies expanding employee benefits to cover fertility treatments. Inspired by this, several Indonesian companies began exploring similar employer-sponsored fertility packages. Furthermore, U.S.-based fertility technology firms such as CooperSurgical and Progyny began exploring partnerships with Southeast Asian clinics, including Indonesian IVF centers, to offer AI-based embryo selection tools and patient management software.

Market Segmentation – Leading Segments by Share

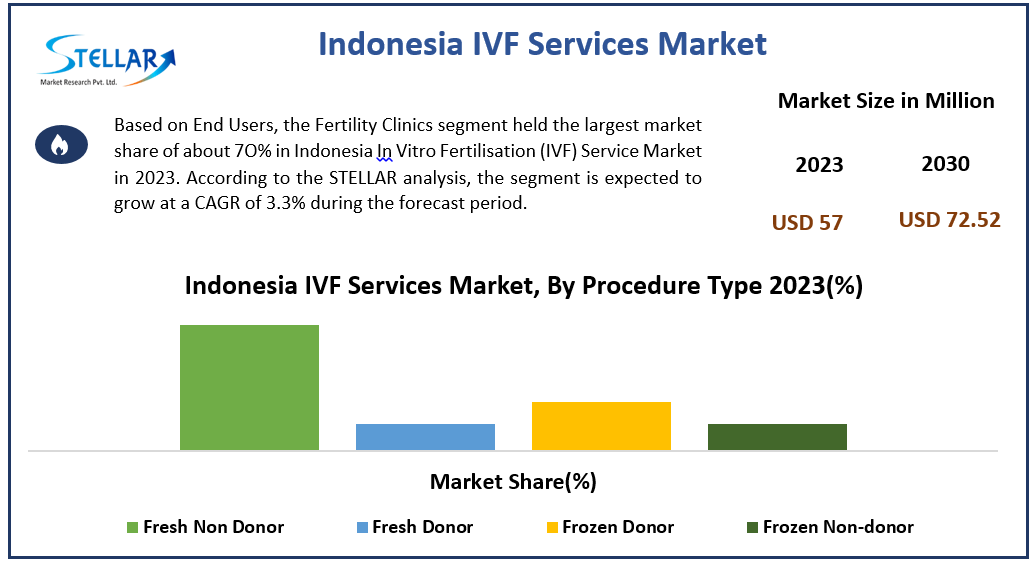

By Procedure Type:

-

Fresh IVF Cycles (Non-Donor) hold the largest market share in Indonesia. This is attributed to their availability, relatively lower cost compared to donor cycles, and growing trust in traditional IVF methods.

-

Frozen Embryo Transfers (FET) are witnessing increasing adoption due to their flexibility and higher success rates in repeat procedures.

By End User:

-

Fertility Clinics dominate the market due to their specialized services, advanced equipment, and experienced professionals. Most IVF procedures in Indonesia are performed in private fertility clinics concentrated in Jakarta, Surabaya, Bandung, and Bali.

-

Hospitals are beginning to expand their reproductive services, particularly large private hospitals partnering with international fertility chains to offer ART procedures.

Competitive Analysis – Top 5 Service Providers and Strategic Developments

1. Morula IVF Indonesia:

The largest IVF provider in the country, Morula IVF operates multiple centers nationwide. In 2024, the chain introduced AI-based embryo grading and expanded services into East Java and Sumatra to meet rising demand outside Jakarta.

2. BIC Clinic (Bunda International Clinic):

A key player in Jakarta, BIC Clinic offers personalized IVF protocols and has invested in time-lapse embryo monitoring systems. Their collaboration with international fertility labs improved IVF success rates and diagnostic precision.

3. Siloam Hospitals Group:

Indonesia’s largest hospital network, Siloam, recently expanded its ART services through dedicated fertility departments across its major hospitals. In 2024, it launched a patient education platform focused on reproductive health.

4. Klinik Fertilitas Bocah Indonesia:

With branches in Jakarta and Yogyakarta, the clinic focuses on low-cost IVF treatments for middle-income couples. They implemented installment payment schemes and launched awareness campaigns targeting millennial couples.

5. RSAB Harapan Kita (National Maternity & Pediatric Hospital):

This government-backed hospital provides subsidized IVF services, particularly for low-income couples. Recent funding has enabled the installation of advanced laboratory equipment to enhance embryo viability.

These organizations are leading the market through technology adoption, geographic expansion, patient-centric approaches, and affordability-focused strategies.

Regional Insights within Indonesia

Jakarta and Surrounding Regions (Jabodetabek):

Jakarta continues to be the epicenter of IVF services in Indonesia, home to the country’s most advanced clinics, embryology labs, and experienced specialists. High-income urban populations, medical tourism, and a progressive attitude toward fertility treatments drive demand here.

Surabaya and East Java:

This region is emerging as a secondary hub for reproductive services, with new clinics setting up operations to meet increasing demand. Telehealth adoption and mid-range IVF packages are making services more accessible.

Bali:

Bali is positioning itself as a medical tourism destination, including fertility care. International patients from Australia and Southeast Asia are increasingly choosing Bali-based clinics for IVF due to lower costs and quality care.

Policy & Government Support:

The Indonesian government, through the Ministry of Health, is supporting fertility awareness and ART regulation. While public insurance does not yet fully cover IVF, discussions are underway to include partial coverage under national health schemes. Regulatory bodies are also tightening quality standards for embryology labs to improve outcomes and protect patients.

Conclusion & Strategic Outlook

The Indonesia In Vitro Fertilization (IVF) Service Market is on an upward trajectory, supported by a growing number of fertility clinics, technological advancements, and cultural openness to reproductive assistance. As infertility becomes less stigmatized and healthcare becomes more consumer-focused, the demand for accessible, effective IVF solutions will only rise.

About us

Phase 3,Navale IT Zone, S.No. 51/2A/2,

Office No. 202, 2nd floor,

Near, Navale Brg,Narhe,

Pune, Maharashtra 41041

+91 96073656561

sales@stellarmr.com

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness